Aid with a heart lifts industry's soul

Pandemic-related tax cuts, subsidies, fee exemptions, bonds to pre-empt frauds and bailouts

While large economies such as the United States, Japan, the United Kingdom and the European Union continue to reel from the impact of the COVID-19 pandemic, China's economy grew by 3.2 percent year-on-year in the second quarter, making experts and laymen wonder alike: How on earth was such an achievement possible?

Analysts said the better-than-expected growth in spite of the pandemic can be attributed to the Chinese government's sharp and sustained focus on keeping the wheels of the world's second-largest economy turning, through prudent, textbook-compliant yet imaginative fiscal policies.

Nowhere is the positive impact of such policies more evident than in Shenzhen, the poster city of New China in the southern Guangdong province.

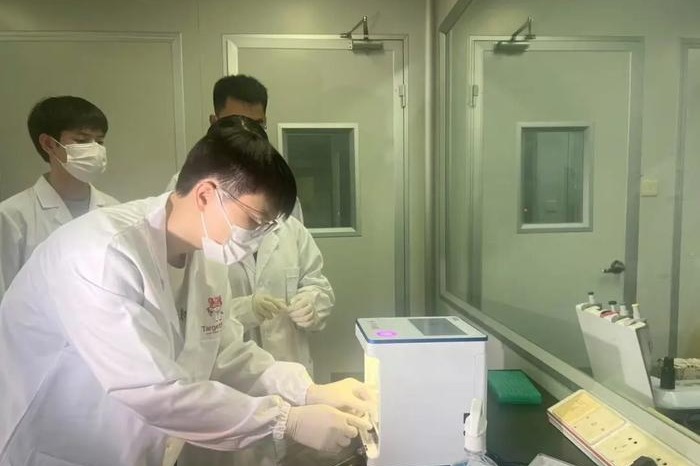

Even at the peak of the outbreak, key factories in the city that serve not just the domestic market but the world remained open because shutting them could have proved costlier.

For instance, a sight like that of a worker in a protective suit operating a four-story-high robot arm to move a 75-inch liquid crystal display panel to the next process on the assembly line was not uncommon at the height of the outbreak.

In fact, at the factory of TCL China Star Optoelectronics Technology Co Ltd (CSOT) in Shenzhen, a wholly-owned subsidiary of home appliances giant TCL, such scenes were considered normal. The company knew the cost of halting some production equipment would be huge. TCL alone supplies as many as 17 percent of panels for the world's television producers. It boasts the world's second-largest market share in TV panels.

Located in Guangming district, about a 70-minute drive from downtown Shenzhen, TCL CSOT's TV panel factory is one of the many that dot the more than 200 industrial parks. Here, a large group of high-tech, new energy and new material companies are thriving on the back of supportive fiscal policies launched by the central, provincial and local governments in the wake of the pandemic.

"Our current level of supply can't meet the sharply higher demand of TV-makers, our clients," said Yang Anming, senior vice-president of TCL CSOT.

Yang expects the subsidiary's sales revenue to increase by 26 percent this year to 42.8 billion yuan ($6.18 billion).

When the COVID-19 shutdown ended and near full-scale production resumed in late April, the company accelerated its output. That was possible thanks to the Shenzhen city government's concessional tax policies.

The company was allowed to pay value-added tax on imported equipment in installments. It also enjoyed VAT rebate. All this saved about 200 million yuan in costs.

Besides, the tax authorities reduced a part of tariffs on imported materials, components and purification room system. This saved another 200 million yuan for TCL CSOT, according to Yang.

"The preferential tax policies helped ease our financial crunch, enabling us to focus on increasing production, which in turn empowered us to build factories overseas," said Yang.

TCL CSOT has another large plant in Wuhan, Hubei province, the epidemic's first epicenter. The company kept production there at 85 percent of total capacity when the city was locked down in February and March.

"Maintaining operations during the pandemic also helped stabilize global supply chains, making China's products more reliable for foreign importers," Yang said.

TCL CSOT's six production lines supply products to global tech giants, including Sony of Japan, Huawei of China and Samsung of South Korea. Next year, TCL CSOT's factory in India will start operations. Its factories already supply 50-60 percent of LCD panels used in the domestic market.

Shenzhen established a Special Economic Zone or SEZ four decades back that transformed the Chinese economy. Its recent preferential industrial development and tax policies have proved to be a boon for high-tech and private companies. The city's GDP reached 2.69 trillion yuan in 2019, the third largest after Shanghai and Beijing.

