Long-term steps urged to regulate housing sector

Long-term measures are needed to regulate the housing market and stabilize land prices and market expectations, despite a complicated economic environment, said participants at a recent symposium on the real estate sector.

The symposium was organized by the Ministry of Housing and Urban-Rural Development and the People's Bank of China, the central bank. Participants said there are enough indications that the central government is keen on having a long-term mechanism for the real estate sector that focuses on financial management and financing regulations, so as to maintain a stable and healthy development of the property market in the country.

The speakers also said that it was necessary to dwell on the need for the long-term mechanism and said that property should not be seen as a short-term stimulus for the economy. Local governments should implement policies based on the conditions in each city so as to ensure the consistency and stability of the long-term mechanism.

"The essence of the meeting is that government departments for the first time discussed the long-term mechanism from the real estate developers' perspective," said Yan Yuejin, director of the Shanghai-based E-house China Research and Development Institution.

In a bid to further the creation of a long-term mechanism for the real estate sector, the meeting called for more efforts on financial management, enhancing market order, regulation and transparency of property companies financing.

Bonds worth 624.2 billion yuan ($90.3 billion) have been issued by Chinese real estate firms so far this year. Of this, more than 70 billion yuan was raised in July alone, while 26.1 billion yuan of credit bonds was issued in August, according to Centaline Property Research.

"The large quantity of financing raised by real estate firms is the major motivation for the newly launched financing regulations, which is targeted at avoiding financial risks," said Zhang Dawei, chief analyst at Centaline Property Agency Ltd.

Rules on capital monitoring and financial management for key real estate developers have already been formed based on the collective opinions gathered.

Ding Zuyu, CEO of E-House (China) Enterprise Holdings Ltd, a property agency, said despite the comparatively loose financial measures, financing of the property sector will remain cautious. "It is likely that the financing environment will get further tightened with respect to real estate," said Ding.

Yan from E-house said: "It is noteworthy to mention that the new regulations are not to simply clamp down on developers, but to better regulate and help the developers."

The meeting stressed that market-oriented, well-regulated and transparent financing regulations will help property firms to create stable financial measures, to manage their business and financing activities reasonably, to strengthen their capability in resolving financial risks, and to promote a healthy and stable real estate market.

The implementation of the new financing rules will help cool down the land market and speed up sales of newly developed residential properties, said Ding.

The meeting also discussed topics like methodologies for supportive financing policies on rental housing market, as well as promoting the formation of a dual housing system for both home purchases and rentals.

Pan Hao, a senior analyst with the Beike Real Estate Research Institute, said: "Against the backdrop of a complex economic scenario, it is important for the real estate industry to play its role as a stabilizer."

According to Pan, due to the varied conditions of the property market in various Chinese cities, regulatory measures have to be implemented in accordance with the local situation and efforts should be focused on improving regional collaboration.

"Housing is for living in, not speculation" would continue to be the underlying objective of the property, said the speakers. Even amid the COVID-19 outbreak, the central government has not relaxed its regulations on the property sector. "From previous experiences, we expect a new round of adjustment in property policies soon," said Ding.

Today's Top News

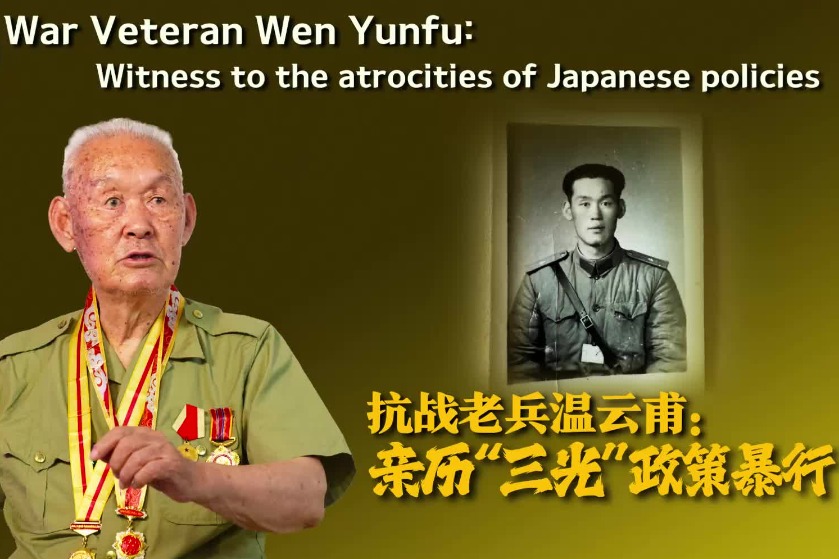

- China holds 2nd rehearsal for event marking 80th anniversary of victory over Japanese aggression, fascism

- Foreign athletes embrace culture, innovation at Chengdu World Games

- Meet again? Putin says: Next time in Moscow

- Zelensky to meet Trump in Washington on Monday

- Wang Yi to visit India from Monday

- Trump, Putin tout 'productive' Alaska talks without apparent breakthrough