'Kissing buildings' the answer, but woes stay

Shenzhen offers 7 million rental homes for its 20 million residents, yet, most of them were built illegally

Shenzhen on Wednesday listed the first land parcel on which property developers can only rent out homes and not sell them, as part of the city's latest move to encourage the rental market.

Unlike Hong Kong, which has long been reeling from an acute shortage of housing supply, including homes for rent, Shenzhen boasts abundant housing resources. It may thus seem paradoxical that the SAR's closest mainland neighbor still plans to further develop the sector.

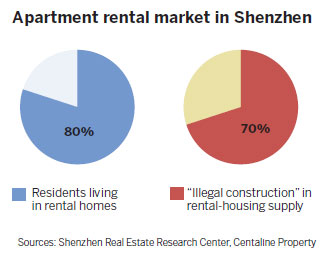

But, the crux of the matter is that about 70 percent of Shenzhen's apartments in the rental market are branded "illegal constructions". Industry experts believe that instead of increasing supply, making the market more "professionalized" and less scattered is the real intention of the local authorities' latest document listing a series of new policies related to rental property.

According to the municipality's land and housing authority - the Urban Planning, Land and Resources Commission (UPLRC) - Shenzhen's homes leasing market is the largest in the country in terms of rental population and housing quantity.

Li Yujia, a senior analyst at the Shenzhen Real Estate Research Center, said the city's existing population is about 20 million, with 80 percent of the residents living in rental apartments, while 70 percent of the 10 million available units are for rent.

Based on his estimation, the city has about 7 million apartments for rent. Assuming that each unit accommodates three people on average, these homes can roughly accommodate 21 million people.

It seems the supply is more than enough to meet the demand of the 16-million rental population. However, of the 10 million apartments up for rent, only about 2 million are standard residential buildings, while most of them had been illegally built, according to Song Ding, director of the Tourism and Real Estate Industry Research Center at Shenzhen-based think tank China Development Institute.

The problem of "illegal construction" is unique in Shenzhen. These homes had been built by villagers on their collectively-owned land parcels, but the State had acquired all the land in the city 20 years ago.

The property rights and legality of these illegal homes have become a contentious issue since. Strictly speaking, most of them are illegal, said Song.

According to Centaline Property, these buildings provide about 6.5 million apartments, accounting for 70 percent of Shenzhen's rental-housing supply.

The apartments are usually "the first stop" for university graduates or immigrants due to their low rents and prompt availability in convenient locations. Song said their function is similar to that of Hong Kong's sub-divided flats.

However, these buildings are notorious for their poor sanitary conditions, low construction quality and sordid living environment, disorderly neighborhoods and informal leasing contracts. For example, the distance between these structures is so close that they are called "kissing buildings", creating high risks of fires and other accidents.

Song believes that to solve the problem of these buildings' illegal status, upgrading their quality and guaranteeing the social rights of their tenants are the main goals of the UPLRC's new policies.

According to the commission's document issued in August for public consultation, the Shenzhen government plans to acquire, rent or rebuild 1 million such homes by late 2020 in a bid to improve surveillance and management in these areas.

Meanwhile, it will also provide public services equal to those of other residential buildings for the tenants.

He Qianru, director of the research center at Midland Realty, however, warned that getting to the bottom of the decades-long problem would not be plain sailing as the cost of the transformation is high, and the owners of these villager-built constructions would be unwilling to participate if these buildings are to be taxed.

The solution would be to encourage the establishment of professional leasing companies to unify the market and improve services. The government itself has vowed to set up three to five State-owned rental house management companies by 2020. The first of these opened last month.

As for private companies' participation, Yang Yuejin, research director with E-house China R&D Institute, pointed out that one of the chief obstacles is the city's low rental yield. He suggested that the authorities encourage capital institutions to enter the market.

Since 2014, Shenzhen's rental yield has been on a losing streak, having dropped to below 2 percent, according to real-estate agency Qfang.com, while in the United States and European countries, the percentage is about 5 percent.

Considering the huge initial investment leasing companies would need to make to acquire houses, the UPLRC has promised to encourage the setting up of long-term bond and trust funds. At the same time, the companies' taxes would also be cut. At present, they are required to pay up to 17 percent in taxes on their rental income and 33 percent on profits.

Stimulated by a series of nation-wide preference policies, property developers are also acting partially as landlords. Mainland real-estate giant Vanke aims to offer 150,000 rental apartments by 2019, while Longfor Properties is keen to add 30,000 units for rent in the next two years.

Buildings on former villagers' collectively-owned land are among their major housing sources, while they are also engaged in transforming old factories and their dormitories.

grace@chinadailyhk.com

(HK Edition 10/13/2017 page9)

Today's Top News

- Beijing supports Tehran in maintaining dialogue

- Stabilizing global supply chains vital to intl market

- Visa facilitation steps boost number of foreign visitors

- Japan hypes excuse for its military build-up: China Daily editorial

- Philippine defense secretary's remarks undermine regional peace efforts

- Mainland strongly opposes Lai's planned 'transit' through US