Mobile payments on the move

Competition heats up internationally as technology becomes more mainstream

"Alipay or WeChat Pay?" she asks as soon as he finishes his lunch.

"So you don't accept bank cards? And cash isn't an option?" Chang Xiaohui, 27, an electrical engineer, counter-questions the waitress at a Hong Kong-style restaurant in Shanghai.

She replies: "Sure we do. I mean, not many people are using bank cards or cash nowadays, right?"

"Right." With that, he pays with cash.

Chang has no other option because his smartphone is dead because the battery is flat. He can't remember his bank card PIN either - it's been more than two months since he used it for payments.

Chang is not an exception but the rule across China. Millions of consumers like him simply love the convenience of mobile payment.

Cash and plastic cards are nearly out. Third-party mobile payment tools are in.

From street-side peddlers of roast sweet potatoes to hypermarket checkout counters, ubiquitous quick response - or QR - code stickers and laminated labels plead "scan me to pay".

At a Shanghai wet market, if you pay for a kilo of squid using WeChat, you can get a discount of up to 5 percent.

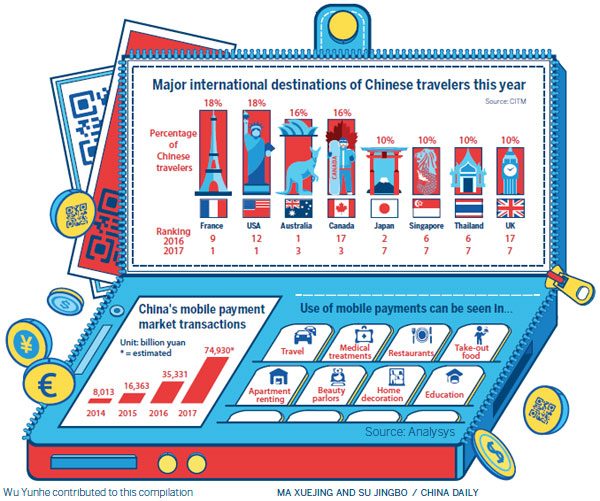

According to market research firm Analysys, China's third-party mobile payment providers accounted for transactions worth 18 trillion yuan ($2.66 trillion; 2.25 trillion euros; £2.01 trillion) in the first quarter of 2017, up by about 47 percent quarter-on-quarter.

Analysys estimates China's mobile payment market will account for transactions worth 100 trillion yuan by 2019.

"Growth of mobile payment tools is faster than that of any other payment models. The trend indicates that mobile payments will become the mainstream payment model across China in the near future," says Zhou Yuedong, vice-president of the credit card division of ICBC, the country's largest lender.

In July, UnionPay, China's bank card association and payment technology provider, jumped on the mobile payment bandwagon. Its QR codes offer multiple payment modes, thus intensifying the already fierce competition in the market.

UnionPay users can scan QR codes at points of sale. Alternatively, sellers can scan their customers' UnionPay QR code. One-to-one transfers can be made, facilitating payments between individuals, individuals and businesses, and between businesses.

Cash withdrawals from ATMs via QR codes and similar innovative solutions will also be available in the future, according to UnionPay.

"Consumers may think UnionPay was too slow and trailing Alipay and WeChat Pay. But UnionPay launched QR code-based payments only after the authorities officially approved such mobile payment systems," says Liu Fei, a retail sector researcher with Shanghai Mingshan Consulting.

Before launching its QR code-based payments, UnionPay promoted its near field communication, or NFC, payments that enable customers to pay by merely tapping their smartphones. The embedded SIM card in the phone forges a payment agreement with the point-of-sale without having to key in the PIN or sign the bill.

The contactless NFC mode has been widely accepted by merchants where frequent, low-value payments are the order of the day - restaurants, convenience stores, bus stations and subway stations.

But industry observers say Chinese consumers seem to favor QR code-based payment services, particularly those offered by Alipay and WeChat.

According to Analysys data, Hangzhou-headquartered Alipay has nearly 54 percent market share in the third-party mobile payment market. Shenzhen-based WeChat Pay has almost 40 percent.

But the idea that only 6 percent market share is up for grabs doesn't wash with other payment tools.

UnionPay is eyeing overseas markets as it has agreements with several merchants and ATM operators abroad, says a source who has close knowledge of its mobile payment strategy.

The source says: "NFC payment is UnionPay's blockbuster product and is widely accepted in overseas markets, particularly in Asian destinations with the fastest growth of Chinese tourists. Now, UnionPay has also launched promotions for QR code-based solutions in developed markets such as Europe and the United States.

"The rationale is that UnionPay has more exposure abroad than other domestic payment service brands. Chinese tourists will get attracted to UnionPay as they are familiar with the brand. Hopefully, that will deepen customer loyalty. When such tourists return to China, they will likely continue using UnionPay products. Thus, they will win more market share."

So, UnionPay International, the overseas business arm of the bank card association, has signed a cooperation agreement with France's Office de Tourisme DLVA for payments at the Coeur de Provence tourism project, which targets Chinese tourists.

The two sides will encourage local merchants to accept UnionPay cards. In the future, tourists will be able to use UnionPay cards conveniently in France.

Cai Jianbo, CEO of UnionPay International, says the company is seeking to "serve cardholders globally" and "grow together with partners globally".

Chinese consumers who use UnionPay for mobile payments can receive benefits such as vouchers, discounts, free admission at tourist attractions and privileged concierge services in more than 60 destinations and at more than 10,000 merchants.

In the domestic market, UnionPay is extending collaborations with international players. UnionPay also partners with Swiss watchmaker Swatch to enable the latter's customers to make mobile payments using Swatch Pay technology that is embedded in its products.

All the third-party mobile payment players are gearing up for the challenge of making the technology more inclusive, especially in lower-tier cities, says Zeng Jianqiu, a researcher with Beijing University of Post and Telecommunications.

In addition, it takes more resources to build up infrastructure to ensure safe and convenient transactions, Zeng says.

wuyiyao@chinadaily.com.cn

| UnionPay is increasing its visibility with ads near tax-free shops and scenic spots that are popular with Chinese travelers at tourist destinations like Japan and the United States. Provided to China Daily |

(China Daily European Weekly 08/04/2017 page25)

Today's Top News

- Premier stresses high-quality implementation of major national projects

- Syrian interim govt begins phased implementation of ceasefire in Sweida

- Mayors from around the world gather in Qingdao for dialogue

- Premier announces construction of Yarlung Zangbo hydropower project

- Digital countryside fueling reverse urbanization

- 'Sky Eye' helps unlock mysteries of the universe