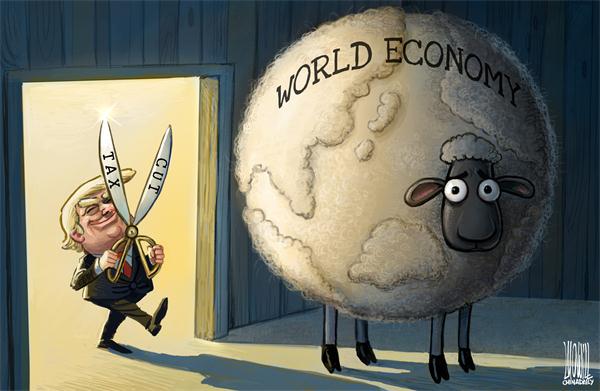

Trump's tax cut bill more of a political game

The year 2017 is coming to an end amid a couple of economic shocks. With the Conference Committee of the US Congress passing the bill for the Tax Cut and Jobs Act of 2017 on Dec 15, worries are mounting across the world on its possible ramifications, including global tax competition, capital flows into the United States, possible shift of manufacturing investment back to the US, and the rise of the dollar against other currencies, especially the renminbi.

However, looking at the serious economic implications and constraints, the bill doesn't appear as significant as described by US President Donald Trump and the Treasury Department.

First, the effect of corporate tax cut will be limited. The bill will reduce the corporate tax from a maximum of 35 percent to 21 percent. But the current actual corporate tax level is already very close to 21 percent, instead of the nominal 35 percent. Due to various tax incentives, rebates, credit and rational evasions, the actual total corporate tax levied in 2014 was $505.3 billion on a total pretax corporate income of $2,140.6 billion, or an average corporate tax rate of 23.6 percent. The rate increased to 24.0 percent in 2015 and then dropped to 22.7 percent last year.

During the third quarter of this year, the total annualized pretax corporate income was $2,215.0 billion, with a total tax of $476.4 billion levied-or an average corporate tax rate of 21.5 percent. To minimize the increase in federal budget deficit, the final version of the tax cut bill will most probably eliminate all the tax rebates and credit. In that eventuality, the corporate tax will release only limited money for additional investment.

Second, the main trouble in the US' capital investment is not a shortage of capital, but a shortage of demand. By the end of last month, the Dow Jones Industrial Average index had shot up 86.4 percent since the end of 2013. On the other hand, by October this year, the US industrial production index was just 6.1 percent higher than 2012, and the manufacturing production index was only 4.8 percent higher. Apparently, the largest share of the capital resources moved to the stock markets in search of higher profits. Limited tax cuts are unlikely to change the pattern.

Third, the tax bill is also less likely to bring about any phenomenal increase in consumption. Most of the personal income tax cuts will be for the rich, with the middle class getting only a "trickling benefit". A study shows that, according to the tax bill, the income of the richest 1 percent of the American population will increase by 8.3 percent on average, or $130,000 per family, while the poorest 95 percent's income will increase by only 1.2 percent. Since the very rich don't use the extra money on "mass" consumption, and the limited income increase for the middle class will not be enough for much higher consumption, the tax cut is less likely to result in a phenomenal rise in personal consumption.

Fourth, the increase in federal budget deficit will sooner or later result in the shelving of or a change in the tax cut regime. Even President Ronald Reagan, after having approved tax cuts in the 1980s when the federal government public debt was less than 30 percent of GDP, had to selectively hike taxes after public debt increased from $1 trillion to $3 trillion.

The US federal government public debt is already 103 percent of GDP, leaving little room for revenue cuts. The federal budget deficit in fiscal 2017 was $665.7 billion, or 3.5 percent of GDP, already above the baseline of 3 percent. And Kelvin Bradley, chairman of the House Ways and Means Committee, has estimated that the proposed tax cuts will add another $1.5 trillion to federal government debt over the next 10 years.

However, the US Treasury Department has presented a rosy picture, saying the tax cut-induced boost to GDP growth will generate more tax income for the federal government and finally balance out the budget. This is extremely questionable. Since corporate tax accounts for less than 10 percent of the federal government's fiscal income, the increase in its tax revenue, if any, will be far from enough to fill the gap. And personal income tax, the main source of budget revenue, by no means presents an optimistic picture. Because of the drastic cut in the tax imposed on the rich and the scrapping of the heritage tax (an important source of government revenue), a solid increase in tax revenue doesn't seem likely.

In such an event, the federal government will have to issue more Treasury bills to cover the budget deficit, or increase the social security contributions. In the former case, the extra money released by the proposed tax cuts will be sucked back into the Treasury Department to make ends meet. In the latter case, additional burdens will be imposed on the middle class, which will reduce their incomes. In any case, the effect of the tax cuts will be smaller.

Fifth, the trade deficit will tend to increase. Experiences from the tenures of former US presidents Ronald Reagan and George W. Bush show that the tax cuts did spur growth in the short term, but in the long run, they greatly increased the trade deficit. Following Bush's tax cut, the GDP growth rate accelerated from zero in 2001 to 4.4 percent in mid-2004. During the same period, the growth rate of US imports from Germany, too, accelerated from minus 12 percent to 22 percent, and that from Japan rose from minus 21 percent to 13 percent. This scenario conflicts with the Trump administration's central goal of trade balance. Therefore, the Trump administration is likely to launch trade protection measures more extensively, which in turn will drag down economic growth.

The economic benefits of the proposed tax cuts, to say the least, are doubtful. The University of Chicago conducted a survey of 38 leading economists, 37 of whom disagreed with the tax bill. We should therefore reserve our judgment on the benefits of the tax bill.

The tax bill, however, is very significant politically. The political priority of the Republican Party is to maintain majority in both houses of the Congress in the mid-term election in November 2018. Since the Republicans failed to totally scrap "Obamacare" (Patient Protection and Affordable Care Act), the only powerful tool they now have is the tax bill. The success of the bill will help the Republicans politically, at least in the next 11 months.

Moreover, the tax cut menu favors the rich, whom Trump represents. If the tax bill becomes law, the Trump administration could start redistributing national and social wealth more among the rich, and less among the poor and middle class.

Trump won the presidential election on the promise of helping the poor. But he is doing just the opposite. His pro-rich measures will have serious consequences for his presidency in the long run, because the further widening of the social income gap will become an almost insurmountable problem for him.

The author is senior fellow at the Center for China and Globalization.