Nation's car rental market rebounds amid epidemic

China's car rental market has quickly rebounded and better overcome the negative impact of the COVID-19 epidemic. Given its privacy and cleanness, more customers are seeking to take self-driving trips and personal short-term rentals.

This year, revenue of the car rental sector in China are foreseen to exceed 100 billion yuan ($14.4 billion). The orders on Trip.com Group, which cooperates with more than 2,000 car rental companies, are expected to jump by 30 percent on a yearly basis, it forecasted.

China's largest online travel agency Trip.com found nearly two-thirds of its car rental customers are new users this year. Industry-wide, 45 percent of the total car rental customers are new, which is a strong indication of the growing potential of the sector, Trip.com said.

The most popular destinations for car rentals are Sanya in Hainan province, Chengdu in Sichuan province and Shanghai, respectively.

"Individual drivers have shown increasingly diversified demand of car rentals in different scenarios," said Peng Liang, a researcher of tourism big data at Trip.com.

"Since the outbreak of the epidemic this year, more Chinese started to work from home and the demand of business travels has declined. Yet, more have recognized the advantages of car rentals, and they rent cars for work and vacation, or rent a luxury car for photography tours," he said.

Currently, China has more than 30,000 car rental companies. Most companies have a lineup of 30 cars on average.

In China, the five largest car rental providers, such as New York-listed Ehi Car Service, State-owned Beijing Shouqi Group and Beijing-based Car Inc, took about 30 percent of the total market share. In the past five years, the compound annual growth rate of the sector was 20 percent, Trip.com said.

The younger generation has become the backbone of car renters. Those aged between 24 and 40 accounted for 51 percent of the total car rental customers of Trip.com, while people aged below 24 make up for 12 percent, it found.

Separately, renters are showing big concerns about car rental securities.

Besides prices, car types and conditions, drivers pay attention to aspects such as the transparency of insurance compensation and the reliability of car pick-up stores. Renters are also concerned if customer services would cover the whole rental process and if orders can be easily canceled or changed, Trip.com said.

"The car rental sector is a highly decentralized market and it may generate problems such as different standards and service guarantee difficulties. Mergers and innovations will help increase service standards, and the sector will see more growth opportunities," Peng said.

On another front, a niche for the recreational vehicle rental business has developed in the country as more travelers are seeking safe and distinguished travel experiences.

Orders of RV trips in July on Fliggy, the online travel arm of Alibaba Group, surged more than 120 percent year-on-year. It was one of the few segments that has seen its revenue significantly surpass that of last year, Fliggy said.

The SAIC MotorRV Technology Co Ltd is China's largest RV rental company. It has a dominant market share of nearly 60 percent.

"Despite the fact there is still a gap between China's RV rental business and that in Europe and the United States, China's stock of RVs jumped with an annual compound growth rate of 30 percent in the past few years," said Yang Songbai, general manager of SAIC MotorRV Technology Co Ltd.

"The sudden outbreak of the epidemic has further driven the popularity of RV trips, as RVs can provide independent space that is safe and private. Now, most travelers who take RV trips are families and college student groups," he said.

Today's Top News

- Trump and Putin begin high-stakes talks aimed at 'pursuing peace'

- China urges the US to cease provocative actions

- Hope, skepticism and questions ahead of Trump-Putin summit

- Xi's article on promoting healthy, high-quality development of private sector to be published

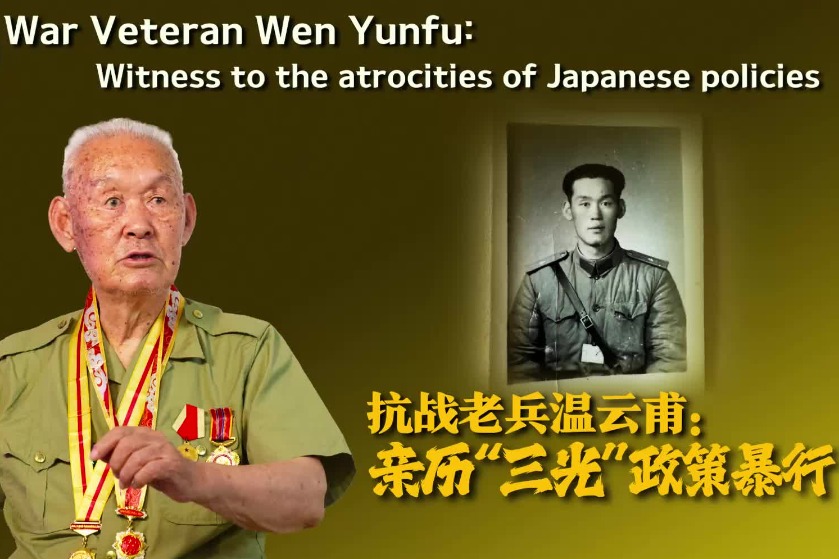

- China's top diplomat urges Japan to learn from its warring past

- China-built roads bring real benefits to Pacific region