Geely, SAIC see rise in profits, JMC and FAW Car record decline

Nine China's listed auto companies — Geely, Great Wall, JMC, FAW Car, TianJin FAW Xiali, BYD, BAIC, GAC, SAIC — announced their 2018 financial results, news portal National Business Daily reported on Thursday.

The portal said the vehicle sales and net profits of Geely and SAIC increased in 2018, while the figures of JMC and FAW Car decreased.

Geely reported its revenue rose 15 percent year-on-year to 106.6 billion yuan last year, the net profits attributable to shareholders increased 18.05 percent to 12.55 billion yuan, and the vehicle cumulative sales (including the company's subsidiary brand LYNK&CO) reached 1.5 million units, surging 20 percent.

Great Wall's revenue and vehicle sales in 2018 were 99.23 billion yuan and 1.04 million units, respectively, a 1.92 percent and 1.63 percent decline from a year earlier, while its net profits attributable to shareholders saw a rise of 3.58 percent to 5.2 billion yuan.

National Business Daily said the two auto companies will increase investment on new cars and adjust their development strategies.

The auto industry has entered into high-quality developing stage. The Great Wall will phase out more low-end products and push more new cars, said Wei Jianjun, president of Great Wall Motors.

This year, Geely will focus on enhancing market share in response to the market's uncertainties, An Conghui, president and CEO of Geely Auto Group, said.

In 2019, Geely will launch six new models and 10 facelifts, National Business Daily said.

JMC's revenue showed a decline of 9.88 percent year-on-year to 28.25 billion yuan in 2018, and the net profits attributable to shareholders was 92 million yuan, slumping 86.71 percent.

FAW Car said its revenue was 26.24 billion yuan last year, down 5.94 percent from a year earlier, and the net profits attributable to shareholders was 155 million yuan, sliding 44.88 percent.

Due to TianJin FAW Xiali selling its FAW Toyota stocks the company's net profits saw a surge of 102.27 percent year-on-year to 37.31 million yuan in last year, while its revenue went down 22.5 percent to 1.13 billion yuan. If the non-recurring profit and loss is excluded, the company's net loss was 1.26 billion yuan last year.

National Business Daily citing JMC, FAW Car and TianJin FAW Xiali said their performances declined due to the car market slow down.

Moreover, BYD said its net profits fell on account of the subsidy cutting and rise in R&D spending. In 2018, BYD's net profits attributable to shareholders were 2.78 billion yuan, dropping 31.63 percent year-on-year, while its revenue reached 130.06 billion yuan, up 22.79 percent.

The car makers will face more challenges as the new energy cars subsidy will be further reduced and competition will intensify in 2019, the National Business Daily said.

BAIC, GAC, and SAIC saw good financial results last year, with the revenues 151.92 billion yuan, 72.38 billion yuan and 902.19 billion yuan, respectively, a year-on-year rise of 13.2 percent, 1.13 percent and 3.62 percent, respectively.

The three companies' net profits attributable to shareholders were 4.43 billion yuan, 10.9 billion yuan, 36 billion yuan, a year-on-year increase of 96.6 percent, 1.08 percent and 4.65 percent, respectively.

Last year, GAC sold 2.15 million vehicles, up 7.34 percent year-on-year, with the self-owned brands sales volume increasing 5.23 percent; the sales volume of the joint venture brands including GAC Honda, GAC Toyota and GAC Mitsubishi rising 5.16 percent, 31.11 percent and 22.69 percent, respectively.

SAIC's annual sales were 7.05 million vehicles with self-owned brands Roewe and MG selling 730,000 vehicles and joint venture brand SAIC Volkswagen selling 2.06 million vehicles in 2018.

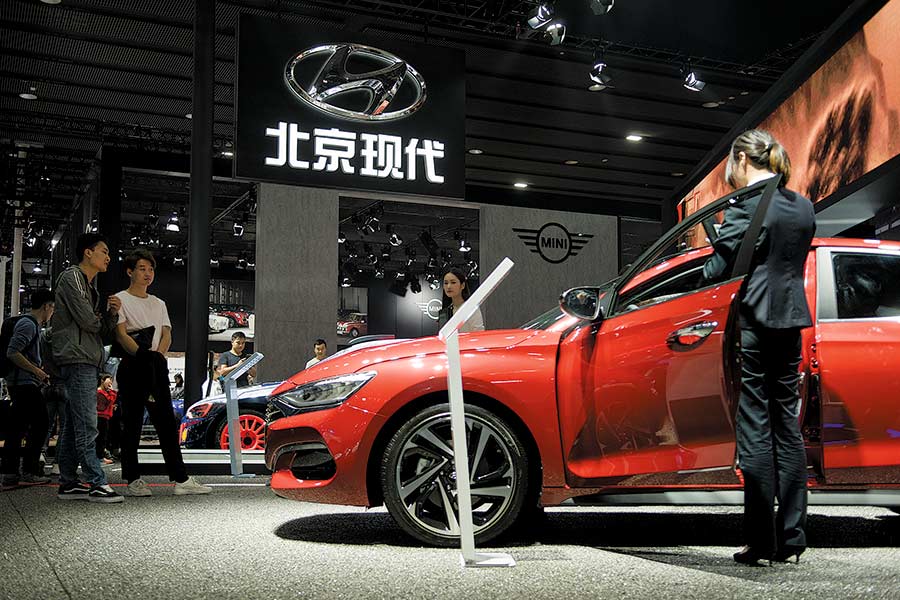

BAIC sold 1.46 million vehicles BAIC last year, down 0.4 percent with its joint venture brands- Beijing Benz, Beijing Hyundai and Fujian Benz selling 485,000 vehicles,790,000 vehicles, and 29,000 vehicles, an increase of 14.8 percent, 0.7 percent and 27.3 percent, respectively; while its self-owned brands sold 156, 000 vehicles last year.

Beijing Benz becomes backbone in BAIC's revenue with the figure reaching 135.41 billion yuan in 2018 from 116.77 billion yuan in 2017, jumping 16 percent year-on-year, that accounted for 89.1 percent of BAIC revenue in 2018.