How capital market will aid high-quality development

The Fifth Plenary Session of the 19th Central Committee of the Communist Party of China has proposed to implement the registration-based system for stock issuance across the whole capital market, establish a regular delisting mechanism, and increase the proportion of direct financing.

This is a major decision made by the Party's central leadership toward the new historical starting point of the 14th Five-Year Plan period (2021-25). It is also a strategic goal and key task for the capital market to achieve high-quality development during the new five-year plan period.

During the 13th Five-Year Plan period (2016-20), new direct financing came in at 38.9 trillion yuan ($5.96 trillion), accounting for 32 percent of the total increase in social financing over the same period.

Increasing the share of direct financing is of great significance for deepening the supply-side structural reforms of the financial sector, accelerating the construction of the new dual-circulation development pattern, and achieving a higher-quality development that is more efficient, equitable, sustainable and secure.

Opportunity with challenge

During the new five-year plan period, the country will step up efforts to build the new development pattern in which internal economic circulation is the mainstay while the domestic and external markets can support each other. This has provided a precious strategic opportunity for boosting direct financing.

As the great potential of China's real economy further releases, demand for capital will speed up to expand. Meanwhile, the macro environment, with a better coordination of macro policies and an improved rules-based system, is supportive to direct financing.

The global appeal of the country's capital market is on the rise, while households' booming demand for equity investment has created the right conditions for increasing direct financing.

But at the same time, as the country's indirect financing has long occupied a dominant position, development inertia and service stickiness remain strong.

Intermediary institutions have weak capital strength and insufficient professional service capabilities; the investor structure needs to be optimized while the culture of rational, long-term, and value investing needs to be further nurtured; and coordinated efforts are needed to strengthen the mechanism ensuring market integrity.

To increase the share of direct financing, the country must adhere to the problem-solving approach and speed up the removal of institutional obstacles.

Key tasks

First, the country will implement the registration-based system across the whole market and broaden access to direct financing, which lies at the core of increasing the share of direct financing.

To complete the task in a steady and smooth way, China will continue to respect the basic meaning of the registration-based system, draw on the best practices abroad, incorporate Chinese characteristics, and learn from the experiences of the STAR Market in Shanghai and the ChiNext board in Shenzhen in piloting the system.

Meanwhile, the capital market regulators will let the registration-based reform drive other reforms in the basic rules governing issuance, listing, trading, and continuous supervision, making the market pricing mechanism more effective and truly granting the market the right of choice.

Second, China will improve the multi-layer capital market system with Chinese characteristics and make direct financing more inclusive.

The country should scientifically set the positioning of different layers of the capital market, improve differentiated institutional arrangements, and smoothen the mechanism for enterprises to alter their financing ventures.

For instance, the country should leverage the role of the STAR Market in promoting rule innovations and highlight ChiNext's characteristics of serving innovative, growth-fueling startups.

Third, the regulators will promote improvements in the quality of listed firms, cementing the development foundation of direct financing.

The regulators will continue to improve mechanisms for refinancing, mergers and acquisitions, and equity incentives to support listed companies, accelerating upgrade and development, while improving the delisting system and encouraging listed firms to improve corporate governance and information disclosure transparency.

Also, they will step up efforts to deepen innovations in the bond markets, accelerate the development of private equity funds and attract more long-term funds into the market.

Concerted efforts

Boosting direct financing is a systemic project that entails more top-level planning to bring in joint efforts of market entities, regulatory agencies, macro management departments, media and others.

In particular, the country should pursue a coordinated development of direct and indirect financing, improving market-based interest rate formation and transmission.

It is also important to promote high-level opening of the market, broaden the channels for foreign investors to enter the stock and bond markets, and enhance the convenience of foreign investment.

The writer is Yi Huiman, chairman of the China Securities Regulatory Commission, the country's top securities regulator.

Today's Top News

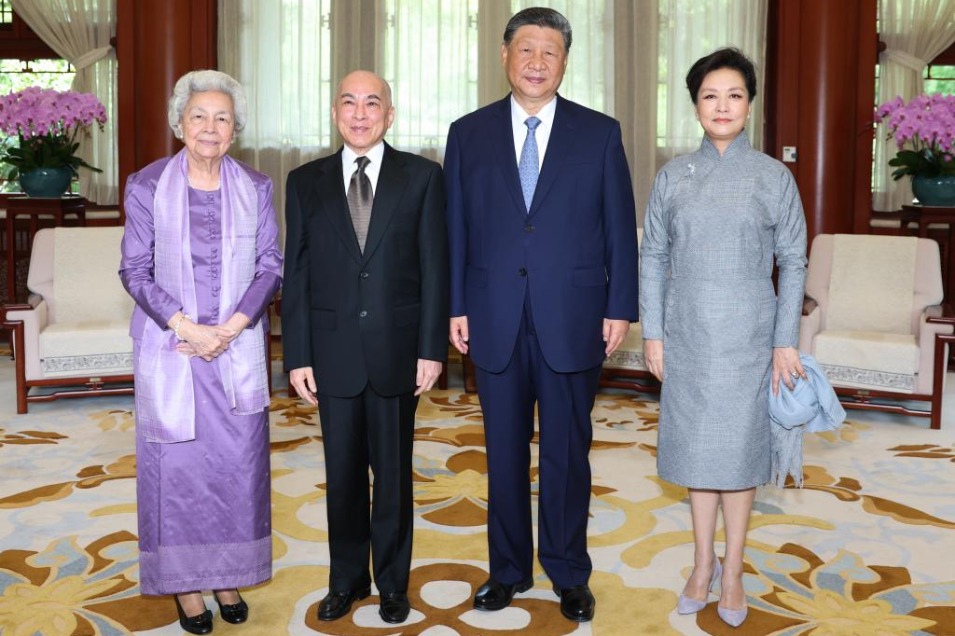

- Xi and his wife meet Cambodian King, Queen Mother

- Xi meets Russian State Duma chairman

- Parade a tribute to Chinese people's sacrifices in WWII

- SCO will strongly uphold multilateralism

- China targets disguised illicit gains

- US 'freedom of navigation' lacks basis