Internet firms consider secondary listings in HK

More large Chinese mainland internet companies that are currently listed in the United States may consider secondary listings on the Hong Kong stock exchange as it would ease regulatory risks and expand their investor base, analysts said.

Jerry Liu, head of China internet research at Swiss bank UBS, said tighter scrutiny of listed Chinese firms in the US could spur the dual listing plans of Chinese companies.

Large internet companies can use some of the documents and materials that they have filed in the US to directly pursue relisting in Hong Kong, which is quite convenient, Liu said.

"But for smaller internet companies, the whole process would be far more complicated, as they either have to reorganize their corporate structures or get delisted from the US stock markets to meet the relevant requirements," Liu said.

Data from Shanghai-based market tracker Wind Info showed that 227 Chinese companies were listed in the US markets by the end of last year and of these 145 are listed on Nasdaq.

According to UBS estimates, about 42 US-listed Chinese mainland companies meet the standards of getting relisted in Hong Kong after the Holding Foreign Companies Accountable Act takes effect.

"Having a secondary listing in Hong Kong can help grow these companies' investor bases, considering the Shanghai-Hong Kong Stock Connect mechanism," Liu said.

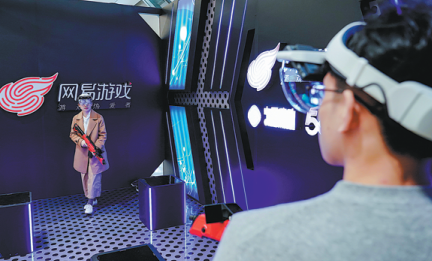

NetEase issued about 171 million new ordinary shares to raise HK$21.09 billion ($2.7 billion) to finance its global strategies, innovation and general corporate purposes. It has been listed on Nasdaq since 2000.

According to Liu from UBS, some of these Chinese internet companies' secondary listing plans will not involve the issue of many shares as they do not have strong demand for money in the short term. Dual listing is more an attempt to disperse regulatory risks, he said.

A report from Xinhuanet, which quoted US media, said that the US Senate had passed a legislation in May that could ban many Chinese companies from listing shares on US exchanges or raising money from US investors without adhering to the US government's regulatory and audit standards.

Today's Top News

- China urges the US to cease provocative actions

- Hope, skepticism and questions ahead of Trump-Putin summit

- Xi's article on promoting healthy, high-quality development of private sector to be published

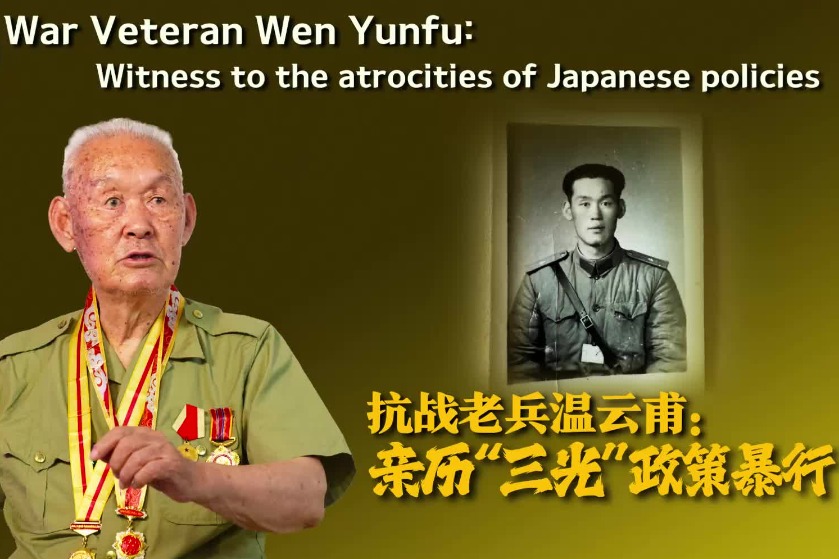

- China's top diplomat urges Japan to learn from its warring past

- China-built roads bring real benefits to Pacific region

- Japan must face up to its wartime past