Fresh ray of hope for solar firms

Chinese panel makers train sights on liberal Europe amid US restrictions and barriers in India

Chinese photovoltaic companies have been on a rollercoaster this year. But the ride may stabilize and hurtle toward brighter vistas, potentially transforming the country's energy mix over the long term, industry experts said.

First, trouble seemed inevitable when, in June, the Chinese government slashed its subsidies for solar power and also halted all subsidies for utility-scale solar projects. It was a blow that plunged even the stocks of listed solar companies into a free fall.

But sunny weather appears to be on the horizon for the industry, following the European Commission's announcement on Aug 31 that it is removing restrictions on sale of solar panels from China.

The EC curbs have been in place for almost five years. The European Union's antidumping and anti-subsidy measures on solar panels from China expired on Sept 3, the EC said in a statement. It was in the best interests of the EU as a whole for the measures to lapse, given the bloc's aim of increasing its supply of renewable energy, the EC further said.

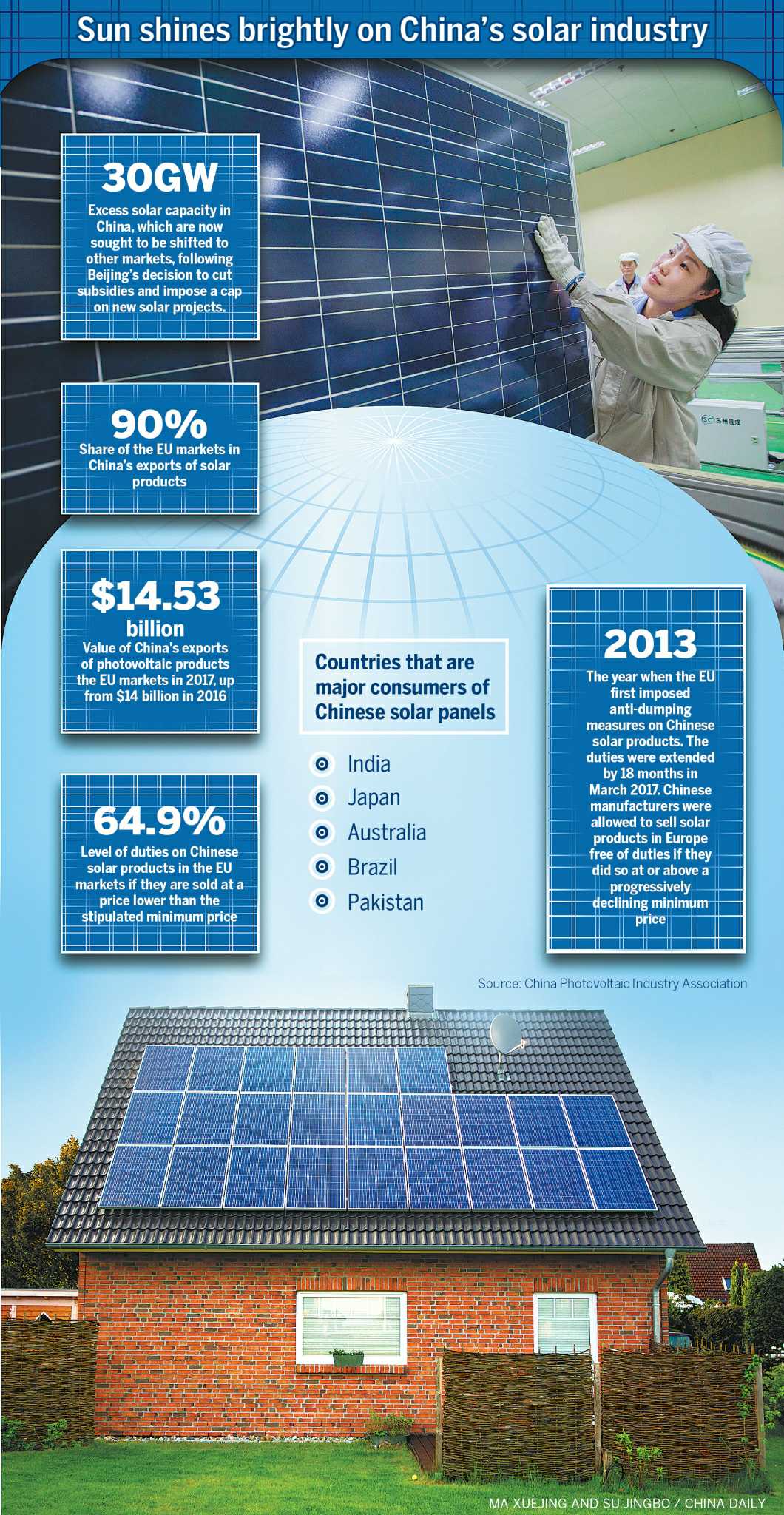

The EU first imposed the measures in 2013. In March 2017, it extended them by 18 months. Chinese manufacturers were allowed to sell solar products in Europe free of duties only if they did so at or above a progressively declining minimum price. If they sold for less, they were subjected to duties of up to 64.9 percent.

The removal of the minimum import price is good news for Chinese solar module manufacturers.

They will now be able to supply most of the EU's utility-scale power projects with solar panels produced in China, said Jiang Yali, a solar analyst at Bloomberg NEF, an industry information provider.

Alex Liu, who analyzes China utilities, renewable energy and environmental services for UBS Securities, echoed her view. The EU's decision to scrap minimum import price restrictions on China would help facilitate Chinese solar exports to the EU market, and help lower solar product prices in the EU and stimulate demand, he said.

"It will promote faster solar grid parity in the EU leading to more unsubsidized solar projects, and the termination could also lead to the scrapping of Section 201 tariffs by the US on solar imports, as well as related tariffs in other countries."

Many domestic photovoltaic companies welcomed the EU's decision not to renew the restrictions but allow them to lapse on expiry. The move, they believe, will result in a win-win or mutual benefits.

Qian Jing, vice-president of Jinko-Solar Holding Co Ltd, the world's biggest solar panel producer by shipments, said the end of the restrictions will benefit the entire sector. "The world is flat," she said. "This is a great example of trade liberalization."

"Solar panels, as an important clean energy product, play a significant role in coping with climate change, achieving emission cut targets for countries around the world.

"The original solar capacity overseas cannot meet the strong demand from the European and US markets, and if the domestic capacity can be offered to Europe, more overseas capacity can be released to satisfy the US market."

