Emerging tech firms face tighter scrutiny

PBOC officials moot stricter measures in financial sector to protect investors

Regulators are expected to adopt a tough stance on emerging technology in the financial sector and extend supervision of technology giants in an effort to curb systemic risks, central bank officials said on Tuesday.

Over-innovated financial products with lagging regulation may lead to financial instability and potential losses for investors, said the People's Bank of China, the central bank. China will tighten regulations on all types of institutions doing financial businesses so as to protect investors who are unable to recognize potential risks, PBOC Vice-Governor Pan Gongsheng said in a speech that was read out at the Third China Internet Finance Forum in Beijing.

"Financial activities for the public, whether in the name of technology or not, should be strictly regulated, and we should safeguard residents' money," he said in his speech.

Proper use of financial technology can help reduce financing difficulties for small and micro enterprises, but activities, which lead to funds circulating within the financial system to boost speculative investment should be controlled, said Pan.

The annual Central Economic Work Conference, which was held last week, highlighted prevention and control of financial risks as one of the "three tough battles" and a key task that needs to be carried out next year.

The PBOC established a special work group in 2016 to tackle risks rising in internet financing businesses. In 2017, the government banned so-called "initial coin offerings" or ICOs, a way for startups to raise funds by selling off newly-created digital currencies. All trading platforms for such virtual assets have been closed in the country.

"We have avoided the risk of a massive virtual asset bubble," said Pan. The regulators will build an online financial risk supervision mechanism to improve the disposal of cross-market risks by taking advantage of new technology, he said.

Financial regulators around the world are working on a set of global regulatory standards, and countries standing at the leading edge of financial technology will have more advantages to dominate the rules. Thus China, as one of the global fintech pioneers, should proactively participate in the international rule-making process, said experts.

The development of financial technology is more like a competition among countries. For instance, the PBOC is still in the process of developing its own digital currency, in a race with some other countries. This competition of government-backed cryptocurrency can be seen as a key feature of the "digital era", Wang Xin, head of the PBOC's research bureau, said on Tuesday.

A recent report from US-based CNBC said that China's support for financial technology, represented by blockchain, "could put other countries behind, to the point where the world's second-largest economy could dominate the technology and the way it's developed".

But it is not easy for the private sector to win the digital fiat money making competition. "The right to issue money is important for the government, as it is one of the fundamental measures for the government to raise funds and implement macroeconomic adjustments," said Wang.

In a financial crisis, the central bank can inject liquidity and stabilize the financial system through flexible adjustments such as money supply, a function that privately-issued money, such as Facebook's Libra, may find it hard to implement, he said.

Some large financial technology companies, which have a broad business scale involving a large group of investors, should be regulated as systemically important financial institutions, said Xiao Gang, former chairman of the China Securities Regulatory Commission.

Higher regulatory standards for capital adequacy ratio, asset liability ratio and information disclosure should be introduced to these large companies, including the financial holding groups, according to Xiao. "New regulatory standards are needed, not just copying the supervision system for traditional banks."

Today's Top News

- 'China shopping' boom spurred by favorable policies helps drive growth: China Daily editorial

- New tariff threat to ensure the chips fall to US: China Daily editorial

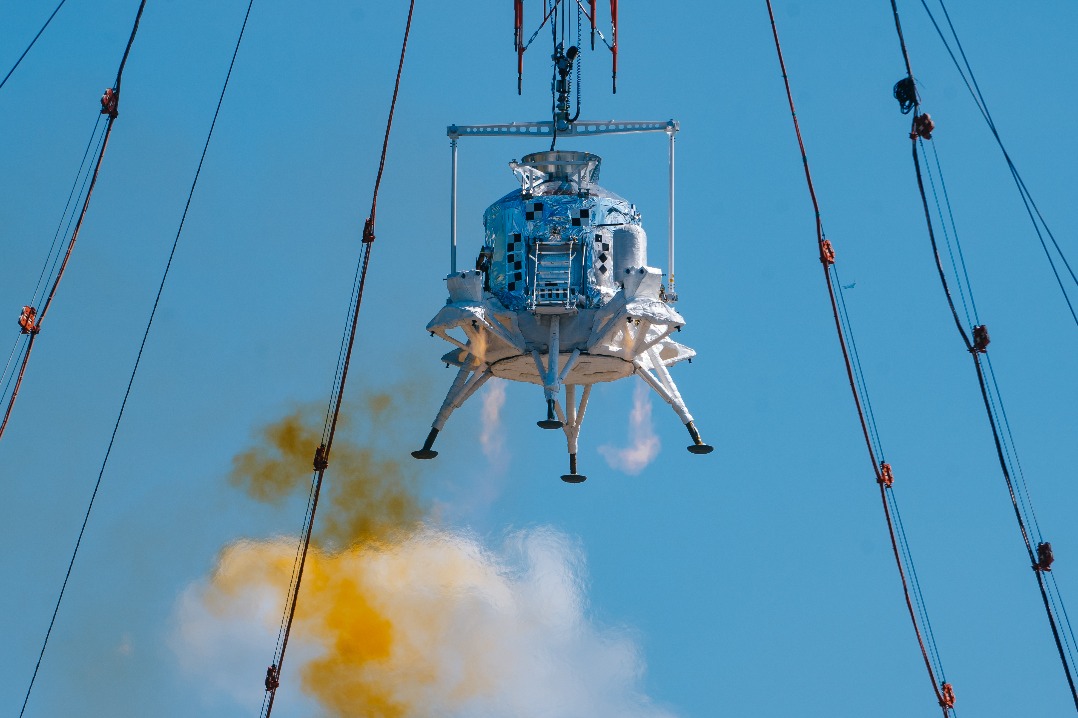

- China completes first landing, takeoff test of manned lunar lander

- China's new free preschool policy to save families $2.8 billion

- China's foreign trade rises 3.5% in first seven months

- China's foreign trade up 3.5% in first seven months