Risk elimination efforts bearing fruit in China, say experts

China has demonstrated considerable success in tackling and eliminating risks amid ongoing efforts to curb financial risks, analysts said.

Government support will remain strong for major banks in China, given authorities' overriding objective of maintaining financial and social stability, global credit ratings agency Moody's Investors Service said in a recently released report.

The introduction of regulations for domestic systemically important banks will tighten supervision of larger banks and help maintain financial system stability, Moody's said. The ratings agency expected the People's Bank of China, the central bank, to continue maintaining ample bank funding through accommodative policies.

China's banking and insurance regulator urged relevant financial institutions to take multiple measures to dispose of and mitigate the risk of banks' nonperforming assets, in addition to classifying bank loans strictly according to their inherent risks as "pass, special-mention, substandard, doubtful and loss" to truly reflect their risk level, Xiao Yuanqi, chief risk officer and spokesperson of the China Banking and Insurance Regulatory Commission, said at a news conference on Oct 21.

Till that date, China's banking sector had disposed of 4.9 trillion yuan ($701 billion) bad loans since the beginning of 2017, he said.

The banking and insurance regulator has effectively contained irregularities concerning financial institutions, businesses and transactions by undertaking remedial measures for almost three years, Xiao said.

China Cinda Asset Management Co Ltd, one of the "big four" State-owned asset managers, has played an active part in the mitigation of credit risks of large private companies with the aim of maintaining regional financial and social stability, as Chinese leaders called for solid efforts to win a tough battle against financial risks.

Xiang Dang, assistant president of China Cinda, said credit risks occurred in some large companies in certain provinces and cities due to various reasons. Some were exposed to the risk of maturity mismatch, which led to liquidity crises. Some pursued an excessively large-scale business without making judgments on business quality and efficiency scientifically. Some overtly diversified their business, and some were lagging behind their competitors in terms of technology.

"We paid high attention to private companies which had the above problems and tracked their problems for the long term … Following the principles of marketization and institutionalization, we pushed ahead with mitigation of potential regional financial risks through a package of solutions," Xiang said at a recent news conference in Beijing.

The asset manager either helped these companies increase the value of their assets and clear up inefficient assets through multiple measures, such as introducing strategic investors, restructuring, and implementing debt-for-equity swaps, after the companies encountered crises or helped the companies resolve liquidity crises by intervening in their business before crises happened.

In 2017, a capital chain rupture occurred at Hongye Chemical Group Co Ltd, a large Shandong-based private company whose business segments include chemical and pharmaceutical industries, trade and small loans, because of overexpansion and its irrational structure of financing.

The crisis affected a number of large local companies which formed a mutual credit guarantee scheme with Hongye, involving debt totaling more than 20 billion yuan. Once a wider crisis occurs, it could have an enormous impact on regional economic, financial and social stability.

China Cinda introduced industrial investors to Hongye. They set up a restructuring fund to dismantle and dispose of the group's assets by business segments, realized asset value maximization of each segment, eliminated outdated production capacity, and cleared up loss-making "zombie" subsidiaries of the group, Xiang said.

"We also broke the chain of debt guarantee of Hongye through combined efforts of reorganization under the bankruptcy law and acquisitions of secured claims, in order to give rebirth to the group and reduce hidden financial risks, on the basis of protecting the interests of its employees and small creditors to the greatest extent," he said.

Today's Top News

- World Games dazzles audiences in Chengdu

- Choirs send message?of amity?at games' opening

- Foreign trade stays on stable growth track

- 'China shopping' boom spurred by favorable policies helps drive growth: China Daily editorial

- New tariff threat to ensure the chips fall to US: China Daily editorial

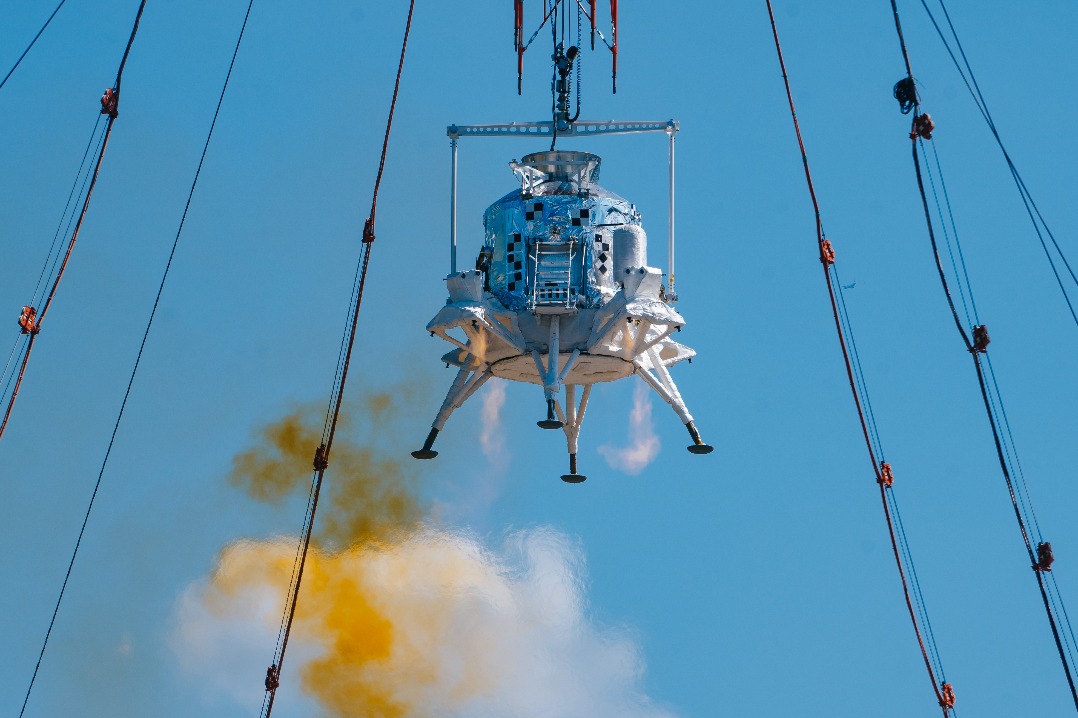

- China completes first landing, takeoff test of manned lunar lander