Reforms aim to boost business

Last year, Premier Li Keqiang chaired a series of meetings intended to produce policies that will help companies overcome major challenges, as Zhang Yue reports.

Sun Zhonghai, founder of Zhanrui Technology Co, made local media headlines when he introduced his company's work to Li Keqiang during the premier's visit to Dalian, Liaoning province, in June.

At that moment, Sun knew he had made the right decision when he chose to become an entrepreneur.

"I was lucky with the timing. My business would not have survived and developed with-out the country's policies to support entrepreneurship and innovation," the 25-year-old said.

A year ago, Sun's family voiced strong objections to his plan to start his own business, pointing out that his peers were busy landing jobs.

"My family believed that starting a business was too complicated and risky," he said.

Now, Sun, along with his team of six, is about to launch his first product and is receiving the first round of financing.

It took just one week to complete the registration procedure: all Sun had to do was to decide on a name for his company, and agree on a certain amount of registered capital-in his case about 100,000 yuan ($15,480).

Like tens of thousands of young entrepreneurs, Sun is benefiting from a raft of new policies approved by the State Council, China's Cabinet, in the past year.

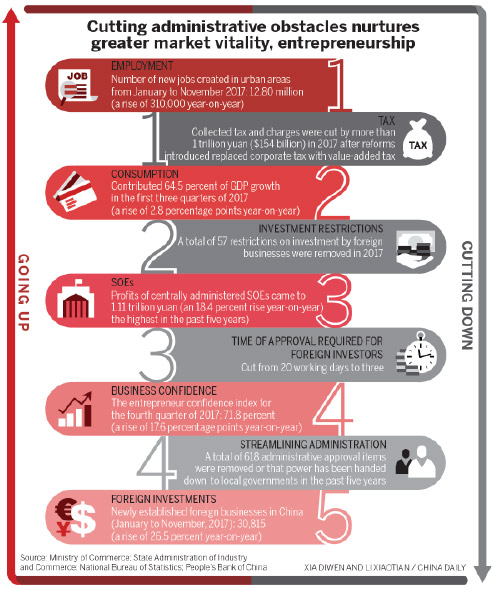

The measures are designed to remove the obstacles that have held businesspeople back and nurture new economic drivers.

Last year, the State Council held 34 executive meetings on 80 topics.

The meetings, chaired by the premier, discussed State-level policies and guidelines, and about one-third of them produced concrete guidelines to remove institutional hurdles and create a more comfortable environment for investment from both home and abroad.

The measures included reductions in taxes and fees, the development of inclusive finance, the provision of faster, cheaper broadband, the reduction of business charges and red tape, and the removal of obstacles to market access for private and foreign enterprises.

The moves were designed to facilitate China's economic transformation from an export-led growth model, which has provided dynamic results in the past 35 years, to one driven by consumption and services.

Cost reductions

State Council executive meetings in January, February, May and August produced measures to expand financing channels for micro, small and medium-sized businesses.

Business fees deemed unreasonable were cut to lower institutional costs and boost market vitality. Meanwhile, oversight charges levied on banks and other financial institutions were put on hold.

Zhao Jie, 31, has worked at Weimeinuo, an innovation industrial park in Changzhi, Shanxi province, since 2014. The park offers production, sales and financial services to companies, especially small and microbusinesses. Most of the businesses in the park sell construction materials.

Last year, the fees levied on the park by local and central governments were reduced by more than 300,000 yuan, according to Zhao. While she expressed approval for the changes, Zhao is more interested in the removal of administrative hurdles.

Weimeinuo welcomed 10 new companies last year, and scores of startups registered to share business premises there in accordance with measures released in 2014 that cut rents and costs.

The State Council also decided to roll out a host of reform measures that had been piloted in eight areas, aiming to allow innovation to spur entrepreneurship and employment, and accelerate the transformation of innovation into real productivity.

Flourishing

In the first three quarters of last year, new business registrations rose 12.5 percent as an average 16,500 new businesses were registered every day.

A report published by the Center for China and Globalization, the country's largest independent think tank which specializes in globalization and international cultural exchanges, showed that more than 40 percent of people who returned to the country last year after studying overseas joined private companies.

In 2014, Wang Shengdi founded Daddy's Choice Co, which makes paper diapers, directly after gaining an MBA from Cornell University in New York because the "real economy is crucial for China, and I want to contribute".

The company now has more than 500 employees, and its young CEO has been impressed by the government's preferential policies for startups, especially the expansion of financing channels for small businesses.

Miao Lyu, co-founder of the Center for China and Globalization, said the State Council's decision to aid domestic startups and attract foreign businesses has ignited competition in innovation and industrial parks, and in business incubators nationwide.

Tax reform

Since May 2016, China has expanded tax reform to all industries, using tailored measures and a number of incentives to reduce the tax burden on companies and nurture business vitality.

In November, the State Council approved a regulation that replaced corporate tax with value-added tax.

The move marked a mile-stone in the reform process by signaling the end of corporate tax, which was introduced in the 1950s.

Last year, the State Council's executive meetings produced three guidelines and documents related to tax reform and the reduction of fees levied on companies.

In addition, Premier Li chaired a number of seminars that centered on tax reform.

Figures from the National Bureau of Statistics show that the tax burden and charges levied on companies has been reduced by more than 1 trillion yuan since VAT was launched nationally in May 2016.

Zhu Qing, a professor at Renmin University of China who specializes in tax studies, believes the move from corporate tax to VAT will have a profound effect, which many people have yet to realize.

"What's crucial about VAT is that it establishes a uniform tax to replace the previous two separate taxes. This is more important than the amount of money businesses have saved through tax reform," he said.

Zhu believes the implementation of a uniform rate of VAT is achievable as a result of China's adoption and development of internet technology and big data.

"The sound development of internet governance, online registration and big data makes it easier to track businesses that try to avoid paying taxes, thus improving the prospects for a uniform rate of tax," he said.

For Bai Chong'en, a professor at Tsinghua University's School of Economics and Management, the reduction of fees levied on companies is an essential move to promote business vitality. He said companies that try to avoid paying fees rarely save money in the long run.

"Cutting fees is just as important as cutting taxes. But because there is a lot of flexibility with fees, some companies may work on finding loopholes to help them avoid paying. Yet by doing so they are also paying the cost of taking a risk," he said.

"Government moves to reduce business-related fees are crucial, because they will discourage companies from trying to avoid fees, and that will gradually build a business environment that more people will believe in."

- China, France agree to launch new round of cooperation on panda protection

- Cracking down on cross-border crooks

- Xi, Macron witness signing of multiple cooperation documents

- Xi says China, EU should be partners

- Xi calls on China, France to expand cooperation in multiple areas

- Courts step up efforts to curb private sector corruption