Loan exchange may forge a profitable path for the economy, Gao Changxin reports in Wenzhou.

|

|

A bird's eye view of Wenzhou, a city in Zhejiang province with a booming private sector, which provides 80 percent of the jobs in the urban areas. Liang Zhen for China Daily |

Xu Zhiqian appeared embarrassed by the media attention he has drawn as president of China's first loan exchange, established as part of a financial reform experiment in Wenzhou, a boomtown in Zhejiang province.

On a rainy Tuesday in his office in the center, Xu was reluctant to be interviewed. His throat was sore and he could hardly speak after holding a news briefing earlier that morning and answering a stream of phone calls from media across the country, he explained.

But talk to the media he must, because of the growing public interest in the Wenzhou trial that will set an example for the much wider financial reform that is a centerpiece of the 12th Five-Year Plan (2011-15). Appointed to lead the Wenzhou Private Lending Registration Service Center, Xu, who worked in the financial industry for more than a decade, said he felt overwhelmed and pressured by the media bombardment. "It makes you feel everybody is watching and you dare not make a mistake," he said.

The nation is certainly watching. Xu's center is one of the first moves in a 12-point financial reform pilot launched in Wenzhou that aims to channel private funds into the financial system. Many economists believe reform is urgently needed in China, where the underdeveloped financial system is hampering the growth of the real economy, which generally involves manufacturing.

The case of Wu Ying, a businesswoman convicted of illegally raising 770 million yuan ($122 million), has wrecked the nerves of underground lenders, who sit on combined capital estimated at $1.3 trillion. Many of them hope the Wenzhou reforms will prompt legislation that affords legitimacy to shadow banking, the practice of raising money from the public with promises to pay it back at high rates of interest.

On May 21, a court in Zhejiang province sentenced Wu to death, albeit with a two-year reprieve. This usually translates into life in prison and is often further reduced for good behavior. The ruling came after the Supreme People's Court overturned a previous death sentence on April 20 and sent the case back to the provincial court for resentencing.

Wenzhou, China's private capital powerhouse, was selected for the pilot project after debt-ridden local entrepreneurs, unable or unwilling to repay what they owe, fled the city last year when State-owned banks cut back on lending to small and medium-sized enterprises amid credit-tightening measures instigated by the People's Bank of China.

During the credit crunch, approximately 100 Wenzhou entrepreneurs were reported to have disappeared, declared bankruptcy or even committed suicide, invalidating debts of 10 billion yuan.

The Wenzhou pilot project covers 12 major areas, including the development of privately owned financial services, the establishment of village banks and rural financial co-ops and encouraging State-owned banks to lend to smaller businesses. Setting up a mechanism to facilitate and monitor private lending is also one of the major tasks.

Xu's center acts as an incubator for money brokers, matching those willing to lend with those who want to borrow. Relying on its government background, the center can help brokers fast-track government procedures and provide them with legal and notary services. But it requires that all the deals reached through the center are registered.

For example, the center has direct access to the local housing and vehicle management authorities, which can expedite mortgages and vehicle loans. So far, four brokers have set up camp in the center, including financial industry leaders such as Sudaibang and Creditease.

The center, established by 14 corporations and eight individual investors and with registered capital of 6 million yuan, requires collateral, mostly cars and homes, for every loan. Crucially though, it allows those in need of funds to borrow more as a percentage of their collateral, compared with banks.

The center only provides services and doesn't guarantee loans extended through the brokers. "So for lenders, it's caveat emptor (Let the buyer beware) with added caveat," said Xu. But the center does control risks. It limits loan rates to less than four times the benchmark interest rate set by the central bank and urges brokers to conduct credit checks on potential borrowers.

|

|

The center's most important function is that of monitoring private lending in Wenzhou. The registration scheme will allow the center to compile data, assess systemic risks and, if necessary, take action before things can get out of control.

Gray area

One of the main reasons that last year's default in the city was so hard to rein in is that until recently there was no reliable data to show how many loans are out there and how high the rates are.

"Private lending in Wenzhou is a gray area. There are no data on it and nobody knows its size," said Zhou Dewen, chairman of the Wenzhou SME Development Association. "The center will help to bring the city's private lending above ground, and that will help with risk control."

