IPO change forecast to lift fitful market

After tumultuous start to year, analysts remain confident of long-term prospects

China's stock market is enduring its worst-ever yearly start, yet analysts have expressed long-term confidence in the market maturing and expect a milestone revision to the country's IPO system to attract more foreign investors.

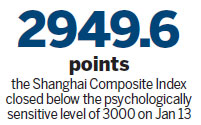

The benchmark Shanghai Composite Index tumbled 2.42 percent on Jan 13 to close at 2949.6 points, adding to the previous week's 10 percent loss. It was the first time the index had closed below the psychologically sensitive level of 3000 since August.

Government measures to calm the market, which included removing the controversial circuit breaker that shut down trading on Jan 4 and 7 and restrictions on sales by major shareholders, failed to prevent a rush by investors to sell and avoid further losses.

Yet experts speaking ahead of the World Economic Forum in Davos, Switzerland, which runs Jan 20 to 23, have said they remain firm in the belief that China's stock market is becoming institutionalized, with the government's role shifting to that of a rule enforcer rather than directly influencing stock prices.

One potential game-changer is the proposed reform of the initial public offer system. The revision would allow nominated advisers to float a company for which they see a market demand - essentially just registering an offering instead of seeking approval for it - which is expected to speed up the IPO pipeline.

Currently, IPOs are subject to approval from the China Securities Regulatory Commission, which controls both timing and pricing but has limited resources, which means companies need to wait to sell shares.

On Jan 13, the commission said the reform will start on March 1 and should be wrapped up in two years.

"The registration system would contribute to a change of the market landscape for retail and institutional investors," says Norman Li, a Hong Kong-based attorney with Allan and Ovary. "The regulators would play a more neutral role in the IPO process, by putting the focus into setting and improving the rules rather than endorsing an IPO. They would set and enforce the rules, such as on information disclosure, listing and delisting criteria, market misconduct and investor protection."

This would allow investors to focus more on the fundamentals of investment, rather than investing in an IPO because the regulator has endorsed it, he says.

Yet despite internal challenges for the Chinese stock market, experts say foreign investors are still keen to access the market, believing it cannot be ignored at a time when so few good investment opportunities exist globally.

"Given its trading volume and size, institutional investors with mandates that permit investment in Chinese listed stocks are increasingly likely to include Chinese stocks when doing global asset allocations," says Tim Bednall, a corporate partner at King & Wood Mallesons, a law firm in London.

The reasons for more global asset allocation into China's stock market are many, Allan and Ovary's Li says, and within this context the internationalization of the renminbi plays a significant role, as companies and financial institutions that hold offshore RMB as a consequence of the currency's increasingly global circulation may prefer to invest in the Chinese market.

Contact the writers through cecily.liu@mail.chinadailyuk.com

(China Daily European Weekly 01/15/2016 page25)

Today's Top News

- Second round of recall votes targeting Kuomintang lawmakers fails

- Recall vote shows 'Taiwan independence' separatism doomed to fail

- China holds third rehearsal for event marking 80th anniversary of victory over Japanese aggression, fascism

- China activates emergency response as Typhoon Kajiki approaches

- Putin-Zelensky meeting not being planned, intense mutual attacks persist

- Ancient civilizations should adjust ties