RRR cuts to boost liquidity in housing market

The People's Bank of China's decision to reduce the reserve requirement ratio, or the amount of cash banks have to set aside as reserves, will ease credit pressure for homebuyers but may not spur huge spikes in home sales, as the broad sentiment that housing is for living instead of for speculation remains unchanged.

The central bank cut the RRR on Wednesday for most financial institutions by 0.5 percentage point effective on Jan 6 to support the development of the real economy and lower social financing costs.

The across-the-board RRR cut on the first day of this year will help increase liquidity and lower social financial costs, with indications that more adjustments in loan and interest rates are in the offing, said Yan Yuejin, research director at the E-House China R&D Institute.

"The RRR cut, the first this year after three instances in 2019, indicates that the monetary environment is shifting from tight to loose, and will be positive for the real estate sector in terms of financing," said Yan.

Reasonably ample liquidity and social financing will open up more lending avenues for homebuyers in the first quarter, but property developers may continue to see crimped financing conditions, said Zhang Bo, chief analyst of Anjuke, a leading Chinese property portal.

Analysts said the application of the loan prime rate introduced by the central bank will possibly bring down home purchase costs.

The central bank had last Saturday decided to scrap the traditional benchmark lending rate for new loans starting from this year, and made the loan prime rate (LPR) the only benchmark rate for fresh lending starting this year.

Financial institutions and their clients can negotiate a floating rate higher or lower than the benchmark, and for those loans already issued but yet due, new contracts will be signed between banks and borrowers between March and August to shift to the LPR.

"The increased liquidity will likely lead to a cut in the LPR, which means the interest rate for homebuyers will be marked down too," said Zhang Dawei, chief analyst at Centaline Property Agency Ltd.

Despite the positive impact for homebuyers, industrial analysts said demand for homes will remain steady, as the annual Central Economic Work Conference has earmarked stabilizing land and home prices as well as market expectations as one of the key tasks to ensure steady and health development of the property market this year.

"The key target for the real estate market is to prevent risks, so that the financing environment for the property sector will remain stable in the future," said Xu Xiaole, chief market analyst with Ke Research Institute, a research organization under real estate brokerage platform Ke.com.

"It is highly likely that the central government will take steps to ensure adequate liquidity and lower financing costs this year, but such decisions will not be a stimulus for the property market. We have to bear in mind that housing is for living in, and not for speculation," said Ding Zuyu, CEO of E-House (China) Enterprise Holdings Ltd.

Xu said the consistent reserve ratio reduction since 2018 is a response to ease the financing difficulties of medium-and small-sized enterprises in particular as China's economic development is shifting from high growth to quality growth. The RRR cuts will not increase demand for home purchases, he said.

Today's Top News

- World Games dazzles audiences in Chengdu

- Choirs send message?of amity?at games' opening

- Foreign trade stays on stable growth track

- 'China shopping' boom spurred by favorable policies helps drive growth: China Daily editorial

- New tariff threat to ensure the chips fall to US: China Daily editorial

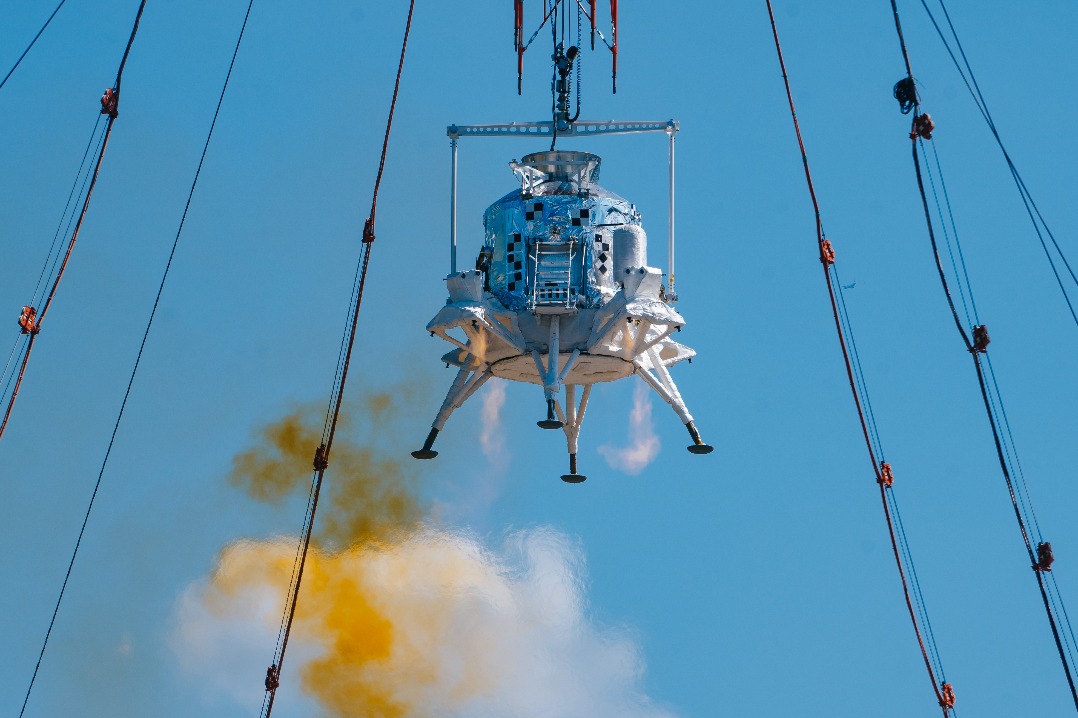

- China completes first landing, takeoff test of manned lunar lander