Special treasuries to mitigate COVID-19 pain, funding woes

China is likely to complete the 1 trillion yuan ($141.3 billion) special issuance of central government bonds by the end of July as part of its efforts to mitigate the economic fallout from the novel coronavirus epidemic and ensure sufficient liquidity in the financial sector, said experts.

The first two batches of COVID-19 special treasuries, totaling 100 billion yuan, will be offered for bidding on Thursday. The first batch of bonds will mature in five years, while the remaining will be for a period of seven years, according to a notice released by the Ministry of Finance late on Monday.

The coupon rates and the underwriters of the two batches will be disclosed around the bidding date, and the treasuries will be traded from June 23, the notice said.

People who participated in a preparatory meeting of the issuance told China Daily on Tuesday that all the special treasuries will be publicly issued, and the funds should be raised by the end of July. The central government will repay all the interest and 300 billion yuan of the principal, while the balance 700 billion yuan will be paid by local governments.

A report from China Securities Journal said on Tuesday that individual investors can also purchase the special treasuries once they open an account and trade through the stock exchange system or at the underwriters.

The country's budget reports, which have been approved by the nation's top legislature in May, showed that the COVID-19 central government special bonds "will be mainly used for local public health and other infrastructure construction and epidemic responses, while some funds will be reserved for local governments at the primary level to solve special financing difficulties".

"Efforts will be made to improve coordination and alignment between COVID-19 bonds and other fiscal funds, and more decision-making power will be given to local authorities over the use of funds," the budget reports said.

A senior official of the Ministry of Finance said last week that the ministry would build a new transfer payment mechanism for provincial-level governments to pass the funds on to lower-level governments, while a supervisory system will be established to prevent embezzlement.

The public offering of the COVID-19 treasuries indicates that the Ministry of Finance has refused to monetize the fiscal deficit, a system in which the central bank directly purchases treasuries in the primary market, said Ming Ming, a senior analyst with CITIC Securities. "The government wants to let the market decide the price of the treasuries."

Experts close to the Ministry of Finance said that the "bottom line" has been set by the central bank law and the budget law, which stipulates that the government should not overdraw from the central bank and monetary authorities should not buy government bonds in the primary market.

"But the monetary policy will have to coordinate with the bond issuance, to maintain sufficient liquidity and keep financing costs at a low level," said Ming.

Local government bond issuance rose to 1.3 trillion yuan in May, a monthly record, and led to an upward momentum in bond yields during the past week. On Tuesday, the 10-year treasury bond yields remained almost above 2.8 percent.

Analysts said that the government may need to raise more than 4 trillion yuan from the domestic bond market between June and September, which is a significant amount and the People's Bank of China, the central bank, will have to take measures to facilitate the bond issuance.

Liu Yu, an analyst with GF Securities, said the surge in the bond issuance in the coming weeks may push the central bank to carry out "unexpected" operations, such as cutting interest rates or the reserve requirement ratio, to further ease the monetary policy.

Today's Top News

- 'Shanghai Spirit' should be advanced with new vitality

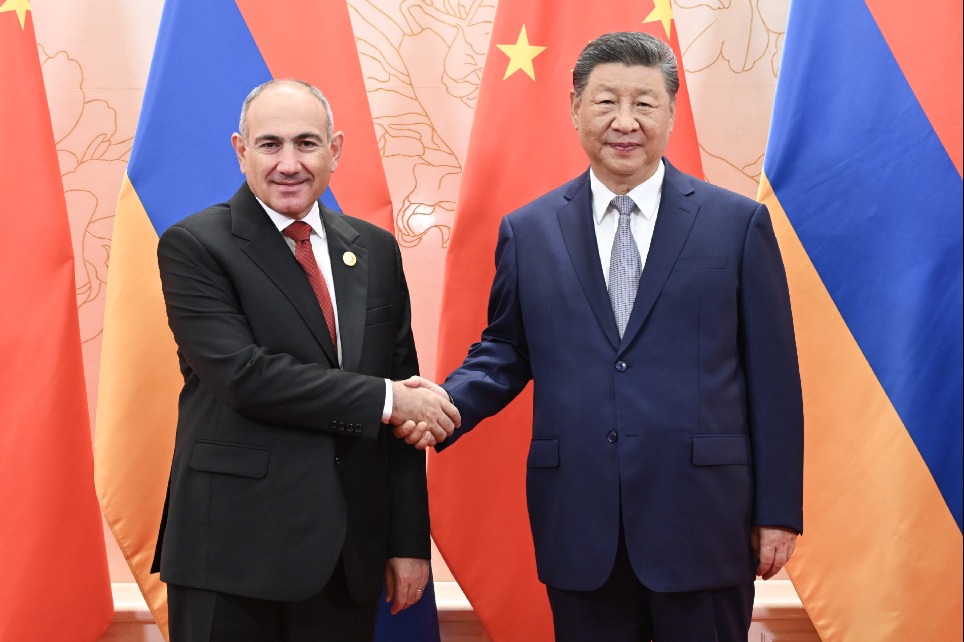

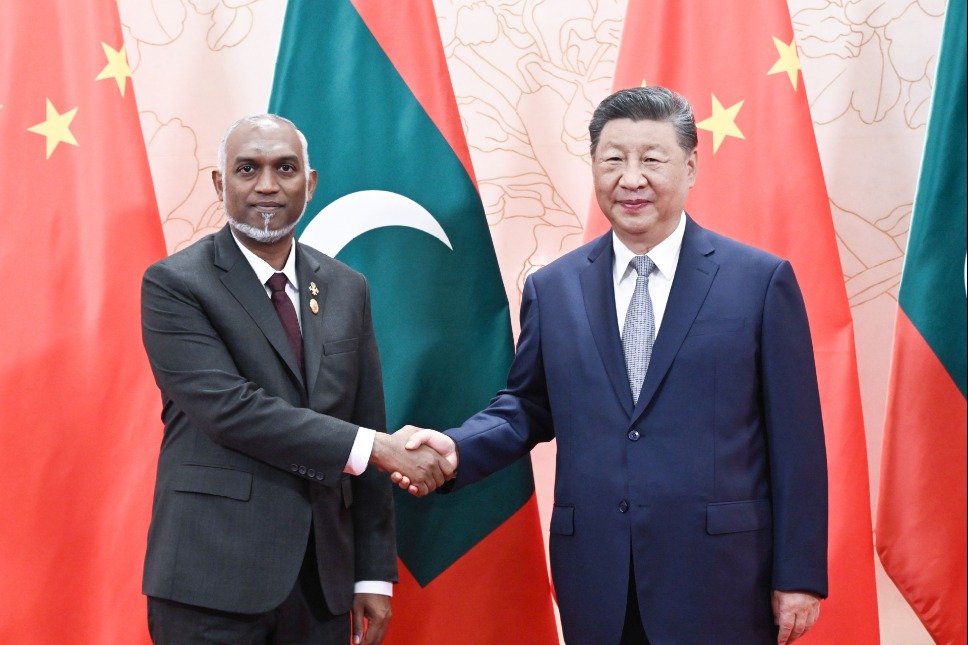

- Xi, leaders engage in high-level talks

- Xi cements neighborly bonds with SCO friends

- Kyrgyzstan, China deepening strategic partnership in a new era

- Partnership seen as key to Sino-Indian relations

- Xi: SCO plays growing role in safeguarding peace