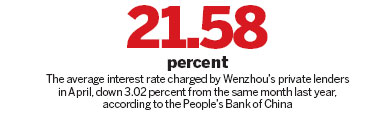

In fact, after the launch of the center, the Wenzhou branch of the People's Bank of China, the central bank, has started to report the average interest rates of Wenzhou's private lending on a monthly basis. In April, the average was 21.58 percent, down 3.02 percent from the same month last year and 0.08 percent from March, according to the report.

Despite close media attention, the center wasn't a runaway success initially. Although capital of more than 1 billion had been registered by May 15, only 7 million yuan was actually lent out. More than 100 people visit the center every day, but few actually strike deals, Xu added.

Xu Qian, a local small business owner, visited the center for the first time on May 16. With around 500,000 yuan in spare cash, he is not satisfied with the deposit rates offered by the banks and is skeptical of the stock market.

Previously, Xu would lend money to acquaintances through verbal contracts. But following the events of last year, he now demands collateral for every penny he lends, he said.

"I'm in no hurry. I'm just checking this place out. Safety is key nowadays," he said.

Borrowers, however, are more eager, but often find the loan conditions too demanding. "They are asking for too much collateral. But if I already had enough, I would have gone to the banks," said Zheng Ran, the owner of a small business. "I am willing to pay higher rates to lenders, but it's not allowed."

Zheng's frustration highlights a serious problem with the center: Why would private lenders work in a more transparent setting, when they can conduct their highly profitable business while remaining underground?

However, Ye Zhen, the general manager of Sudaibang, said many "gray lenders" will make the move, especially after the massive defaults last year raised risk-awareness in the city. "Lenders in Wenzhou have started to realize that they can't lend money on verbal contracts any more. If they want formal procedures, they will come to us and come to the center," said Ye.

Reluctant to lend

However, Wenzhou's private lenders have already become more reluctant to lend. A recent survey by the city's banking regulator shows that scale of private lending is currently 30 percent lower than in August, as lenders grow more cautious.

But disputes are growing. Legal cases concerning private lending in the city increased 89 percent year-on-year in the first four months of this year, according to Wenzhou Intermediate People's Court on May 21.

Xu, the center's president, said it is reasonable that people will be cautious about the center at the beginning, but things will gradually get on track. He expects the monthly transaction volume to reach at least 100 million yuan in the near future.

The stakes involved in the center are high because it's the first step in Wenzhou's financial reforms. If the center proves a success, it will probably affect the way that the central government pushes ahead with other measures in the pilot. If it's unsuccessful, the chances are slim that it will be expanded to other parts of the country.

The reforms are urgently needed. China's current banking monopoly by State-owned lenders, which Premier Wen Jiabao has vowed to break, leads to low interest rates on deposits and makes credit scarce for SMEs. The monopoly effectively taxes depositors and distorts the distribution of financial resources nationally. While inefficient State-owned enterprises revel in easy loans, private businesses, which create 80 percent of the jobs in urban areas, often find potential business-saving credit hard to obtain.

Many experts believe that the nation's backward financial system is choking the vigor of the real economy. Pu Haiqing, a deputy of the National People's Congress, said during the annual "two sessions" (meetings of the NPC and the Chinese People's Political Consultative Conference) in March, that the banking sector's "exorbitant profit" blunts the nation's competitive edge and the development of the real economy.

Lai Xiaoxuan, deputy general manager of Zhejiang Topsun Holding Group, which makes outdoor sporting equipment, said his company could have grown much more quickly if bank loans were more easily accessible. "We are building a design center in Europe. A lack of funding is one of the main reasons that we didn't move faster," he said.

At a time when domestic economic growth is slowing and external demand shows no sign of picking up, funding is even more important for private businesses to help them weather the hard times, he added.

Back at the month-old private lending center, Xu Zhiqian was taking a last walk around before leaving the office at the end of the day. "I am confident about the future of the center," he said. "There is demand and there is supply - all that's needed is a suitable way of connecting them."

Contact the reporter at gaochangxin@chinadaily.com.cn