Beijing's support critical in crises

Yang Sheng remembers baptism-of-fire as Asian turmoil erupted straight after HK's return to China

The Hong Kong Monetary Authority's Chief Executive Norman Chan Tak-lam has said maintenance of financial stability must be a top priority for the government. Without it, he said, nothing else will matter. In the 20 years since Hong Kong's return to China, the special administrative region has weathered at least two major challenges that threatened to seriously undermine the integrity of its banking system and the linked exchange rate regime. Fortunately, the SAR was able to cope with the challenges, with unreserved support from central government authorities.

But recent developments in global financial markets have sounded the alarm, creating a need for increased vigilance. As former HKMA chief executive Joseph Yam Chi-kwong has warned, the next global financial crisis - which could come sooner than many expect - would be many times more devastating than those the world has seen so far.

At times like these, Hong Kong can take comfort in the belief that it can count on the mainland not so much for subsidies, or gifts, but rather for steadfast and responsible financial policies which had helped the city face previous threats with confidence and aplomb.

The financial markets of some regional economies, particularly Thailand, Indonesia and South Korea, began to crumble as Hong Kong celebrated its return to the motherland in 1997. Later that year the contagion effect of competitive currency devaluations in the affected economies hit Hong Kong like a tsunami.

In those chaotic times, central government authorities had steadfastly resisted pressure to devalue the yuan against the US dollar and other hard currencies. Its responsible monetary policy has been widely credited for helping avert a regional financial meltdown and lent strength and confidence to the Hong Kong government in defending the linked exchange rate system against repeated savage attacks from overseas hedge funds.

The successful preservation of financial stability at that time was the single most important achievement that had enabled Hong Kong to weather the economic recession and, more importantly, the collapse of asset values. The banking system remained intact despite the hit from a 60 percent plunge in average home prices.

An important development that helped kick-start economic recovery in 2003 was the arrangement, approved and supported by the central government that led to an influx of mainland tourists to Hong Kong. The resulting tourism boom has created many new jobs in the highly labor-intensive retail and catering sectors.

Fast-forward to 2008, when the outbreak of the United States sub-prime credit crisis plunged the world into a prolonged economic recession and destabilized global financial markets. As an international financial center and regional trade hub, Hong Kong took a particularly hard hit from the fallout.

While the developed economies were fighting a losing battle against deepening recession with austerity, the mainland came to the rescue with a 4 trillion yuan ($585 billion) economic stimulus plan that dazzled the world and lifted the gloom. The subsequent increase in trade and investment on the mainland had greatly pushed up demand for financial and other services from Hong Kong, thanks to close integration of the two economies.

Looking ahead, there is clearly a need for Hong Kong to seek further economic integration with the mainland to let it benefit from the various economic initiatives, particularly the Belt and Road.

Some critics have labeled the various large-scale infrastructure projects undertaken at great cost to facilitate movement of goods and people between Hong Kong and the mainland as "white elephants". They are not, even if the immediate benefits of these projects aren't all that obvious to the short-sighted politicians of the opposition camp.

Despite economic diversification efforts, the services sector accounts for more than 80 percent of Hong Kong's GDP. Integration with the mainland, its major business partner and client, is essential to enhance Hong Kong's identity as a financial center and business hub.

Hong Kong's unique role in the region is facing rising challenges from real and imagined rivals in neighboring economies. But it can always count on the direct, or indirect, backing of the central government to advance its role through financial stability.

The author is a current affairs commentator.

(HK Edition 06/27/2017 page1)

