Growing future money trees

China's venture capital has increased tenfold - from $3 billion to $31 billion - since 2013, as the nation has placed more and more emphasis on innovation

Investors are proving they don't believe the claim that Chinese industry can't innovate. A recent KPMG international survey of business leaders found that 23 percent say China "shows the most promise for disruptive technology breakthroughs that will have a global impact", close behind the United States at 29 percent. All other countries are in single digits. A recent study by the McKinsey Global Institute estimates that "indigenous innovation" could contribute as much as half of Chinese GDP growth, $3 trillion to $5 trillion per year, by 2025.

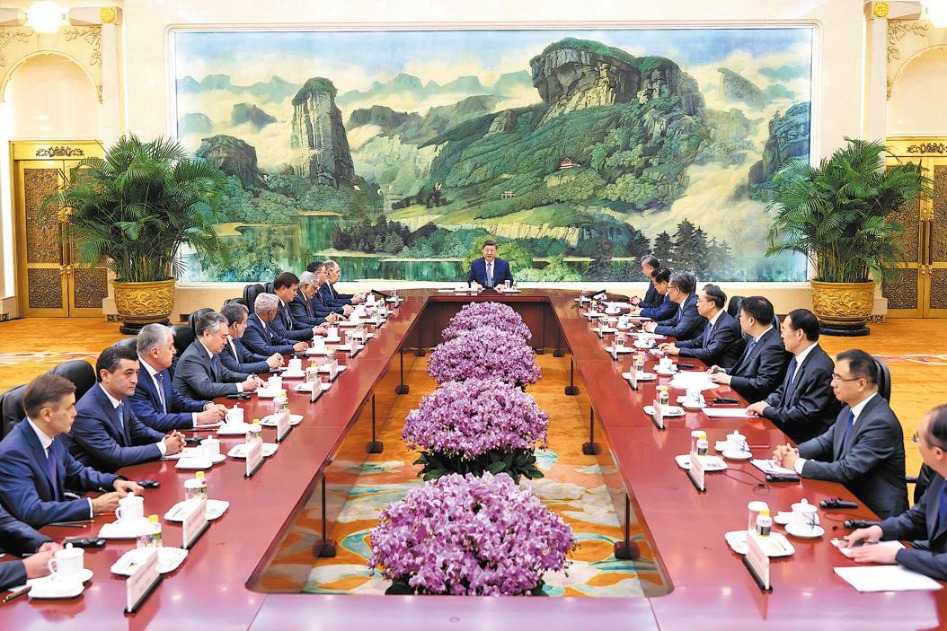

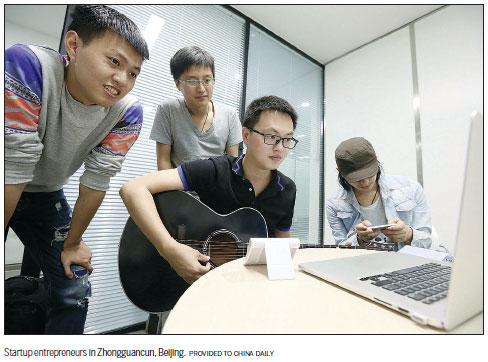

Investors are putting their money behind these opinions. Venture capital investments in China soared from only $3 billion in 2013, to $12 billion in 2014, to $26 billion in 2015 and to $31 billion in 2016, according to Venture Pulse. More than half that total was invested in Beijing, mostly in the high-tech district of Zhongguancun in the northwest section of the city.

Encouraging innovative startup companies is a key part of China's strategy to move toward an economy based on more homegrown high-tech and high-value-added products by 2025. Premier Li Keqiang often stresses the need for "mass entrepreneurship and innovation". In his speech to the meeting of the National People's Congress in March, he mentioned "entrepreneurship" 22 times and emphasized that 12,000 new companies were founded in China each day in 2015.

Many countries are attempting to create innovation hubs, but only a handful succeed. So why might Chinese innovation now challenge the dominant position of Silicon Valley?

Wang Jun, founding and managing partner of Kinzon Capital in Beijing, argues that the ecosystem needed to support innovative companies is coming together.

The surge in startups is also supported by government policies and by China's vast innovation-loving consumer market. John Gu, head of private equity at KPMG China, says: "China is changing very, very rapidly in terms of having the environment to embrace new technology and new business models. I can clearly see a trend where a lot of the commercialization of new technology (whether Western developed or Chinese developed) takes place in China. This is because China has large consumer markets and government support for the startups. The Chinese government is more receptive to new technology, with the view to upgrading the structure of the Chinese economy. So, if you have an early startup technology and get the right government support, it is easier to roll out new products in China than in the US. It appears that no foreign government will provide that kind of support."

