Maternal and infant sector on steady growth track

China's maternal and infant product market is poised to witness steady growth over the next few years as an increasing number of young mothers scout for high-quality, personalized and trendy products along with upgrades in their consumption.

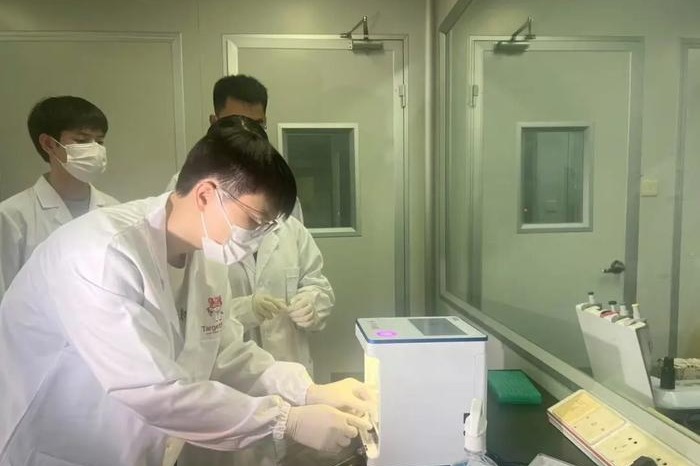

Mia, an online retailer specializing in items for infants, toddlers and mothers, is ramping up efforts to build up the global supply chain for maternal and baby commodities. It has already established its self-owned brands such as Mompick and Superfarm.

Liu Nan, the founder and chief executive officer of Mia, said the company will continue to expand the categories of its self-owned brands which cover infant and mom, cosmetics, nutrition and health. They will strictly control the quality of their products.

Liu said Mia has established many transfer bonded warehouses worldwide and inked in-depth cooperation with the authorities in New Zealand to explore the best raw materials in the country.

More Chinese consumers are keen on online purchases since the COVID-19 outbreak, which has reshaped the shopping habits of consumers, she said.

"The new generation of young moms are highly educated, economically independent and tend to shop rationally. They pay more attention to the high-quality and cost-effective products. They not only pursue international brands, but also focus on the safety, practicality, durability and material of those products," Liu said.

Young moms also have a higher degree of acceptance for domestic brands and are also looking for niche and personalized domestic brands, Liu said.

At this time, many domestic brands prefer to choose stars and key opinion leaders or KOL that are popular among the youth. They have adopted livestreaming formats to entice a new breed of users and promote their products.

Statistics from Beijing-based internet consultancy Analysys showed that revenue from the maternal and infant product market in China reached 2.9 trillion yuan ($413 billion) last year. The figure is expected to reach 3 trillion yuan in 2020. The whole industry is expected to maintain a 20 to 30 percent annual growth rate in the next 10 years.

Founded in 2011, Mia had served more than 50 million registered users aged from 24 to 40 by the end of 2018. It is dedicated to helping middle and high income families access the best mother and baby products such as diapers, baby formula, toys and garments for babies and toddlers.

Statistics from Mia also showed its users from first-and second-tier cities are more willing to spend on comfortable underwear, snacks and intelligent home appliances. Users living in third-to fifth-tier cities tend to buy women's apparel, latex pillows, juice extractors and other homegrown products.

Chinese e-commerce giant JD said it will develop more niche products in the maternal and baby category to expand product selection. This would help brands develop consumer-to-manufacturer or C2M products that can better meet the specific demands of consumers.

It will also continue to develop omnichannel solutions, leverage its smart supply chain and attract new customers in lower-tier markets. The Beijing-based technology giant is a top retailer for leading international brands which include Wyeth, Mead Johnson, Unicharm, Kao and Abbott.

Data from JD showed that post-1990s consumers account for 70 percent of all customers of maternal and baby products on JD. The proportion of post-1990s customers in lower-tier markets is even higher. They prefer trendy products and are less price-sensitive and spend more time watching livestreaming and short videos.

Cao Lei, director of the China E-Commerce Research Center, said consumers who were mainly born in the 1980s and 1990s have stronger spending power and attached more importance to the safety and quality of maternal and infant products.

"With the rise of new retail, or the integration of online and offline sales platforms, it is foreseeable that retail competition will grow in intensity. In the face of increasingly discerning consumers, brands must stand out from the complex competitive environment by improving product quality, creating a pristine reputation, and building brand awareness," said Brady Ni, vice-president of Nielsen China.

Today's Top News

- Trump and Putin begin high-stakes talks aimed at 'pursuing peace'

- China urges the US to cease provocative actions

- Hope, skepticism and questions ahead of Trump-Putin summit

- Xi's article on promoting healthy, high-quality development of private sector to be published

- China's top diplomat urges Japan to learn from its warring past

- China-built roads bring real benefits to Pacific region