IMF raises China forecast, sees risks

The International Monetary Fund on Tuesday raised China's growth prospect but warned of medium-term risks and called for accelerated reforms.

In its latest report, the IMF projects China's GDP growth to average 6.4 percent between 2017 and 2021, compared to the 6.0 percent in its last year's report.

China continues to transition to a more sustainable growth path and reforms have advanced across a wide domain, according to IMF's 2017 Article IV report for China released on Tuesday. Article IV is IMF's annual consultation with individual members on the health of their economies.

The report noted that the growth comes at a cost of higher debt, which leads to rising risks. Total non-financial sector debt - which includes household, corporate and government debt - is expected to continue to rise strongly, reaching almost 300 percent of GDP by 2022, up from 242 percent in 2016.

The IMF said that the high debt raises concerns for a possible sharp decline in growth in the medium term.

James Daniel, IMF's mission chief for China and assistant director of the Asia and Pacific Department, said addressing these risks requires the rebalance of the economy towards less credit intensive growth.

He described the debt issues as the largest macroeconomic risk facing China, saying the debt issue is getting worse because debt is still growing, but its pace of growth has perhaps moderated.

He said China should focus more on the quality and sustainability of growth and less on quantitative growth targets.

IMF recognized China's reforms now under way, efforts to reduce overcapacity, make local government borrowing more transparent and take important initial steps to facilitate private sector deleveraging. "Our advice: These reforms need to accelerate," Daniel told a conference call on Tuesday.

The IMF believes that given strong growth momentum, now is the time to intensify deleveraging efforts.

The IMF noted that China's national savings, at 46 percent of GDP, are 26 percentage points higher than the global average, largely due to the household sector, with consumption correspondingly low.

This reduces the current welfare of Chinese citizens, fosters high levels of investment which are unlikely to be absorbed efficiently, and, were investment to fall, would lead to even larger current account surpluses, worsening global imbalances, the IMF said.

Eswar Prasad, a senior fellow at the Brookings Institution and a former IMF China section chief, said that while there has been some progress on growth rebalancing in recent years, there is a considerable way to go before the economy attains a better balance in terms of consumption versus investment driven growth.

Employment growth remains a major challenge, which can only be addressed through a broad range of financial and structural reforms.

He said the report notes that depreciation pressures on the renminbi appear to have abated and that inward and outward capital flows have become more balanced. "However, in the absence of further financial and real economy reforms, China remains vulnerable to a new round of capital outflow and currency depreciation pressures," Prasad told China Daily.

In the report, IMF's executive directors said they took note of the assessment that the renminbi remains broadly in line with fundamentals, although the external position in 2016 was moderately stronger than implied by fundamentals.

They stressed the importance of continued progress toward greater exchange rate flexibility, and welcomed the authorities' commitment to deepen reforms and rely more on market forces to determine the exchange rate.

The IMF also noted in the report that social spending in China is on the rise, but more can be done.

Increasing government spending on health and pensions would increase government consumption, but also private consumption by reducing households' need to save.

chenweihua@chinadailyusa.com

????????????????????????????????????????????????????????????????????????? (China Daily USA?08/16/2017 page1)

Today's Top News

- Green, beautiful, livable cities call for modernized urbanization path: China Daily editorial