VC companies are the link between startup companies and investors. Small startups come with high risks, so they usually don't have access to bank loans or stock markets. The VC receives investment from various types of investors - insurance companies, wealthy individuals, large corporations, governments - and uses that money to buy partial ownership of promising young companies. If the VC chooses wisely, the investors might get a big payday after 5 to 10 years, but there is always the risk of losing. VCs invest early in the life of a business, so they are betting on new technology or a new business model. Private equity firms, which are structured similarly, invest at a later stage, when the company has a record of revenues and profits. Chinese venture capital and private equity firms have assets totaling more than 7 trillion yuan ($1.02 trillion) under management, according to the research firm Zero2IPO.

On Aug 6, 2015, the State Council, China's Cabinet, approved the establishment of national entrepreneurship investment funds. The government has dedicated capital of more than 2.1 trillion yuan to fund VCs and startups, as reported by Zero2IPO. This funding is being used to support about 780 startup funds set up by central agencies and local governments across the country.

For example, the Beijing Zhonghai Investment Management Co, located in the high-tech mecca of Zhongguancun, manages approximately 6 billion yuan - 5 billion from the local Haidian district government and 1 billion from the central government, according to Wang Hua, deputy general manager.

She says: "The Haidian guidance fund is not looking for a return. What it wants to do is support high-tech, small-scale companies, especially those with their own intellectual property rights. The key is whether the company can contribute to Haidian."

But, she goes on to note: "The firms we invest in must get private money, too. In every area, the government fund occupies about 25 percent, very much less than 50 percent. What the government is doing is giving guidance about what area private capital should pay attention to."

On the other hand, Zheng Yi, a partner at Beijing-based VC Aqua Ventures, says there are restrictions on taking government funding.

"We tried to raise some local government money in our second fund, but the government fund has many very strict limitations," Zheng says. "In particular, you have to invest in the local area. I understand the purpose from the government side, but internet businesses can grow only in some areas of China. In Beijing, it might be OK. But, you do not find any good internet companies in Gansu, Qinghai or Shanxi, even though those provinces have huge funds."

Incubators and startup parks that help startups with mentoring, services, links to investors and office space are also getting government backing. Zhang Jinsheng, chairman of TusStar, the incubator in Tsinghua University Startup Park, says his organization provides the companies with "support of many kinds - legal, financial accounting. We link them with mentors from the faculty, famous industry or financial experts, and strategic partners. We buy equity shares of less than 20 percent."

He emphasizes that TusPark is a separate legal entity and must make a profit.

Zhongguancun is leveraging the talented people coming out of the many universities in northwest Beijing, to become the leading world competitor with Silicon Valley. Elsewhere, Shanghai is leading in financial technology startups and South China's Guangdong province specializes in linking new technology to manufacturing. However, the model will not work everywhere.

Technology clusters are just a part of China's development strategy, other government programs support various types of development. For example, agricultural reform is encouraging migrant workers to return to their homes to start businesses.

The Made in China 2025 strategy is pushing industrial transformation. On March 28, the People's Bank of China, the Ministry of Industry and Information Technology and three financial regulators announced policies encouraging banks, bond and stock markets, and insurance companies to boost investment in the real economy and industrial upgrading, according to Caixin Global.

Asked about the danger of government VC funds misallocating or wasting capital, Wang Jun, of Kinzon Capital, says: "I'm not worried that much. In general, there is progress from the government perspective. What I'm seeing is that most of the government money is going into professionally managed funds. They are very good professionals, the top venture capital firms in China. They get the money from the government and from institutions and then they allocate that money to market-driven venture funds. Their pay is based on the performance of the VC firms."

But Zheng, from Aqua Ventures, believes the current VC boom is definitely a bubble: "A lot of people saw the 100 times or 1,000 times return from Momo, Didi, or Toutiao and have jumped into putting money into venture capital.

"At the same time, a lot of younger rich Chinese don't like real business. They don't want to run their fathers' firms. They like to do investments so they raise money from their parents or their parents' friends, but they are just playing games in this field."

But Liu Bo, general-manager of TusStarVC, who works with many young startups, believes the current generation of youth is more hard-working and professional, in terms of better education and broader views.

Starting a business anywhere in the world is hard. Niu Hu, a senior vice-president at Huarong Securities, says: "Many of my classmates from business school started companies in Zhonguancun, but few of them existed for more than three years."

Liu agrees: "Lots of people tried investing in startups in the last two years, and they found it is not easy. Most startups in China fail within 18 months."

"In China, I see a lot of young managers working for an investment bank for 2-3 years, then coming out and starting their own fund, raising $20-30 million. Do you think these people have the right skills?" says Gu of KPMG.

davidblair@chinadaily.com.cn

(China Daily USA 04/14/2017 page4)

Today's Top News

- Economic growth momentum expected to continue

- Tianzhou 9 embarks on cargo mission to Tiangong

- SCO urged to play more active role

- Green, beautiful, livable cities call for modernized urbanization path

- Urban renewal beyond economic growth

- Xi meets Russian FM in Beijing