Beijing's decision to cut subsidies and impose a cap on new solar projects meant there was some 30 gigawatts of excess capacity to export.

However, there were few major markets to explore further given the tariffs imposed by the US and those planned by India, the second- and third-largest markets trailing China. The EU market thus meant a new door opened for domestic companies.

Qian's view is shared by Leon Chuang, global marketing director of Risen Energy. He estimated that the price of solar cells and modules is expected to fall slightly in the fourth quarter of this year compared with the same period in 2017.

"Considering the European market tends to be conservative and stable, the end of the EU's restrictions won't affect demand immediately but the demand in the European market is likely to be higher than the originally anticipated figure due to price cuts starting from next year," he said.

Bloomberg NEF, however, does not expect the EU move to have a marked effect on either global module prices or short-term demand in the EU.

In July, India imposed safeguard duties against PV cells and modules imported from China, Malaysia and developed countries, starting at 25 percent this year, although these have been temporarily put on hold.

Meanwhile, some large manufacturers in China are still moving ahead with planned manufacturing expansions, according to Bloomberg NEF.

JinkoSolar, GCL-Poly and Tongwei are among those ramping up capacities, with JinkoSolar planning to raise cell capacity by 40 percent and panels by 20 percent by the end of this year, from levels seen in the second quarter, according to a financial results-related presentation in August.

According to Jiang, the MIP undertaking was largely unsuccessful as European manufacturers did not benefit from the anti-subsidy tar-iffs as expected. This year, there is very little manufacturing capacity left in Europe and Germany-based SolarWorld AG, the last major EU PV manufacturer, even filed for insolvency in early 2017.

China's Ministry of Commerce also described ending trade controls on Chinese solar panels as a successful model of resolving trade frictions through consultations, adding it will restore China-EU trade of solar panels to normal market conditions and provide a more stable and predictable business environment for both industries to realize win-win results.

These days, it is more important than ever to take steps toward dealing with climate change. China is willing to continue cooperating with the EU to advance emission cuts, climate adaptation and sustainable development, and push for global free trade and a rule-based multilateral trading system, a spokesperson for the ministry said in a statement.

According to Jiang, EU utility-scale project developers who have already bid at auctions and are about to procure their equipment, including those in Spain, Germany and Greece, are big winners from the expiry of the MIP, as the related premium will fall and they will benefit from a huge supply of cheaper modules.