Affluent half of China's wealth by 2020

Despite a slowing rate of economic growth in China, the ranks of the rich continue to grow and by 2020 their assets will account for over half of the country's individual wealth, according to a study.

2016 China Wealth Report: Growing Against the Trend with Global Asset Allocation was compiled by the Boston Consulting Group and China Industrial Bank. The report, released Wednesday, said China's high net worth families will reach 3.88 million by 2020 and their assets will represent about 51 percent of the country's individual wealth.

From 2015 to 2020, the investable financial assets of high net worth individuals (HNWIs) will increase at an average annual rate of 15 percent, significantly higher than the projected GDP growth rate of 6.5 percent in China over the same period, noted the report. "China will become one of the world's largest markets of HNWIs," it said.

David He, a Boston Consulting Group partner in Beijing and report coauthor, said: "Financial service sectors (in China) targeting the high net worth segment, such as private banks, trust companies and security firms, will benefit from their growing demands."

"We should recognize the undersupply of private banking services," Chen Jinguang, vice-president at China Industrial Bank, said in a statement. "At present, China's private banking institutions manage less than 20 percent of the wealth of high net worth families, which implies huge opportunities for development."

He said HNWIs are interested in both wealth expansion and preservation. "A majority of China's HNWIs have acquired their wealth within their own generations, so they are still very interested in wealth expansion and believe they have the ability to replicate their success. However, we see the increasing appetite for wealth preservation due to growing needs for wealth inheritance," he wrote.

For non-financial assets, HNWIs favor real estate investment; for financial assets, bank wealth management products and trust are popular due to their low risk and fixed income status, said He.

"In the next four to five years, we expect the wealth allocation to real estate will decrease as the expected return from real estate investment is decreasing. According to our survey, 54 percent of HNWIs believe real estate prices in 3rd- and 4th-tier cities will drop and 18 percent believe real estate prices in all areas will decrease. The decreasing return from bank wealth management and trust products will trigger more demand for alternative investments, such as private equity," added He.

paulwelitzkin@chinadailyusa.com

(China Daily 06/24/2016 page2)

Today's Top News

- Revision of foreign trade law necessary move: China Daily editorial

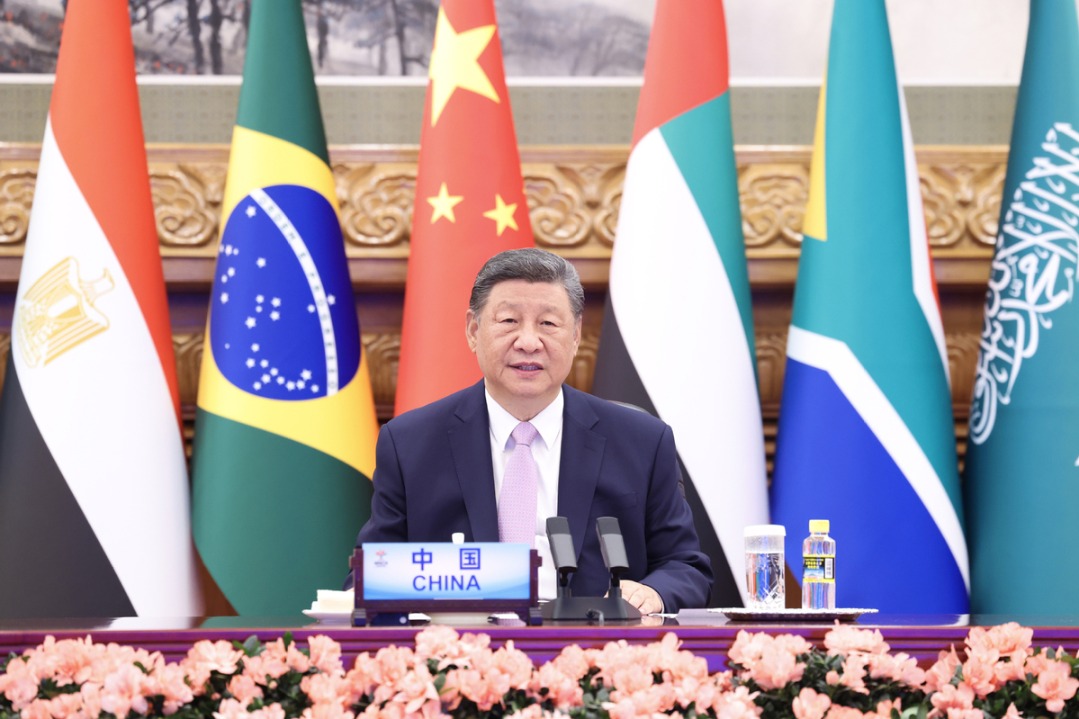

- Model of mutual respect and cooperation shows importance of trust in turbulent times

- Xi sends Teacher's Day greetings, urges nurturing capable youth for socialist cause

- Xi extends congratulations to Kim over DPRK's 77th founding anniversary

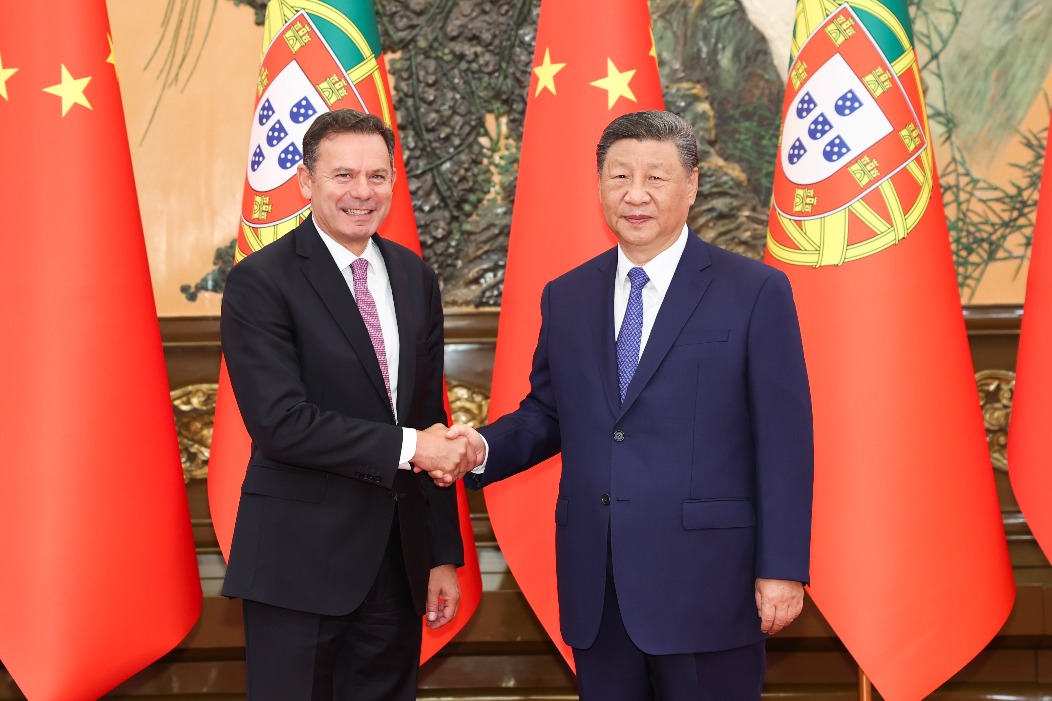

- Xi meets Portuguese prime minister

- Autonomous regions making good progress on multiple fronts