China's growing green power tide

Rising use of natural gas brings benefits to consumers, industry and economy

Millions of residents in northern Chinese cities can literally breathe more easily this winter as the air will likely be a lot cleaner, and smog a lot thinner, given that natural gas will increasingly replace dirtier coal as power plant fuel in the region.

Natural gas sales are expected to rise by more than 20 percent to 13.9 billion yuan ($2.1 billion; 1.76 billion euros; £1.58 billion) this year, according to China National Petroleum Corp, the country's largest oil and gas supplier and producer.

Consumption of natural gas, which emits 50 percent less carbon dioxide than coal, will rise as demand is set to surge. China's commitment to smog-free air and green power is good news for not just electricity consumers and green campaigners, but also for those who thrive on gas imports.

The efforts to ensure adequate supplies of natural gas will involve creation or expansion of infrastructure like pipelines, ports with suitable terminals, storage facilities and transportation networks.

Existing Chinese investments in overseas energy assets like oil and gas fields will likely be augmented, and fresh targets identified.

Given the implications for the entire economy, winter is warming the cockles of the power industry players' hearts. Nowhere is this more palpable than in the Chinese capital.

Downtown Beijing will shutter four major coal-fired power plants in its vicinity, and keep itself warm in the winter with four gas-fired plants at a cost of around 50 billion yuan.

Hebei, one of the most polluting provinces in northern China, has also phased out 33,600 small coal-fired boilers.

Tianjin, one of China's four municipalities besides Beijing, Shanghai and Chongqing, said it planned to further cut coal consumption and increase the supply of natural gas for both indoor heating and vehicle fuel purposes.

Analysts believe China's determination to move away from coal and other fossil fuels to address air pollution will be a long-term positive for the natural gas sector.

Joseph Jacobelli, a senior analyst tracking Asia utilities at Bloomberg Intelligence, says that although clean energy won't completely replace coal-fired power generation at least for the next 30 years, the share of gas-fired generation in the overall electricity mix will increase steadily.

"We're already seeing that clean generation accounts for a greater proportion of newly installed capacity compared with the coal-fired ones."

On the back of continued policy support from Beijing and the industry's coal-to-gas transition, the liquefied natural gas, or LNG, market in China has witnessed sharp growth this year.

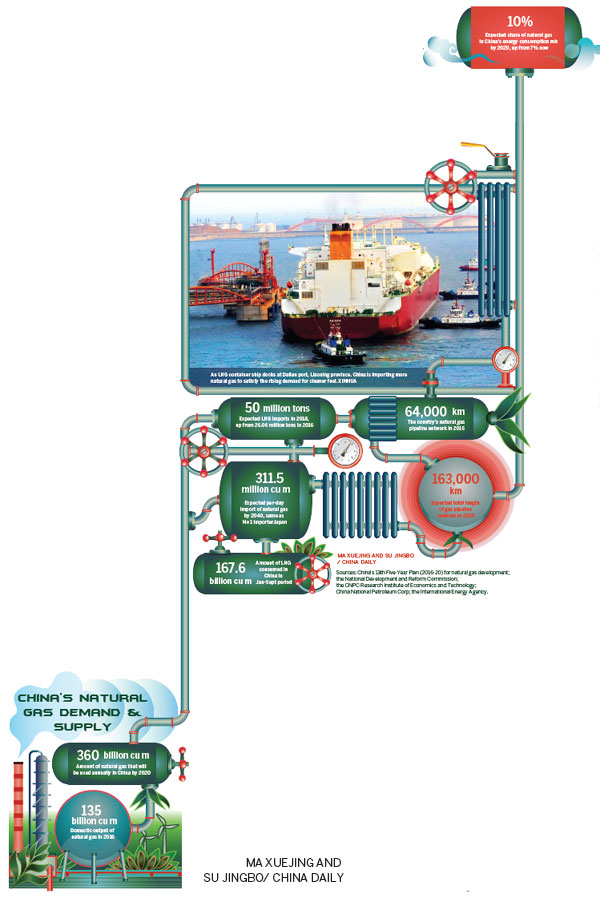

According to the the CNPC Research Institute of Economics and Technology, LNG consumption reached 167.6 billion cubic meters during the January-September period, up by 16.6 percent year-on-year. Full-year growth in 2016 was 7 percent.

The peak season of winter, and even the period between summer and winter months, witnessed a pickup in gas consumption as well, says Duan Zhaofang, chief engineer of the institute's natural gas market research department.

Power industry insiders believe the demand will continue to surge in the coming years. Marc Howson, director of the LNG market development division of S&P Global Platts, an energy industry information service, says Chinese LNG imports will continue to grow toward 50 million metric tons in 2018.

China's LNG imports rose by 32.8 percent to 26.06 million tons in 2016.

Contracts for LNG supply to China, mainly from western and eastern Australia, and the US Gulf Coast, are up by nearly 50 percent year-on-year this year as the government steps up efforts for cleaner-burning fuel, he says.

S&P Global Platts forecasts that by 2018, China will surpass South Korea to become the world's second-largest LNG importer, trailing only Japan.

As for natural gas, domestic output rose from 50 billion cu m in 2005 to 135 billion cu m in 2016.

China's natural gas use will exceed 360 billion cu m by 2020, according to the National Development and Reform Commission, the country's top economic planner.

That would be more than 10 percent of China's energy consumption by 2020, up from 7 percent now, according to the commission.

By 2040, China is expected to import as much as Japan, about 311.5 million cu m of natural gas a day, according to the International Energy Agency.

Rising demand for nonfossil fuel has prompted the country's energy behemoths to step up efforts to secure adequate supplies of LNG through imports. They are continuing negotiations with some resource-rich Central Asian nations for additional stocks.

Qu Guangxue, spokesman for CNPC, which accounts for over 70 percent of the natural gas supplied in China, says the company's natural gas demand is expected to reach 81.3 billion cu m this year, up by 11.7 percent from 2016.

According to CNPC, the China-Central Asia natural gas pipeline that it built, and which runs through China, Turkmenistan, Kazakhstan and Uzbekistan, will have transported a total of 200 billion cu m of natural gas from 2009 till the end of this month - equivalent to the total annual natural gas consumption of China or 11 years of natural gas supply for Beijing.

China started importing natural gas through a pipeline from Turkmenistan in 2010 and has since also imported natural gas from Uzbekistan, Kazakhstan and Myanmar.

Meanwhile, terminals and infrastructure are also being boosted to meet the surge in demand. The country's natural gas pipeline network in 2015 reached 64,000 km and is expected to reach 163,000 km by 2025.

China is also increasing its presence in the Arctic region's natural gas sector, with CNPC participating in the Yamal LNG project with Novatek, Russia's independent natural gas producer, which will ensure CNPC at least 3 million tons of LNG per year.

Li Li, energy research director at consulting company ICIS China, says the country will also continue to buy considerable LNG from the United States, considering the latter's willingness to increase exports of its natural resources.

The US would benefit from China's new demand for natural gas and is already a net exporter, she says.

zhengxin@chinadaily.com.cn

(China Daily European Weekly 12/01/2017 page26)

Today's Top News

- Elderly people should consider new careers

- Concept of ecological civilization 'inspiring'

- Lychees tell the story of Chinese modernization

- Trump announces 25-40% tariffs on 14 countries

- Smart SCO cities to intelligent urbanization

- War against aggression commemorated