Banking regulator to step up risk control efforts

Core regulatory indicators show that the overall risks of banks and insurers are still under control, and their operation still remains fairly good although the level of risks is higher at some small-and medium-sized financial institutions, said an official of China's top banking and insurance regulator on Monday.

"The China Banking and Insurance Regulatory Commission remains vigilant all the time, screening high risk financial institutions and thinking of various methods to dispose of their risks," said Xiao Yuanqi, chief risk officer and spokesperson of the commission.

"Apart from taking regular measures, we also took action proactively, such as restructuring Hengfeng Bank Co Ltd and joining hands with the People's Bank of China in a takeover of Baoshang Bank Co Ltd. Just as we did last year, we will adopt a comprehensive suite of risk disposal solutions this year, which includes introducing new strategic investors, restructuring, and mergers and acquisitions. We will take different risk mitigation measures for different financial institutions," Xiao said during a news conference at the State Council Information Office in Beijing.

Huang Hong, vice-chairman of the commission, said, "In 2019, we continuously tightened financial regulations, resolutely fought against financial market irregularities, properly handled major risks, and made crucial progress toward our goal of winning a tough battle against financial risks."

The commission said at its recent annual work conference that it will comprehensively strengthen regulation of assets and liabilities' quality to improve the liability status of banks and insurers, especially small-and medium-sized financial institutions.

"The effort is aimed to strengthen liquidity management of banks, which means stabilized core liabilities will account for a fairly large proportion of their total liabilities, whereas interbank liabilities will be cut moderately. This will ensure that bank liquidity is not unduly affected by rising market fluctuations," said Zeng Gang, deputy director-general of the National Institution for Finance and Development.

China's banking sector disposed of around 2 trillion yuan ($290 billion) in nonperforming loans last year. About 19,200 creditors' committees were set up nationwide, supporting debt-for-equity swaps totaling 1.4 trillion yuan, according to the regulator.

A creditors' committee, defined by the regulator as a temporary organization established by at least three banking institutions that are creditors of a company that has difficulty in repaying a large amount of debt, helped the company deleverage, reduce debt and improve efficiency.

Besides, the regulator kept dismantling high-risk shadow banking and reduced the volume of this type of business by 16 trillion yuan over the last three years compared to the historical record. It also severely punished banks and insurers for allowing funds to flow into the real estate sector by violating regulations. The growth of bank loans directed to the property sector dropped by 3.3 percentage points year-on-year in 2019.

Today's Top News

- A Quixotic quest to reindustrialize US

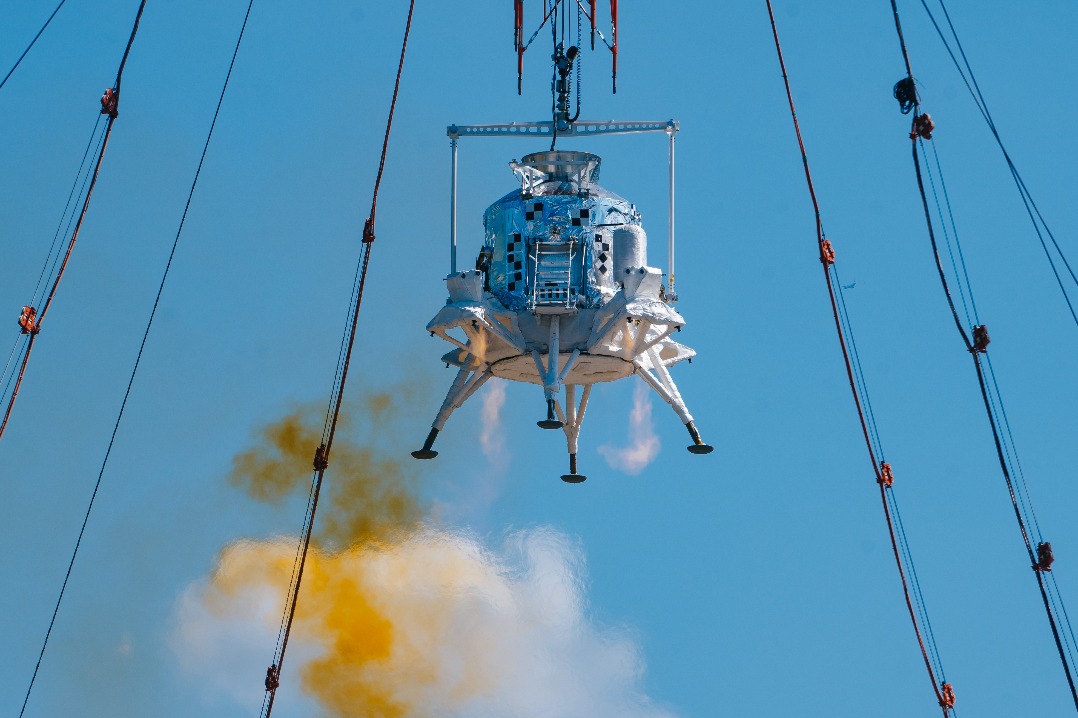

- Major test brings lunar mission closer to reality

- China likely to continue buying gold

- World Games dazzle spectators in Chengdu

- Choirs send message?of amity?at games' opening

- Foreign trade stays on stable growth track