Value creation is key for great companies

China's economy needs to shift toward getting the most return from investments, says professor Liu Qiao

In 1995, China had no businesses with revenues large enough to be included in the Fortune Global 500 list of the world's largest companies. By 2015, 106 Chinese companies were on the list, gaining fast on the 128 based in the United States. Does this mean that China's corporate sector is healthy, even great?

Liu Qiao says that China now needs to emphasize the quality of capital investments, not just the quantity. In his new book, Corporate China 2.0: The Great Shakeup, the dean of the Guanghua School of Management of Peking University says the nation needs to build great companies that put value creation above sheer size.

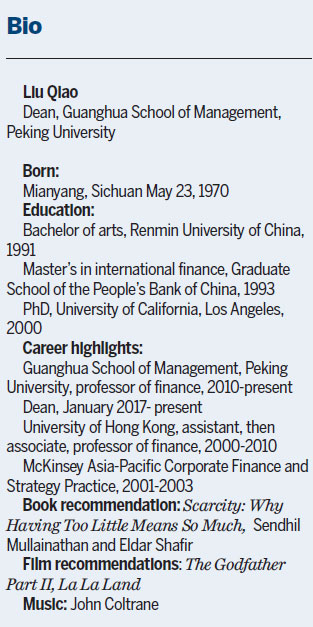

| Liu Qiao, dean of the Guanghua School of Management of Peking University. Provided to China Daily |

"The Chinese economy has been successful over time because of high investment and an appropriate mix between government and the market. But the nation has reached the point where the economy needs to shift toward emphasizing getting the most return from investments," he tells China Daily.

Liu argues that companies should focus on the profits generated by invested capital. Size, measured by assets or revenue, should not be the goal. Great companies are able to make a high return on invested capital, or ROIC, over a long period of time. He writes: "Higher ROIC also makes the company financially able to produce great products or provide differentiated products over several life cycles, and ultimately exert inerasable influence on the world. ... If a company maintains a high level of return on invested capital for a long period of time, it is a great company."

Companies that are simply big don't create much value for their country. Liu notes that Chinese workers receive only 1.8 percent of the value of the iPhones they produce. China needs to export 800 million shirts to get enough profits to buy a single Airbus 380.

He sees Huawei Technologies, Alibaba Group, Xiaomi and SF Express as candidates to join the small group of truly great companies. However, he says, "we have many large companies, in terms of size. But it is about time to push on another dimension; we need to have more companies that put value creation ahead of size."

Balancing government, market

Fast growth has provided opportunities for all the people of China, Liu says. "In the past 25 years, GDP has increased more than 25 times. That means a lot to every Chinese. China's GDP when it started was very low. In the beginning of the reform process, capital was scarce, so anyone brave enough to do some investment got a high return. Now, China has almost accomplished the industrialization process. The service sector contributes over 50 percent of GDP. Since there is more capital, the return to new investments is lower, so it is important to put emphasis on (return on invested capital) to keep the economy going."

"China has identified an appropriate approach for developing this economy. The country has found a very nice balance between government and the market. But now the country needs to move to more entrepreneurship and more emphasis on investments that yield high returns. A five-year plan is basically a top-down approach. I'm not saying that a top-down approach is always wrong, but innovation and entrepreneurship is based on bottom-up efforts. The government can set up the guidelines and point out the big direction. But let the private entrepreneurs at the bottom make their own decisions and let private capital have more opportunities," Liu says.

"I'm not saying that government is bad. In a conversation, Alibaba executives said they used the market to become a great company. Remember the huge investment in 3G, the huge investment in the high-speed railway system and in expressways. There is no way e-commerce could prevail in China without this. So, government investment, despite problems, helps. What China needs now is a better balance between the two," he says.

Data presented in Liu's Corporate China 2.0 shows that private companies consistently have a return on invested capital that is 4 to 6 points higher than SOEs. So, encouraging the growth of the private sector and improving corporate governance can be seen as key to improving the efficiency of the overall economy.

The government is strongly pushing reforms to improve the efficiency of State-owned enterprises. In May, the National Development and Reform Commission announced a pilot program to introduce mixed-ownership reform in 20 centrally owned SOEs.

Liu says the government faces a dilemma: "They are encouraging the SOEs to put value creation ahead of size and are also implementing a new set of incentive mechanisms to ensure that the company will be profit driven. But a dilemma is that when the economy stalls, the government still relies on investment rate to boost economic growth and the SOE sector tends to be the pillar of this kind of policy initiative."

Room to grow

Liu says the greatest strength of the Chinese economy is that it is growing rapidly and there is still plenty of room for further growth: "I still believe that as long as the economy is growing and the market is big enough, those problems can be resolved eventually. For example, last year the GDP was 74.4 trillion yuan ($11 trillion; 9.8 trillion euros; £8.6 trillion). If you make the moderate assumption that real GDP growth will be 5.5 percent, by 2030 the GDP will be 157 trillion yuan - more than double the 2016 level. The bottom line is that if the growth is healthy enough, the existing problems can be resolved by larger size."

|

| Liu's new book Corporate China 2.0: The Great Shakeup. |

Liu acknowledges that the recent explosive growth in corporate debt means that China is not using capital efficiently enough. However, household debt and government debt is low by international standards. Furthermore, the government has a lot of tools in its hands, so he doesn't believe China will have a crisis like that in the United States in 2007 and 2008.

He sees the accumulation of human capital, skilled and industrious people, as the key to China's future growth. Also, the very deep consumer market creates abundant new opportunities. New investments in education and healthcare will drive the economy.

He also stresses the need for more research and development, both private and public. He notes: China outperformed on most of the policy targets in the 12th Five-Year Plan (2011-2015). But it failed in one area - R&D as a percentage of GDP. We are just now reaching the 2 percent target, but we need to set a target of 4 percent."

Furthermore, companies with high R&D spending tend to outperform their competitors. In China, Huawei spends 15 percent of revenues on R&D, comparable to Facebook or Amazon, but there are few other Chinese companies that do this.

Liu concludes: "The central government can shift the policy discussion to the quality and sustainability of economic growth. What matters is whether you use capital more efficiently. It's all about whether you trust the market to achieve higher value creation - higher ROIC. It's all about this basic principle."

davidblair@chinadaily.com.cn

(China Daily European Weekly 06/30/2017 page32)

Today's Top News

- Summit a key moment for China-EU ties

- Unstable political landscape seen in Japan amid election

- Intl unity in fighting fascism recalled

- Pragmatic discussions can illuminate the way to a brighter future for China-EU ties

- Ruling parties suffer major defeat in Japan's upper house election

- China, EU to hold 25th China-EU Summit in Beijing