PBOC to focus on growth and yuan stability

Officials: Monetary policy to ensure ample liquidity in financial system

Maintaining currency stability and strengthening economic growth will be key objectives of the monetary policy this year, as flexible measures from the People's Bank of China, the central bank, will help maintain ample liquidity in the financial system, officials said on Thursday.

Though there is still room for lowering the reserve requirement ratio (RRR), or the cash set aside by commercial banks as reserves, to inject additional liquidity if necessary, the window is limited, said Sun Guofeng, head of the monetary policy department of the PBOC.

Monetary policies will stress on dampening inflation expectations, maintaining yuan stability and supporting economic growth, said Sun. China's consumer inflation increased by 2.9 percent in 2019, driven by surging pork prices.

Responding to queries on whether the central bank will cut interest rates in the future, Sun said the new benchmark lending rate-the loan prime rate-has dropped since it was first introduced in August last year. "The LPR reflects the current market demand and supply," he said.

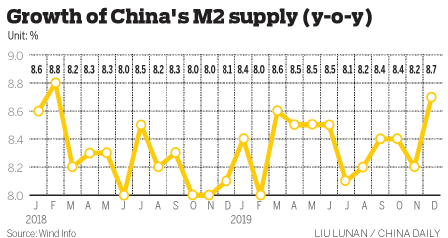

According to the PBOC, most of the financial data for 2019 that were released on Thursday indicate a stable growth in money supply and credit and stronger financial support for the real economy.

The broad money supply, or M2, increased by 8.7 percent last year, the highest level in almost two years, compared with 8.1 percent a year earlier and 8.3 percent by the end of November, according to the People's Bank of China.

The outstanding amount of total social financing, a broad measure of credit and equity capital supporting the real economy, increased by 10.7 percent on an annual basis in December. The total social financing increased by 2.1 trillion yuan ($305 billion) last month, 171.9 billion yuan higher than the same period in 2018.

The statistical range of this indicator has been enlarged since last month, with treasury bonds and all types of local government bonds, including special bonds, included in the calculation.

"The newly incorporated total social financing will include fiscal and monetary policies to improve coordination and enhance macroeconomic administration," said Ruan Jianhong, head of the central bank's statistics and analysis department.

New yuan loans increased by 12.3 percent year-on-year in December, compared with 13.5 percent in the same period last year, with outstandings up by 16.81 trillion yuan in 2019 compared with the level in 2018, the PBOC said.

The latest financial data show that there is reasonably ample liquidity in the banking system, said Ruan.

The accelerated growth of both money supply and credit was a result of the counter-cyclical adjustments of the monetary policy, mainly because of the faster growth in bond issuances and commercial banks' stronger lending to small-and medium-sized companies, said Ruan.

Earlier, the central bank had injected 400 billion yuan into the financial sector on Wednesday, to maintain sufficient liquidity ahead of the upcoming Lunar New Year. This follows the RRR cut announced on Jan 6.

The PBOC has also injected 300 billion yuan through the medium-term lending facility (MLF), while keeping the one-year MLF interest rate unchanged at 3.25 percent. The LPR will be revised again on Jan 20, based on the MLF adding risk premium, and some analysts expect the LPR to fall by 0.5 percentage point this month.

Today's Top News

- Xi says China will continue to promote peace talks in Ukraine crisis

- Leaders of over 20 countries to attend SCO Tianjin Summit

- Xi urges all-out rescue efforts following mountain torrents in Gansu

- A Quixotic quest to reindustrialize US

- Grassroots sports events promoting nation's fitness goals

- Major test brings lunar mission closer to reality