Foreign financial firms gear up for a new era

|

| Banners of financial institutions along the Pudong Avenue in Shanghai's financial district. [Photo/VCG] |

Leading policymakers pledge to further relax overseas investment restrictions to counter the decline in capital inflows while guarding against systemic risks

China is accelerating plans to open up the financial industry with leading policymakers pledging to relax foreign investment rules to counter the decline of capital inflows.

Industry insiders had expressed concern that the government's focus on containing systemic risks and reducing capital outflows would slow the pace of reforms.

This in turn threatened to derail plans to give foreign banks and firms greater access to China's financial industry.

But those fears have been dispelled after the State Council, China's Cabinet, vowed to further reduce market restrictions for foreign companies in the banking, securities and insurance sectors.

"The government's attitude this time is different from just putting out some vague slogans," said Qu Tianshi, an economist at ANZ Group, also known as The Australia and New Zealand Banking Group Ltd.

The State Council's decision means that ministries will now have to come up with timetables and blueprints as regulations are rolled back.

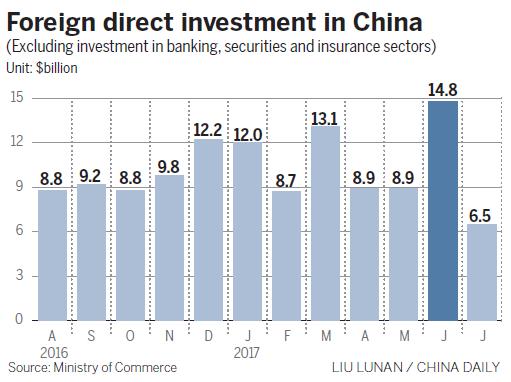

It also comes at a time when inward foreign investment declined by 1.2 percent between January and July to 485.4 billion yuan ($74.9 billion) compared to the same period last year, official data highlighted.

Opening up the industry is part of China's efforts to deepen economic reforms with President Xi Jinping calling for a more robust financial sector while guarding against systemic risks.

Economists and analysts stressed that China is better positioned than before to further loosen financial regulations with stable economic growth, a stronger currency and a more sophisticated business environment.

"The Chinese economy (is now) integrated with the global economy," Qu said. "China should have a more open financial sector to reflect its economic status and to adapt to the trend of globalization."

Since the start of the year, China has made concerted efforts to open up the financial industry and capital markets.

In July, the world's second biggest economy rolled out Bond Connect.

The financial link between the Chinese mainland and Hong Kong meant that overseas investors could trade for the first time in mainland bonds without setting up onshore accounts.

Foreign investors had already been given wider access to the Chinese stock markets in Shanghai and Shenzhen through the QFII, or qualified foreign institutional investor, program.

They also gained further entry through the RQFII, the renminbi qualified foreign institutional investor, scheme between the Chinese mainland and Hong Kong in trading bonds and shares.

A month earlier, HSBC Holdings Plc became the first foreign bank to receive regulatory approval to set up a majority-owned securities joint venture in China.

The United Kingdom-based global lender took advantage of the decision by Chinese regulators to relax the rules on foreign banks setting up here.

HSBC Qianhai Securities Ltd, in which HSBC owns a majority stake, is expected to be open for business by the end of the year.

Irene Ho, designated chief executive of the securities joint venture, pointed out that the securities brokerage will be involved in underwriting and cross-border mergers and acquisitions.

"With the securities (operation), we are able to provide much broader services to our clients from the Chinese mainland," Ho said. "This will allow us to boost our presence here to the level we have in Hong Kong, London and other major markets in the world.

"The joint venture will enrich the variety of our products available to our mainland clients, and allow us to benefit from the opening and growing capital market of the Chinese mainland," she added.

While major foreign players have started making inroads into the financial industry, their presence remains limited.

The assets of foreign lenders accounted for less than 2 percent of the total Chinese banking sector, while foreign insurers only make up about 5 percent of the market share on the mainland.

When you look at the global numbers, those figures are tiny.

Economists at Deutsche Bank, one of the leading lenders in Europe, estimated that the global market for financial assets was worth about $294 trillion in 2015.

At least analysts expect to see a breakthrough in Chinese sectors such as insurance and wealth management as the country's affluent middle class search for more sophisticated financial services and products.

Last week, the country's leading insurance regulator, the China Insurance Regulatory Commission, announced it would further reduce market restrictions for foreign firms.

By cutting red tape, the CIRC hopes to encourage overseas companies to enter areas such as personal insurance, healthcare and retirement funds.

As part of this easing in policy, more foreign asset managers and hedge funds have been given the green light to develop onshore products.

They will also be able to manage assets for institutional and high-net-worth investors from the mainland.

UBS Asset Management plans to issue one or two products in China this year after the Swiss firm secured a license to roll out private funds from the regulator.

"Localization is the key," said Aries Tung, head of strategy and business development for China at UBS Asset Management.

"We want to provide tailor-made and flexible investment solutions that meet the needs of Chinese clients," Tung added.

Wan Zhe, chief economist at the International Cooperation Center, a think tank affiliated with the National Development and Reform Commission, believes the presence of foreign firms will bring financial expertise and more capital into Chinese markets.

Hopefully, this will trigger market-inspired reform of the financial sector.

"Ranging from stocks to bonds, Chinese assets have attracted growing attention from foreign institutions and investors," Wan said.

"Their presence will draw more capital into the country and will also help lift the global profile of the Chinese currency," Wan added.

Li Daokui, economist and director of the Center for China in the World Economy at Tsinghua University, felt a further round of reforms would reassure foreign financial firms.

Chinese policymakers have been walking a tight rope between curbing risks and capital outflows with opening up the country's financial markets.

"There is no perfect timing when it comes to financial liberalization," Qu, of ANZ Group, said. "Reforms always come with risks. What Chinese policymakers need to do is to strike a balance between the two."

Jiang Xueqing and Zhuang Qiange contributed to this story.

- Notable reform successes in China economy in past 5 years: UK economist

- Financial institutions will not bail out distressed firms: Officials

- China to further open financial, new energy vehicle sectors to foreign investment

- PBOC, CBRC ask banks to fund good firms

- CIRC underlines key role of insurance in financial safety