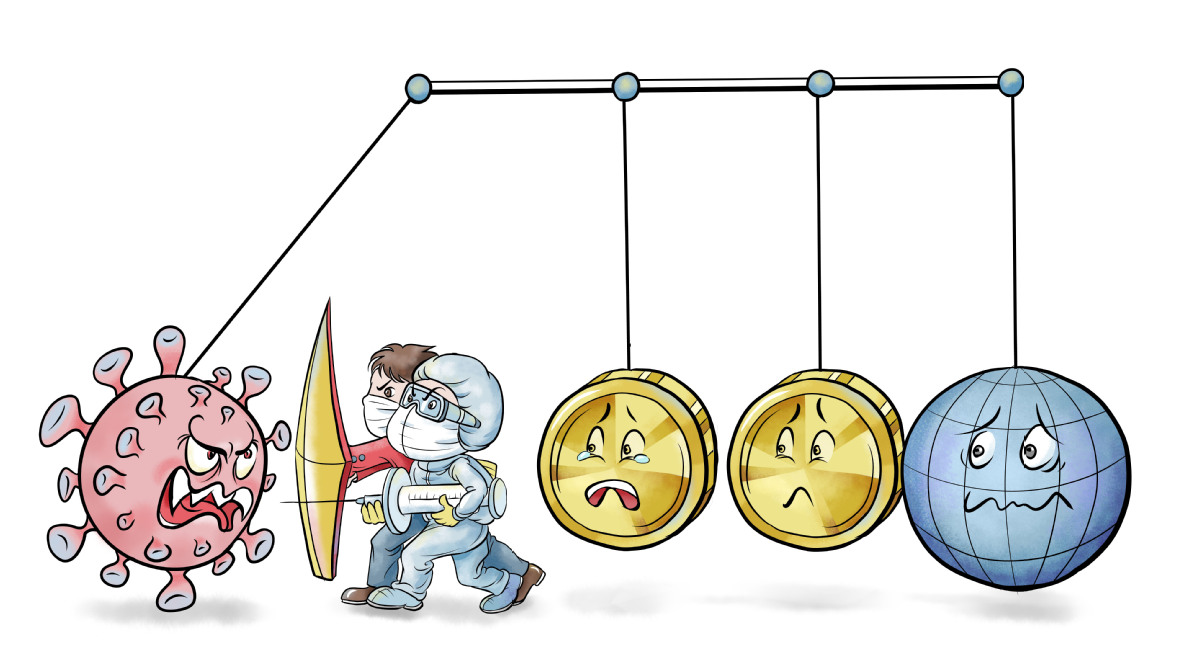

Joint efforts needed to reduce economic shocks

The COVID-19 outbreak comes at a particularly vulnerable point in the global business cycle. World output expanded by just 2.9 percent in 2019-the slowest pace since the 2008-09 global financial crisis and just 0.4 percentage points above the 2.5 percent threshold typically associated with global recession.

Moreover, vulnerability increased in most major economies over the course of last year, making prospects for early 2020 all the more uncertain. In Japan, the world's third-largest economy, growth contracted at a 6.3 percent annual rate in the fourth quarter-much sharper than expected following another consumption-tax hike.

In Germany and France, the world's fifth-and tenth-largest economies, industrial output fell sharply in December, by-3.5 percent and-2.6 percent respectively. And although the United States, the world's largest economy in terms of GDP, appeared relatively resilient by comparison, 2.1 percent real (inflation-adjusted) GDP growth in the fourth quarter of 2019 hardly qualifies as a boom.

As for China, the world's largest economy in purchasing power parity terms, its growth slowed to a 27-year low of 6 percent in the last quarter of 2019.

Virus outbreak has had huge impact on economy

In other words, there was no margin for an accident at the beginning of this year. Yet there has been a big accident: China's COVID-19 shock.

Daily activity trackers compiled by Morgan Stanley's China team underscore the nationwide impact of this disruption. As of Feb 20, coal consumption (still 60 percent of China's total energy consumption) remained down 38 percent from the year-earlier pace, and nationwide transportation comparisons were even weaker.

The disruptions to supply are especially acute. Not only is China the world's largest exporter by a wide margin, it also plays a critical role at the center of global value chains. Recent research shows that the global value chains account for nearly 75 percent of growth in world trade, with China the most important source of this expansion. Apple's recent earnings alert says it all: the China shock is a major bottleneck to global supply.

Demand-side effects also affect global trade

But demand-side effects are also very important. After all, China is now the largest source of external demand for most Asian economies. Not surprisingly, trade data for both Japan and the Republic of Korea in early 2020 show unmistakable signs of weakness. As a result, it is virtually certain that Japan will record two consecutive quarters of negative GDP growth, which would make it three for three in experiencing recessions each time it has raised its consumption tax (1997, 2014 and 2019).

The shortfall in Chinese demand is also likely to hit an already weakening European Union economy very hard-especially Germany-and could even take a toll on a Teflon-like US economy, where China plays an important role as the country's third-largest and most rapidly growing export market. The sharp plunge in a preliminary tally of US purchasing managers' sentiment for February hints at just such a possibility, and underscores the time-honored adage that no country is an oasis in a faltering global economy.

Epidemiologists will have the final word on the endgame for COVID-19 and its economic impact. While that science is well beyond my expertise, I take the point that the current strain of coronavirus seems to be more contagious but less lethal than severe acute respiratory syndrome was in early 2003.

SARS was followed by strong rebound

I was in Beijing during that outbreak 17 years ago and remember well the fear and uncertainty that gripped China back then. But that the disruption was brief-a one-quarter shortfall of 2 percentage points in nominal GDP growth-followed by a vigorous rebound over the next four quarters.

In 2003, circumstances were very different. China was booming-with real GDP surging by 10 percent-and the world economy was growing by 4.3 percent. For China and the world, a SARS-related disruption barely made a dent. That is far from being the case today. COVID-19 has hit at a time of much greater economic vulnerability. Significantly, the shock is concentrated on the world's most important growth engine. The International Monetary Fund puts China's share of global output at 19.7 percent this year, more than double its 8.5 percent share in 2003, during the SARS outbreak.

Also, with China having accounted for 37 percent of the cumulative growth in world GDP since 2008 and no other economy stepping up to fill the void, the risk of outright global recession in the first half of 2020 seems a possibility.

Yes this, too, will pass. While vaccine production will take time-6-12 months at the very least, the experts say-the combination of warmer weather in the northern hemisphere and unprecedented containment measures could mean that the infection rate peaks at some point in the next few weeks. But the economic response will undoubtedly lag the virus infection curve. Which means, at a minimum, a two-quarter growth shortfall for China, double the duration of the shortfall during SARS, suggesting that China could miss its 6 percent annual growth target for 2020 by as much as one percentage point.

Important to heed implications of trend

This matters little to the optimistic consensus of investors. After all, by definition shocks are merely temporary disruptions of an underlying trend. While it is tempting to dismiss this shock for that very reason, the key is to heed the implications of the underlying trend.

The world economy was weak, and getting weaker, when COVID-19 struck. The V-shaped recovery trajectory of a SARS-like episode will thus be much tougher to replicate-especially with monetary and fiscal authorities in the US, Japan and the EU having such little ammunition at their disposal. That, of course, was the big risk all along.

In these days of dip-buying froth, China's sneeze may prove to be especially vexing for long-complacent financial markets.

The author, a faculty member at Yale University and former Chairman of Morgan Stanley Asia, is the author of Unbalanced: The Codependency of America and China.

Project Syndicate

The views don't necessarily reflect those of China Daily.