Ant bid gets nod from MoneyGram

Ant Financial Services Group has raised its agreed offer for electronic payment firm MoneyGram International Inc and the deal was unanimously approved by the US firm's board, outbidding rival Euronet Worldwide Inc.

Ant, the finance affiliate of Alibaba Group Holding Ltd, increased its offer to $18 per share in cash from $13.25, and the transaction is valued at around $1.2 billion, according to a joint statement by Ant and MoneyGram.

"MoneyGram ... will add valuable cross-border remittance capabilities to the Ant Financial ecosystem, serving our more than 630 million users globally," Doug Feagin, president of Ant Financial International, said in the statement.

The two firms said they have made progress toward obtaining the regulatory approvals necessary to complete the transaction, including winning US antitrust clearance.

The renewed offer came after the Chinese firm lashed out at Euronet's hostile bids that created "phantom national security arguments" to stymie Ant's merger proposal.

In January, Ant Financial announced plans to buy MoneyGram for $880 million but was hit with a counter bid of $940 million from Euronet which claims to have a better chance of closing the deal because it's not subject to national security probes that foreign investors are subject to.

Euronet chief executive officer Mike Brown said last week that a deal with the Chinese company posed a risk to national security and was unlikely to get clearance from US regulators due to the proximity of many MoneyGram vendors to US military bases.

"Euronet has conducted broad-based political attacks in Washington against Ant Financial and the integrity of MoneyGram's business and data security practices, in an attempt to stop a compelling transaction involving a core competitor," Feagin said on Thursday.

He said Euronet has over 85 percent of its assets outside of the US, including nearly all of Euronet's servers and data centers where its customer information resides.

He also claimed that Euronet derives only 28 percent of its revenue from the US and pays virtually no tax in the country.

"Besides, Euronet has told investors it plans to cut $60 million in costs if it acquires MoneyGram, which would inevitably impact US facilities and employment, leading to significant US job cuts," he said.

If Ant Financial proceeds with the acquisition, Feagin said MoneyGram would continue to independently operate all its data systems and Ant Financial would not have access to any US customer data.

(China Daily USA 04/18/2017 page2)

Today's Top News

- ASEAN accelerates de-dollarization

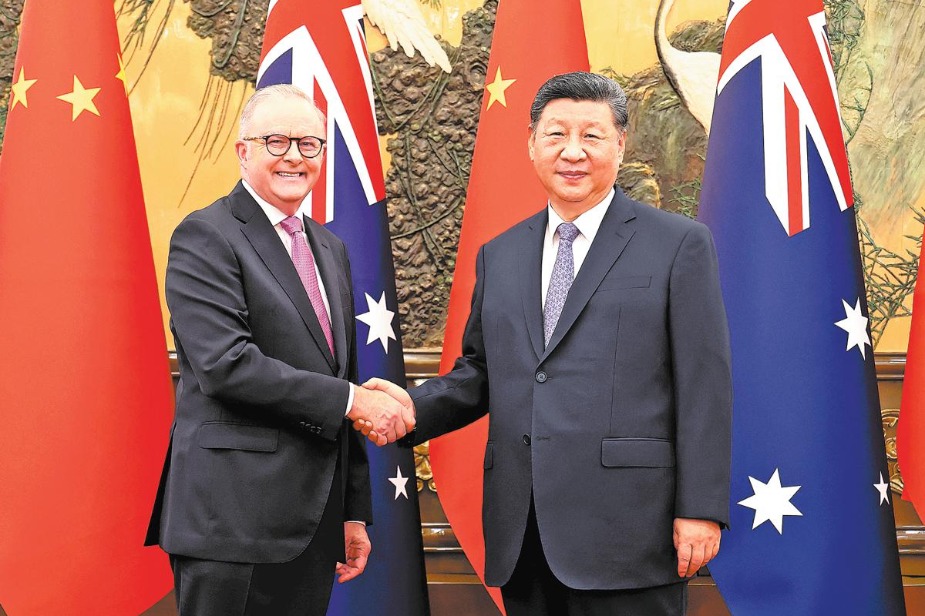

- Xi: China, Russia to promote just, equitable intl order

- Why China still anchors global supply chains

- Xi lays out priority tasks for urban development

- Economic growth momentum expected to continue

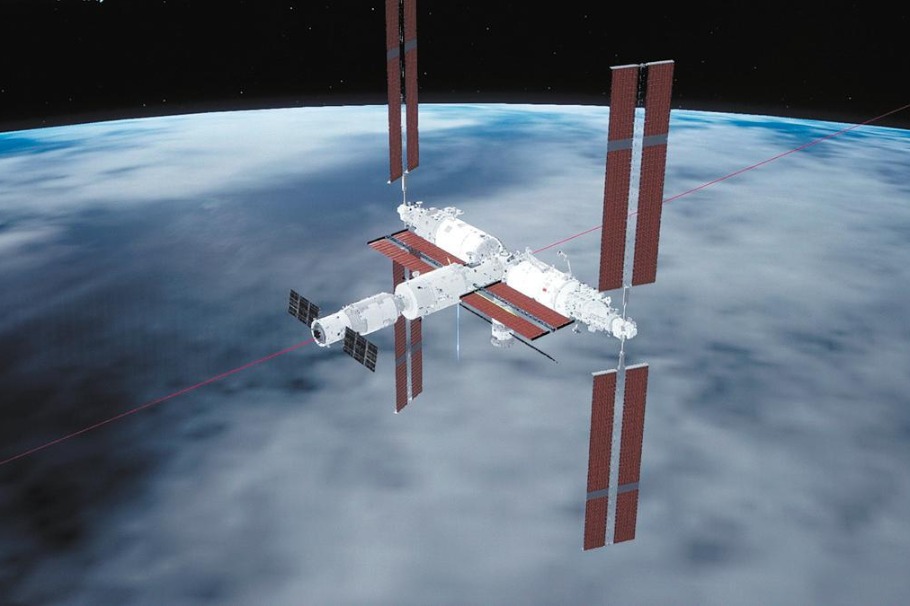

- Tianzhou 9 embarks on cargo mission to Tiangong