But this year, COVID-19 did dent the city's economic performance. City GDP contracted 6.6 percent year-on-year in the first quarter, but recovered a tad later to post a growth of 0.1 percent to 1.26 trillion yuan by June-end. It is the only city among the nation's four first-tier cities to see its local GDP grow, albeit marginally, according to official data.

Tang Shukui, head of the Shenzhen Finance Bureau, said this year could prove to be the toughest since the establishment of the Shenzhen SEZ in 1980, because the city faces tightening fiscal conditions due to the unprecedented COVID-19 crisis and the escalation of China-US trade frictions.

By the end of June, the general public budget revenue of Shenzhen dropped 4.7 percent from a year earlier, while its tax revenues declined by 9 percent.

In the first quarter alone, Shenzhen cut about 76 billion yuan in taxes and fees, following similar policies of both the central and provincial governments, to support local businesses and mitigate the impact of the COVID-19 pandemic.

To encourage banks to lend more to smaller firms, the financial department of the Shenzhen city government set up a capital pool to compensate the risk of loan losses during the COVID-19 crisis.

In the event of any non-performing loans, the fiscal fund will cover a certain portion of bad debts of banks. As of today, the capital pool has included more than 300 billion yuan loans for medium, small and micro enterprises, according to a local government document.

Such supportive policies seek to save companies from disruptions to timely financing, and have resulted in quick production resumption when the virus was controlled, said Tang.

Eternal Asia Supply Chain Management Ltd, a Chinese logistics company that was the first to list from the sector, received 7.5 trillion yuan in special loans from six banks to contain the COVID-19 impact. It is also a beneficiary of other fiscal subsidies.

"The local government has exempted property tax and tax on using urban land during the pandemic, saving 1.56 million yuan in total for us," said Chen Zhengui, chief accountant of the company.

Eternal Asia specializes in offline-to-online supply chain solutions like supply chain financing, artificial intelligence platforms, data analytics and logistics information. It signed agreements with medical supplies and equipment companies from the US, Australia and Southeast Asia to ensure sufficient imports for saving lives during the pandemic. Its imports of medical supplies were exempt from Customs fees, according to Chen.

Rescue of thousands of businesses such as Eternal Asia, which were crucial to society's smooth functioning, became one of the priorities of the Chinese government after the COVID-19 outbreak.

According to data from the Ministry of Finance, reduction of taxes and fees nationwide exceeded 1.5 trillion yuan in the first half of this year. By the end of June, the central government allocated 2.937 billion yuan in subsidies and 239.6 billion yuan in concessional loans for more than 6,600 companies.

"The worse the situation, the more were the funds spent by the government," said Tang.

In Shenzhen, government bonds doubled this year already from the level of 2019 to fill the fiscal gap, Tang said.

In May, Chinese authorities announced 1 trillion yuan in COVID-19 special treasuries. These funds will be raised by the central government, but the proceeds will be passed on to local governments, to be spent on local public health, infrastructure construction, and epidemic response.

The government has specified that funds raised from the special bonds should be used by local governments to safeguard employment and livelihood needs, which might also include further cuts to taxes, fees, rentals, and interest payments where needed, said Andrew Fennell, an analyst with Fitch Ratings, one of the Big Three global rating agencies (the other two being Moody's and S&P).

"There has been a clear change in policy preferences in recent years toward on-balance sheet fiscal easing, and away from credit stimulus. This has been facilitated by the deployment of a broader array of fiscal tools, such as local government special bond financing," said Fennell.

Earlier, Finance Minister Liu Kun said in an interview with Chinese media that the government will be able to achieve its annual fiscal targets, according to the projection of steady economic recovery, cutting more than 2.5 trillion yuan in taxes and fees to support business and mitigate the impact of COVID-19.

Liu stressed strict supervision of the funds raised from the government bonds and special treasuries to ensure they will not be withheld or diverted for unauthorized uses.

Today's Top News

- Meet again? Putin says: Next time in Moscow

- Zelensky to meet Trump in Washington on Monday

- Wang Yi to visit India from Monday

- Trump, Putin tout 'productive' Alaska talks without apparent breakthrough

- A year's rainfall in a single day

- Negotiation the only way out for peace in Ukraine: Editorial flash