Local toymaker wins market with innovation

Beijing-based Pop Mart finds success after tapping the rising demand for collectibles from adult customers

During the 2019 Singles Day festival, a shopping occasion created by Tmall, neither Lego or Bandai, the top two toy brands in the world by value, topped the chart in the toy category.

The champion in terms of revenue was Pop Mart, a Beijing-based lifestyle retailer, which in nine seconds sold 55,000 toys in mini blind boxes-small, sealed packages containing collectible toys that are part of a series. It also sold more than 2 million art toys-designer toys normally designed by artists-worth 82.12 million yuan ($11.8 million).

The growth compared with the previous year's event is 295 percent, and it was only the third time Pop Mart had participated in the Singles Day shopping spree. All the other top four toy brands were foreign. According to Tmall, about 80 percent of the art toys sold on Tmall during the 2019 Singles Day were from Pop Mart.

The company said its victory over international leading toymakers did not come from low costs and large quantities, a stereotype of Chinese toymakers.

"We beat them by selling at decent prices and relying on our own brands," said Wang Ning, founder and CEO of Beijing Pop Mart Culture and Creative Co Ltd. "We are not selling copies of popular toys. We won by innovating a completely new toy category."

Compared to the brick toys and robots, Wang's toy empire is founded on art toys, and Pop Mart's toys are targeting mostly at teenage and adult consumers aged between 15 and 35-people they refer to as art toy collectors. The company has 2 million active registered customers.

"The growth in demand for toys from adult consumers is probably bigger than that from children and parents," he said. "And this has immense potential."

Walking into his Beijing office with its views of the central business district, one might mistake it for that of an artist. Filled with displays of collectibles, paintings and sculptures, the center piece is an electronic drum set that Wang occasionally plays.

Wang opened a store in 2008 in his sophomore year at university, renting out small spaces in the store to individual sellers. In 2010, he founded Pop Mart to sell arty designer products including accessories, makeup and digital products.

While the business was largely unsuccessful, Wang discovered one toy, SonnyAngel, was a big hit. In 2015, Wang took a risk and dropped many categories and focused on selling art toys, notably securing the licensing rights for the character Molly by Hong Kong toy designer Kenny Wong, founder of Kennyswork Co Ltd. His risky move proved successful.

Now defined as an integrated intellectual property operation service provider, Pop Mart is engaged in retailing art toys, acting as a broker for artists, developing new media entertainment and organizing large-scale exhibits.

In China's first-and second-tier cities like Beijing and Shanghai, Pop Mart has about 130 retail stores and more than 700 machine terminals, making it the largest art toy retailer in China. It has cooperated with well-known brands and artists around the world and launched a variety of popular art toys.

In 2017, Pop Mart publicly listed on the National Equities Exchange and Quotations, known as the "new third board", with a loss of 30 million yuan. In the following year, the company made a profit of 8 million yuan. In the first half of the third year after listing, Pop Mart reached a profit of 25 million yuan. The company went private in March 2019.

A total of 65 percent of Pop Mart's business comes from brick-and-mortar stores and the rest comes from online sales. Wang believes offline stores serve as a channel to not only sell products, but also create a space to cultivate a sense of culture.

According to global asset ranking firm Hurun, Pop Mart's capacity in building its own intellectual property supply chain-designing, manufacturing and retailing-has contributed to its sudden surge in the retail and entertainment sector.

"Our business is to commercialize and industrialize what artists have created," Wang said. "It is a pity that an artist can sell only 200 pieces of artwork. I want to bring them to a mainstream audience through our platforms and the ecology we have built."

Speaking about what makes art toys popular in China, Wang said it sometimes requires decades of cultivation for major international intellectual property such as Star Wars to make an impression on Chinese people. But art takes less time and effort, he said. "You could be moved to tears just by looking at a painting simply because it moves you," he said. "That is probably the charm of Molly."

According to Wang, art toys are popular with adults because they meet their desire to preserve rare and collectible figures, especially those hidden in blind boxes.

"Collecting is a natural human desire," said Wang. "Collecting art toys is similar to older generations collecting stamps, or rich people collecting paintings and antiques, girls collecting bags and boys sneakers."

Besides encouraging collecting, Pop Mart has cashed in on the popularity of its products in the secondhand trade market.

According to Xianyu, Alibaba's online platform for secondhand goods, since the second half of 2018, more than 300,000 blind boxes have been traded, with Molly toys traded more than 230,000 times.

Wang said the reason people want to trade and collect art toys such as Molly is the strong demand for the toys. "What has been revealed from the secondhand market is the tip of the iceberg," Wang said.

The desire for individuals to please themselves is also a market opportunity. Wang compares buying blind box toys to sending gifts to yourself. Opening a blind box and finding a rare figure involves anticipation, surprise and delight, he said.