- Urban renewal beyond economic growth

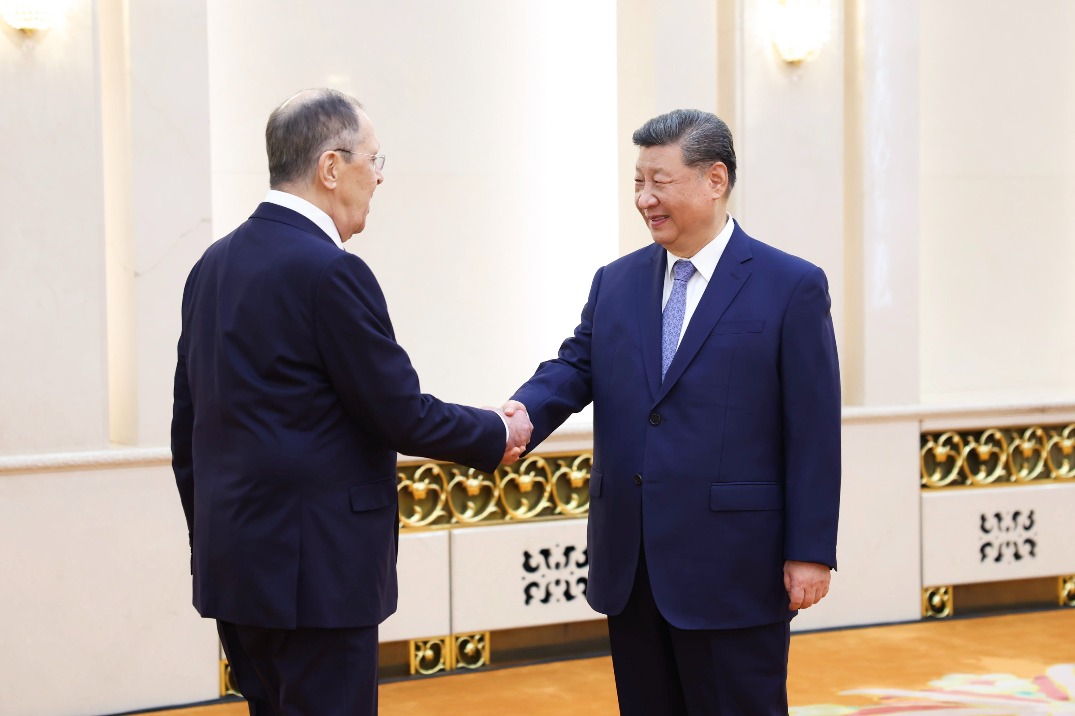

- Xi meets Russian FM in Beijing

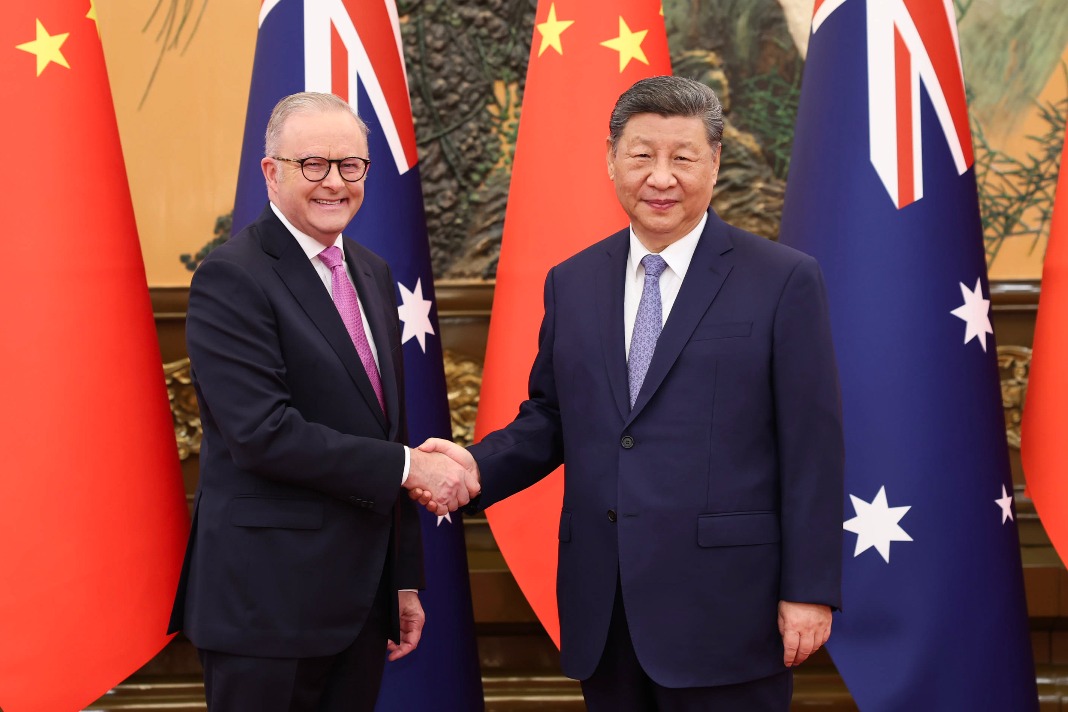

- Xi meets heads of foreign delegations attending SCO council of foreign ministers meeting

- Xi addresses Central Urban Work Conference, listing priorities for urban development

- China reports 5.3% GDP growth in H1