If you're going for quick gains, just follow the herd

A calm stock market is a good stock market. At least that's what many investors, whether institutional or personal, who take the long term view think.

Surprisingly, the Wall Street has become the global model of tranquility with the VIX volatility index, or "fear gauge", plunging to an unusually low level of below 10 - the lowest in nearly 24 years. More unusual is that it's happening at a time of political turmoil at home and growing tension abroad.

The Wall Street's big influence on Hong Kong's capital market is well-known for various reasons. But, the Hong Kong market is anything but calm. Before taking a breather on Tuesday, the benchmark indicator had risen for six consecutive trading days and closed the previous day's session at 24,860 - the highest level in 21 months.

If you must know what's behind the latest rally, you're probably too naive to play the Hong Kong market. Billions of dollars in overseas hot money, mainly from the Chinese mainland, whisking around from sector to sector in defiance of accepted economic logic, is enough to confound even seasoned analysts and torment unwary investors.

Is that necessarily a bad thing? Some analysts and investors reckon that the often unpredictable trading pattern of overseas funds has greatly increased market volatility to levels that are commonly seen only in emerging markets. In the longer term, frequent wide price swings can harm Hong Kong's reputation as a mature market and hamper its ability to attract long-term investment funds from international institutions.

There are also those who believe that some volatility is healthy as long as price manipulation is kept in check by an alert regulatory agency. They argue that investors can make money by keeping track of the funds flow.

That's not an easy task because overseas capital that has flooded into Hong Kong is not controlled by investors' syndicates that can be counted on to make rational investment decisions. In picking stocks, the hot money is often influenced by star analysts on the mainland who claim to be particularly insightful in reading government financial policies.

If you fancy making some quick gains by following the herd, as millions of mainland investors do, you can't ignore their views no matter how outrageous they may sound.

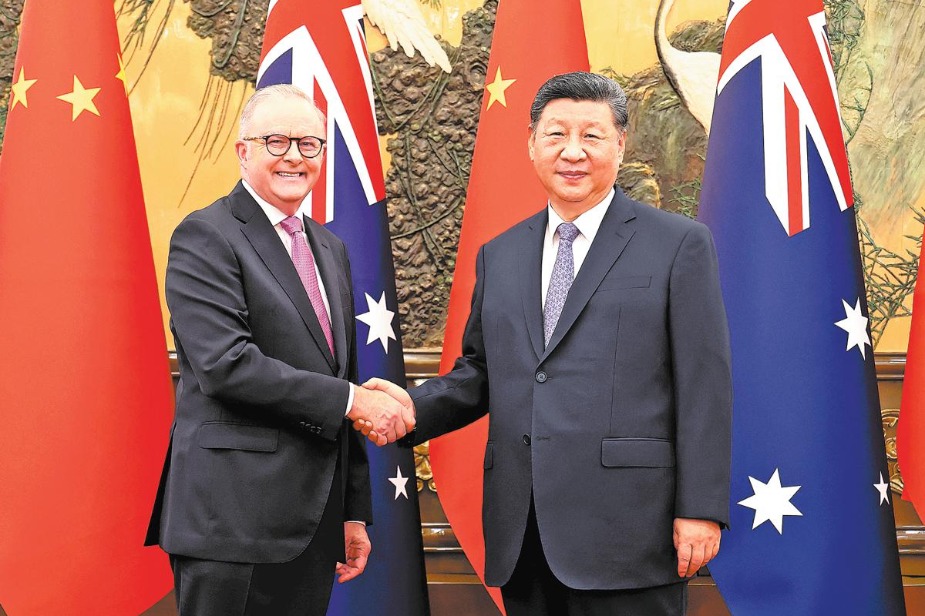

| The Hong Kong stock market rally since January has attracted investors’ attention against the backdrop of a volatile US market. The city’s stocks gauge has hit a 21-month high earlier this week and the market may witness a new round of hot money chasing for quick gains. Provided to China Daily |

(HK Edition 05/19/2017 page9)

Today's Top News

- Beijing supports Tehran in maintaining dialogue

- Stabilizing global supply chains vital to intl market

- Visa facilitation steps boost number of foreign visitors

- Japan hypes excuse for its military build-up: China Daily editorial

- Philippine defense secretary's remarks undermine regional peace efforts

- Mainland strongly opposes Lai's planned 'transit' through US