Niche financial services could be casino-rich Macao's next big bet

When you think of Macao, what's the first thing that comes to mind? Dazzling casinos? Nostalgia-evoking buildings? Exotic delicacies? Portuguese links? To be sure, all these contribute to the charm of Macao, but they don't tell its whole story.

As a city with an area of only 30 square kilometers, Macao has to choose its pillar industries carefully, retain its attractiveness as a city, present itself to the world's tourists in its best shape.

In the past 20 years, Macao's gambling industry had taken on a central role in the local economy, but it also brought about some socio-economic problems at the same time. After many years of casino-fueled growth, it's time to consider which industry will be a good diversification choice for Macao. The answer maybe finance.

Let's first look at the location of Macao. It is southeast of the Chinese mainland and backed by China's Pearl River Delta, one of the wealthiest regions of China connecting Hong Kong, Macao and Guangdong province. The per-capita income is high in these areas, and the accompanying purchasing power laid the foundation for Macao tourism.

What's more, the inland areas are known for their abundant resources, strong manufacturing capacity, widespread logistics and sales networks. All these mean it's unnecessary for Macao to establish a complete industrial structure. Regardless of its past, Macao seems to have a comparative advantage in some unconventional but at the same time indispensable industries.

Let's now also look at Macao from a larger geographical perspective. Facing Vietnam, the Philippines, Malaysia, Singapore, Indonesia and other ASEAN countries across the sea, Macao is an ideal start for travel and business in Asia. In fact, from ancient times, there were frequent trade and other exchanges between Macao and ASEAN countries, and migrants foster common cultural traditions among Macao people and Southeast Asians.

In addition, Macao maintains close ties with Portuguese-speaking countries, and through these ties, Macao extends its relations with other countries in different continents, including Europe, Asia, Africa and South America. If the Spanish-speaking countries are also knit together as close friends, Macao lives up to its reputation as the integrating hub of Eastern and Western cultures.

With casinos and tourism as its key industries so far, and given the advantage of its geographic location, Macao's economic performance can be described as "small but beautiful" over the past few decades. In 2018, Macao's GDP per capita ranked third in the world, and the Macao Special Administrative Region's government revenue from casinos was 113.5 billion Macao patacas ($14 billion), the accumulated fiscal reserves were 505.6 billion Macao patacas.

But as the old saying goes, one coin has two sides. Macao's economy may lose growth momentum if the growth rate of the casino industry declines. Actually, this potential downtrend has emerged in recent years.

Diversification could not only be the source of happiness but a driver of economic growth. When Macao applies this rule to its industrial policy, many potential diversification directions can be evaluated and weighed against each other. Based on Macao's resources and endowments, its existing industrial structure, its positioning in China and neighboring regions, we come to the conclusion that serving the capital flows into and out of the Chinese mainland may be a good choice for Macao, and help maximize the city's economic growth.

Our logic is that economically, China has shifted from a trade-motivated country to a capital-motivated one. Over the past three decades, China has gained revenue from trade activities, boosted economic growth through trade, and accumulated huge foreign exchange reserves.

Now, as a net creditor, China desperately needs to invest its accumulated capital to obtain high investment returns. China's asset allocation will also shift from foreign government bonds to more direct investment and, in the future, more portfolio investment.

This means, on the one hand, there is an urgent need to establish a platform for Chinese enterprises to go global.

On the other hand, China is opening up wider to the world, especially in the finance industry. Macao is one of the most open economies in the world. It is also an independent customs zone with a simple and low tax system. There is no foreign exchange control. Capital can move in and out of Macao freely, and a large capital pool has already formed in Macao.

These features can reassure international investors, especially those who want to share China's economic growth dividend, but still have doubts about China's opening-up policy.

Macao has many reasons for setting up an offshore financial center for two-way capital flows.

The first reason is Macao's capital endowment, including its strong foundation for the financial industry, close relations with Portuguese-speaking countries and other European countries, capital collection capacity and low cost of capital.

The second reason is, the offshore financial industry does not require much space and resource, but usually generates higher profit margins, which can suit a well-connected city like Macao as it has limited land resources.

The third reason is that offshore financial centers can provide services to Chinese and global capital flows, which are increasing quickly and constitute a huge demand. In terms of specific business, Macao can start from investment services, fund raising, wealth management and part of offshore financial services, and gradually expand to other.

However, Macao should limit its services to specialized fields, instead of establishing a global offshore financial center and providing comprehensive financial intermediary services. It may be a bad strategy for Macao to aim to replace or undermine an established global financial powerhouse such as next-door Hong Kong.

Today's Top News

- 'China shopping' boom spurred by favorable policies helps drive growth: China Daily editorial

- New tariff threat to ensure the chips fall to US: China Daily editorial

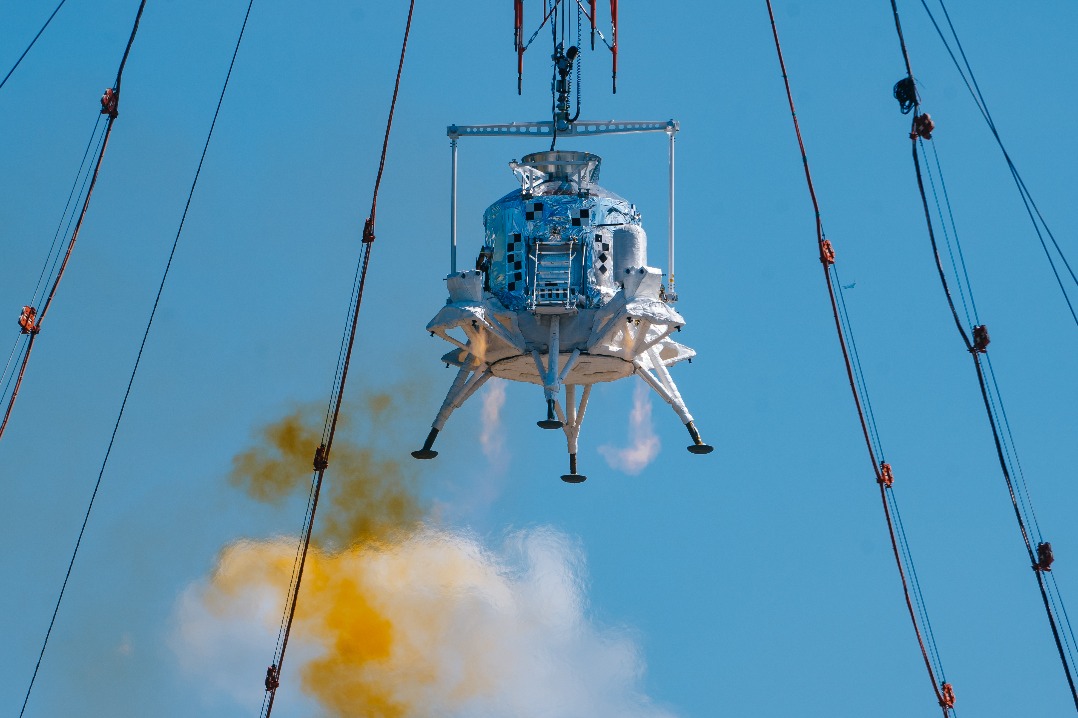

- China completes first landing, takeoff test of manned lunar lander

- China's new free preschool policy to save families $2.8 billion

- China's foreign trade rises 3.5% in first seven months

- China's foreign trade up 3.5% in first seven months