Providing funds for the future may be a problem, report Li Jing and Chen Jia in Beijing.

China's rapidly aging population is a ticking time bomb. Not only in terms of a predicted decline in the numbers of people available for work, but, equally importantly, in paying the vast pensions bill.

A census carried out in 2010 showed that the number of people aged 60, the official retirement age, or older was 177.6 million, accounting for 13.26 percent of the population. That figure is projected to exceed 200 million in 2014.

In 2011, the national average monthly pension for the retired reached 1,500 yuan ($238), according to Finance Minister Xie Xuren, but pension levels vary according to the region in which the recipient lives.

For example, Beijing has said it will soon increase the average pension to about 2,510 yuan per month, while Urumqi, the capital city of the Xinjiang Uygur autonomous region, has this year set a target of raising its average pension to a monthly 1,900 yuan and the Ningxia Hui autonomous region will pay pensioners 1,785 yuan.

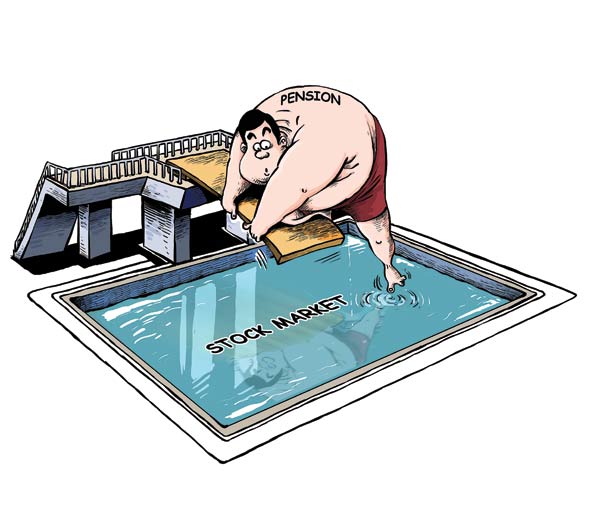

In response to the problem, China has just taken the first steps in reforming the way it manages the massive pension fund by beginning a trial investment in the country's stock market, in a move aimed at better preserving the value of the funds and supporting the country's aging population.

Last week, the southern province of Guangdong won approval from the State Council to entrust 100 billion yuan of its pension fund to the National Council for Social Security Fund for two years. The NCSSF said that most of the money would be placed in savings accounts or used to buy government and corporate bonds and other fixed-income securities. These financial vehicles may not be the most exciting on the planet, but they do have the advantage of security, and safety is the major priority for those operating the nation's pension fund.

Last week, the China Securities Journal reported that as much as 30 billion yuan of those funds is likely to be invested in the nation's equity markets. The council's rules forbid it from putting more than 40 percent of its total fund into equity investments.