Today's Top News

- Xi sends congratulatory letter to 2025 China Intl Fair for Trade in Services

- China set to revise Foreign Trade Law to address challenges

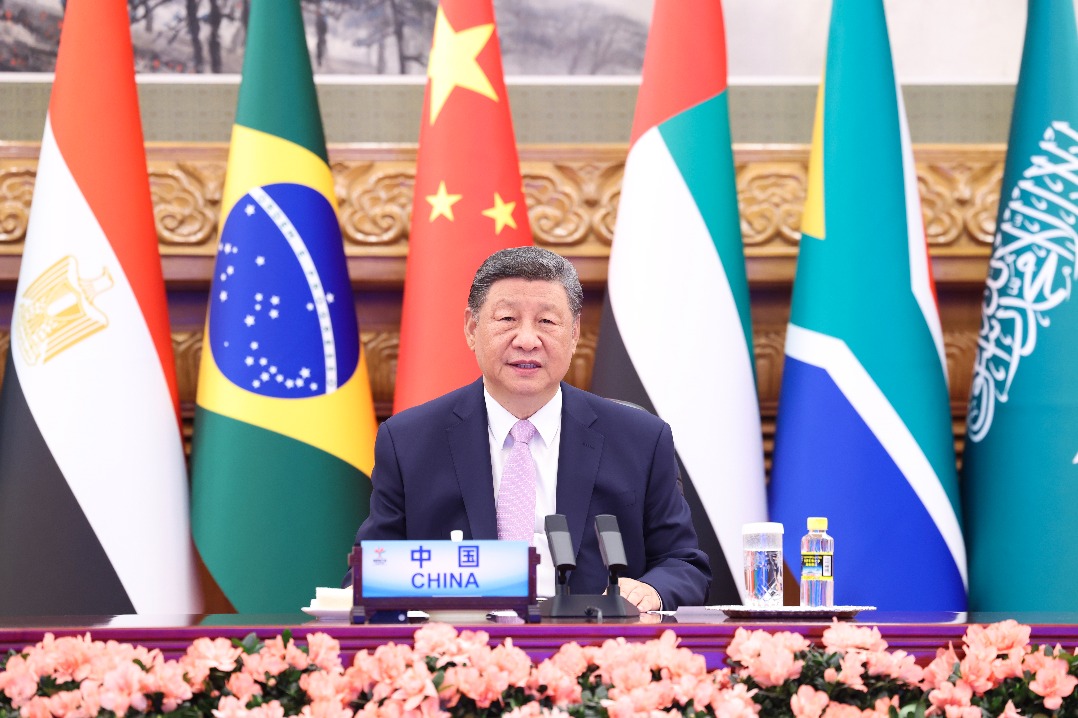

- Xi's BRICS speech charts path forward

- Xi congratulates Kim on DPRK's 77th anniversary

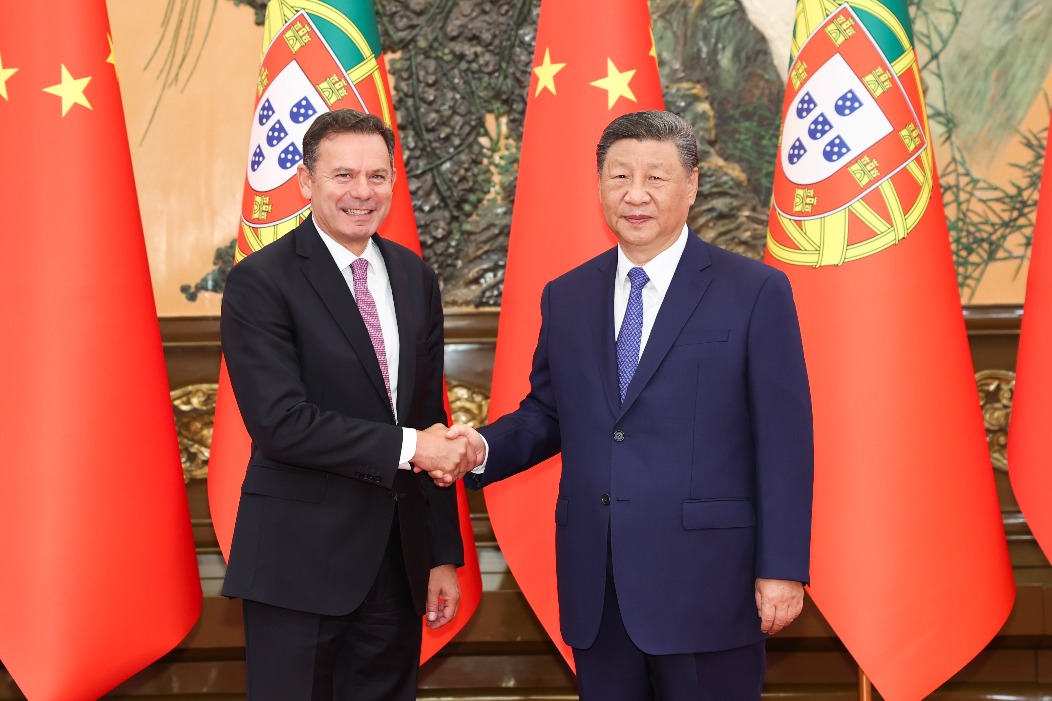

- Sino-Portuguese ties hailed

- US 'Department of War' reflects its true role