First offshore sovereign RMB bond issued

China's Ministry of Finance listed its first sovereign offshore renminbi bond on the London Stock Exchange on Wednesday, marking a significant milestone in increasing London's offshore renminbi liquidity currency and signaling the renminbi's potential as a global reserve currency.

The 3 billion renminbi ($458 million) three year bond is the first offshore renminbi bond issued by the Ministry of Finance outside of China.

It is expected to act as a benchmark to aid the future pricing of renminbi assets and so encourage the issuing of more offshore renminbi investment products. Bank of China and HSBC are joint global coordinators of the bond.

Shi Yaobin, vice-minister of finance, said the Chinese and the UK governments have made joint efforts during the process of issuance.

"The bond issuance reflects the principles of reciprocal cooperation and mutual benefit."

The Bank of England's acceptance of the bond as an eligible collateral instrument increases its attractiveness to investors, as holders of this bond can swap it with the BoE for sterling for short-term liquidity purposes.

Harriett Baldwin, the UK's economic secretary to the treasury, said the bond's issuance is "a golden moment" in the relationship between the United Kingdom and China, and the UK government is committed to further helping improve the renminbi's internationalization.

Gao Yingxin, executive vice-president of Bank of China, said orders for the bond have been received from a wide range of investors. The deal was almost three times over-subscribed, with final allocation 58 percent to investors in the EMEA (Europe, the Middle East and Africa) and 42 percent to Asia. It is the first offshore benchmark renminbi bond that has a greater allocation to the EMEA than to Asia.

Andrew Carmichael, Capital Markets partner at the London based law firm Linklaters, said the fact the issue is listed on the London Stock Exchange shows China's commitment to full participation in the international financial system.

Carmichael added this deal will also help to confirm London's place as the global center of renminbi trading outside of Asia. In April, London overtook Singapore to become the second-largest offshore renminbi clearing center after the Hong Kong Special Administrative Region, it now accounts for 6.3 percent of all offshore transactions using the renminbi.

cecily.liu@mail.chinadailyuk.com

|

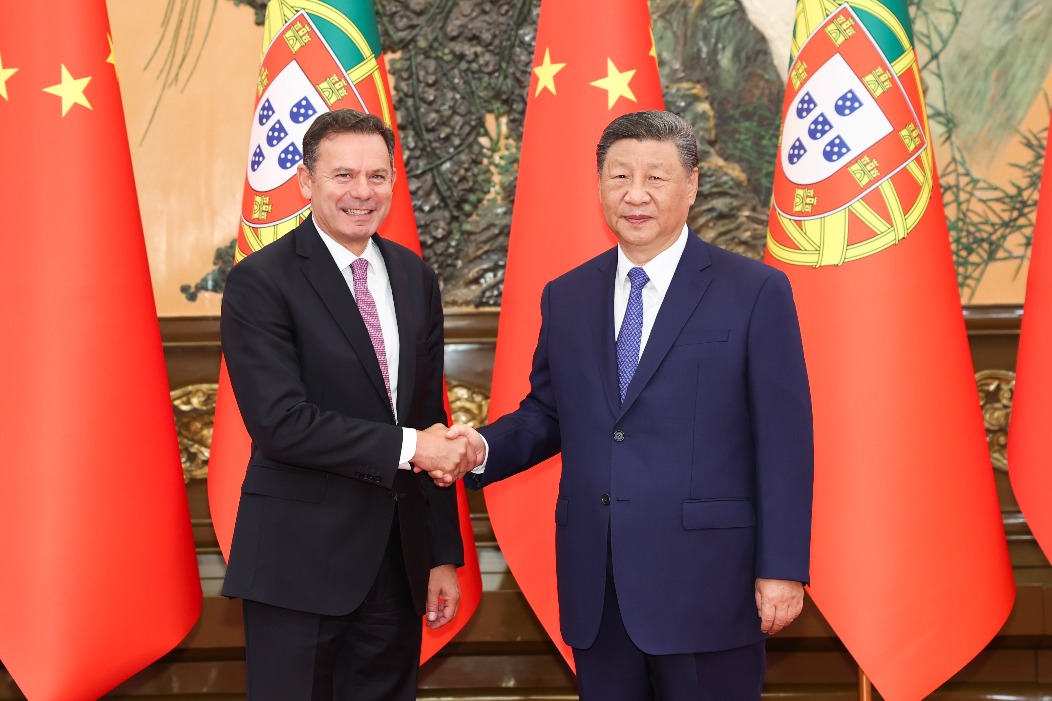

British and Chinese officials greet the launch of China's sovereign offshore renminbi bond in London. Cecily Liu / china daily |

(China Daily USA 06/09/2016 page1)

Today's Top News

- Revision of foreign trade law necessary move: China Daily editorial

- Model of mutual respect and cooperation shows importance of trust in turbulent times

- Xi sends Teacher's Day greetings, urges nurturing capable youth for socialist cause

- Xi extends congratulations to Kim over DPRK's 77th founding anniversary

- Xi meets Portuguese prime minister

- Autonomous regions making good progress on multiple fronts