Bosideng gears up its global ambitions

Clothing maker plans to go upmarket and online to compete with well-known imported brands, become industry leader

By partnering with French fashion designer Jean Paul Gaultier, China's largest down clothing company, Bosideng International Holdings, is trying to boost sales of its high-end offerings as part of its strategy to compete with global upmarket players like Canada Goose and Moncler.

The announcement of the partnership in November was marked by a star-studded fashion show in Shanghai. The show featured some of China's A-list celebrities and fashion bloggers wearing the bomber jackets and down capes created exclusively for the Chinese brand by the 67-year-old designer, who is known for creating Madonna's controversial conical bra and as the former creative director of luxury house Hermes.

To keep up the momentum, weeklong ads on Sina Weibo followed, with slogans like "when the naughty boy of fashion meets Bosideng".

"We plan to first consolidate our hold on the Chinese market over the next three years, enter the international market in four to six years, and then become a global industry leader within the decade," said Mei Dong, CEO of the Shanghai-based company, at a recent news conference to announce its strategy.

Having started as a clothing manufacturer in the 1970s in Changshu, East China's Jiangsu province, the now Hong Kong-listed company repositioned itself as a dedicated down jacked maker in 2017 after years of unsuccessful attempts to expand into menswear.

The move was inspired by the more generous budgets Chinese consumers now have for winter coats due to the increasing efforts of foreign brands, who have transformed the traditionally functional attire into a fashion accessory like bags for women or watches for men.

"Down jackets used to be an immensely seasonal and regional product in China. They were such a marginalized category in department stores that they shared space with swimwear when it was out of season," said Ye Qizheng, co-founder of DFO Showroom, one of the largest fashion showrooms in China connecting buyers and designers.

"But today, down clothing brands enjoy prime locations in the top shopping malls in Shanghai and Beijing. What's more, the most surprising thing is that in Shenzhen, a southern city with an average temperature of 23 C, Moncler has a store," said Ye.

According to the National Bureau of Statistics, the number of down jackets sold in China has fallen for three consecutive years since 2016. In 2018, 190 million jackets were sold in the country, down by 32.8 percent from the previous year and the lowest level in the past five years.

However, the average retail price has been increasing steadily, up by 20.8 percent in 2018. As a result, the main price range has grown from 600 yuan ($85) to 800 yuan to more than 1,000 yuan.

The China Garment Association estimated that the total value of China's down jacket market reached 106.8 billion yuan last year, exceeding 100 billion yuan for the first time in history. It is projected that by 2022, the sales value will surpass 162 billion yuan.

China is the world's largest manufacturer, exporter and consumer of down and feather products. Statistics from the Food and Agriculture Organization of the United Nations showed the number of ducks raised in China accounted for 74.2 percent of the world's total, and the number of geese accounted for 93.2 percent. As a byproduct of the duck and goose farming industry, China supplies more than 70 percent of the world's feather and down material.

Yao Xiaoman, director-general of the China Feather and Down Industrial Association, said while the rising cost of down jackets has partly contributed to the increase in retail prices, a key driver is changing perceptions of consumers, which have encouraged them to spend more.

"While the change was started by foreign brands and companies, it's also a good time for domestic players to upgrade to meet the new demands by taking advantage of the opportunity and our expertise in the industry," said Yao.

Bosideng, for example, has lowered the percentage of its products sold below 1,000 yuan from 47.5 percent in 2016 to 12.5 percent in 2018, while raising those above 1,800 yuan from 4.8 percent to 24.1 percent over three years, according to Business of Fashion.

Meanwhile, it has also had collections displayed at the likes of New York and Milan Fashion Weeks in recent years to boost the brand's image as a trendsetter, rather than a mere clothes maker.

In October 2018, it announced the opening of 100 stores in China on the same day, with the largest one occupying 2,000 square meters in Shanghai. Designed by a French team, the Shanghai flagship store features a facade made up of 28 windows, each separated by a LED wall, while inside customers are invited to try on the products in a room kept at minus 15 C to simulate freezing conditions.

But sales recorded on Bosideng's Tmall e-commerce store show its efforts to upgrade are yet to bear fruit.

Among the e-store's Top 10 bestselling products, none is priced above 1,000 yuan. The collection designed by Gaultier, which mostly retails at between 3,000 and 4,000 yuan, has a sales performance similar to the brand's other high-end offerings, with fewer than 100 pieces sold in one month. The bestselling product is a kid's down vest priced at 79 yuan, with 12,000 pieces sold in 30 days.

Today's Top News

- World Games dazzles audiences in Chengdu

- Choirs send message?of amity?at games' opening

- Foreign trade stays on stable growth track

- 'China shopping' boom spurred by favorable policies helps drive growth: China Daily editorial

- New tariff threat to ensure the chips fall to US: China Daily editorial

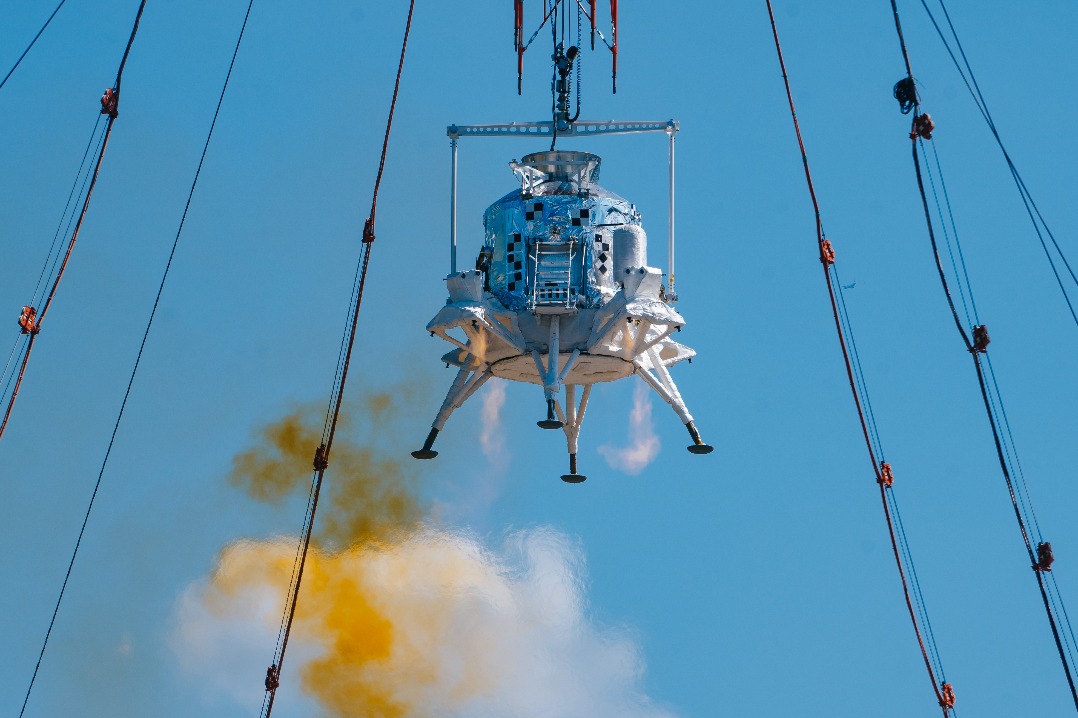

- China completes first landing, takeoff test of manned lunar lander