In addition to retail, Pop Mart also engages in intellectual property operations, working with renowned organizations including The Walt Disney Company.

It collaborates with leading artists and nurtures young artists through courses at art academies around the country. Exhibitions attract hundreds of artists and serve as a talent show for Pop Mart to select partners.

Wang's vision is to be inclusive, and to nurture the entire market.

"If we want to become a company that creates something like Hello Kitty, it would make us a rival to all the toymakers," he said. "But working closely with those toymakers with influential intellectual property, we've become a distributor and collaborator."

Pop Mart has plans to become an incubator for global artists amid its fast expansion to overseas markets. With a presence in 20 countries and regions, Pop Mart's sales have achieved growth worldwide, Wang said.

He hopes overseas sales revenue will eventually contribute half of the company's total revenue, though at present it's below 10 percent.

"China has for so long been a top toy manufacturer, but never a leading toymaker," Wang said. Pop Mart now works with more than 30 domestic top toy manufacturers in Dongguan, Guangdong province, where it has manufactured toys for leading toymakers in the United States and Europe for decades.

"Our orders have taken up more than half of the manufacturing capacity of many such factories," Wang said. "High-end toy orders with more profitability and respect for internationalized manufacturing procedures are incentives to turn Chinese manufacturing capacities to producing toys for Chinese brands."

Art toy sector is still a niche market therefore is challenging to expand to mainstream consumers, said Jason Yu, general manager of Kantar Worldpanel China. However, Pop Mart's capacity to empower art toys with social features and to define them as trendy toys with popular IP and affordable prices have contributed to its high repeating purchase rate, he added.

In addition, Pop Mart's collaboration's and cross-over with other renowned IP have further widened its access to consumers, Yu said.

An art major, Wang said his vision is to make Pop Mart a company that spreads warmth and happiness, and a company that could become the Chinese equivalent of Disney or Netflix.

"We want to stand for well-known intellectual property. When consumers think of our logo, they feel happy," he said.

Today's Top News

- World Games dazzles audiences in Chengdu

- Choirs send message?of amity?at games' opening

- Foreign trade stays on stable growth track

- 'China shopping' boom spurred by favorable policies helps drive growth: China Daily editorial

- New tariff threat to ensure the chips fall to US: China Daily editorial

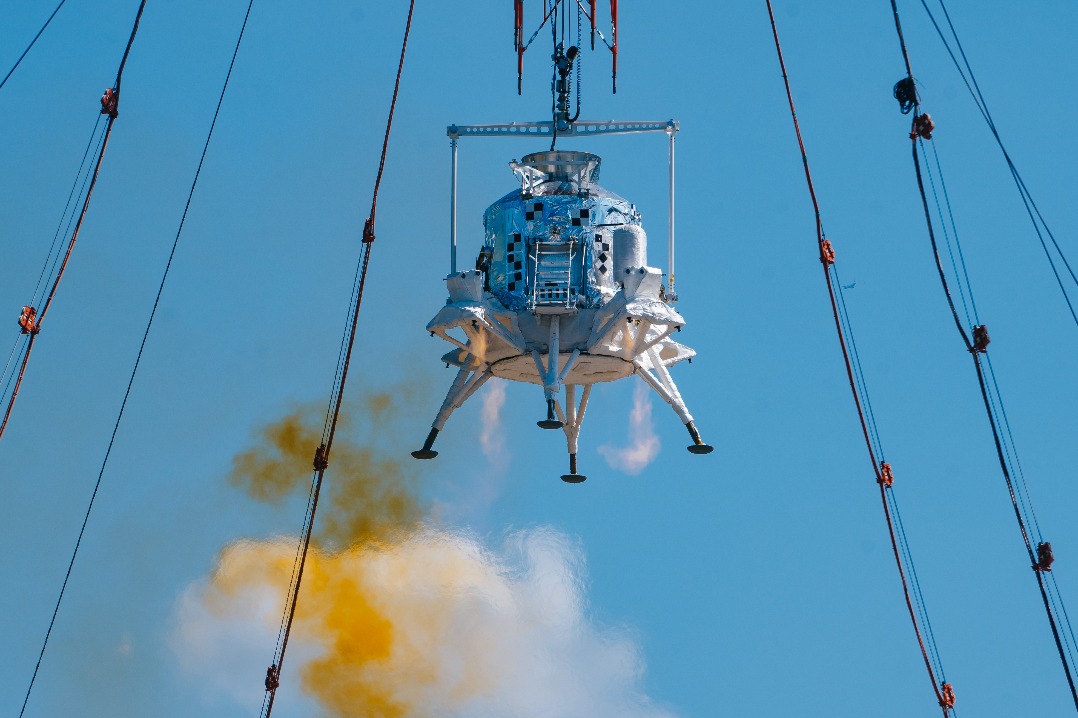

- China completes first landing, takeoff test of manned lunar lander