Opening-up, innovation to be pivot for financial sector reforms

Financial industry opening-up and innovation will gather speed this year as policymakers further streamline capital account convertibility process in China, a leading financial expert said.

Capital account convertibility, or allowing foreign capital to flow freely into and out of China, will be one of the key priorities during the 14th Five-Year Plan period (2021-25), Huang Yiping, deputy dean of the National School of Development at Peking University, told China Daily in an interview.

"We may see more breakthroughs in China's financial opening-up during the five-year plan period," he said.

Huang, who is also a former member of the central bank's monetary policy committee, said liberalizing the renminbi exchange rate would be a good precursor to the full opening-up of the domestic capital markets. Measures are also necessary to prevent any potential risks and volatility, he said.

According to Huang, basic convertibility of the renminbi may occur by 2025 along with a significantly higher global acceptance of the Chinese currency among investors. China's rapid growth will support the stronger currency and so also the increased foreign investment in the onshore bond and stock markets.

Renminbi-denominated financial assets will remain attractive for foreign investors at that time as central banks in several developed economies are planning to maintain close-to-zero interest rates and quantitative easing to spur growth, he said.

"I expect the Chinese financial market to continually attract foreign capital this year, but we need to pay attention to the potential risks from booming asset prices and currency appreciation."

Financial regulators must use macro-prudential measures or regulations to safeguard the financial system, to limit volatility in the capital market, said Huang.

Citing an example, he suggested that measures such as the "Tobin tax", a tax on cross-border capital, could be essential tools to curb speculation and frequent capital flows.

This year, a key area of financial innovation will be the digital currency. Huang said that the People's Bank of China, the central bank, will be one of the first major central banks in the world to issue its own digital currency, the so-called e-CNY.

Unlike the existing mobile payment tools, such as Alipay and WeChat Pay, e-CNY is safer and less expensive, as the PBOC is not going to charge any payment fees. Users can even exchange the digital money offline, based on a technology called near-field communication, said Huang.

"I think it is possible that the e-CNY will be in our digital wallets quite soon, hopefully this year," he said.

From a broad perspective, the economic outlook looks more optimistic this year both at home and abroad, although the new coronavirus cases may lead to lockdowns and travel bans in some regions. The country's GDP growth will continue to improve and probably reach a growth rate of about 8 percent this year, he said.

"As China's economy is returning to a normal state, some special policy measures may need to be moderately adjusted. Policies will shift, but not very sharply."

The proactive fiscal policy, for instance, will continue this year, to strengthen fixed-asset investment and ease the burden on smaller businesses. Monetary policy will not be as loose as last year, but the central bank is expected to maintain adequate liquidity and keep the policy flexible to serve the real economy. A further reduction in financing costs for the corporate sector is achievable this year, through market-based measures, he said.

Today's Top News

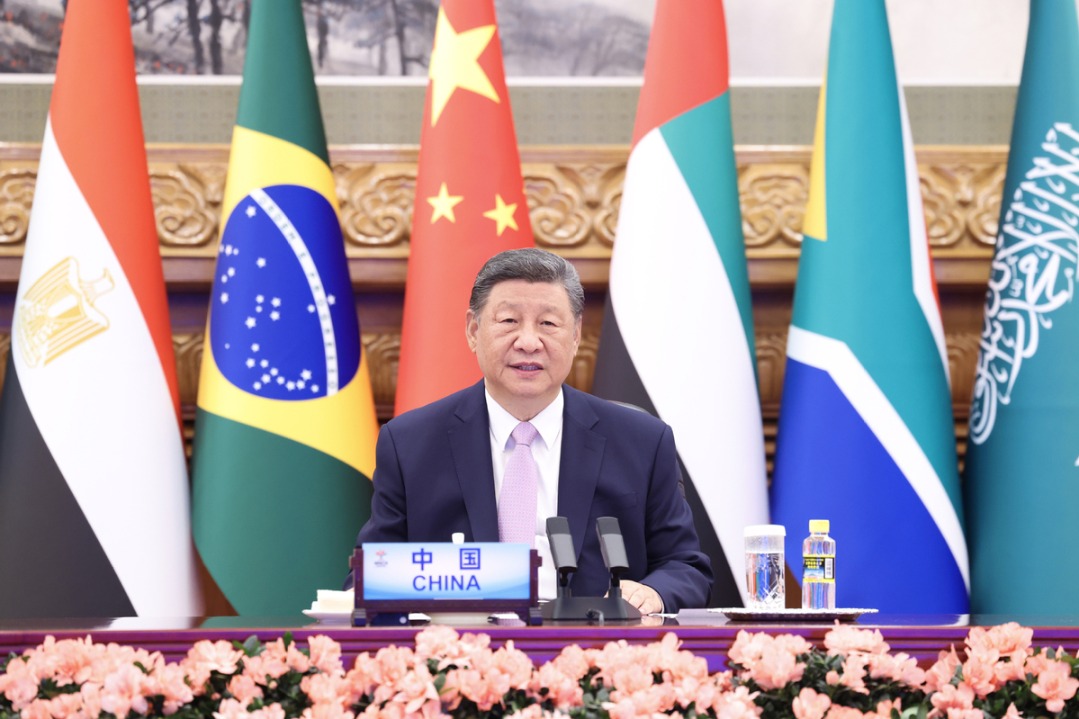

- Xi extends congratulations to Kim over DPRK's 77th founding anniversary

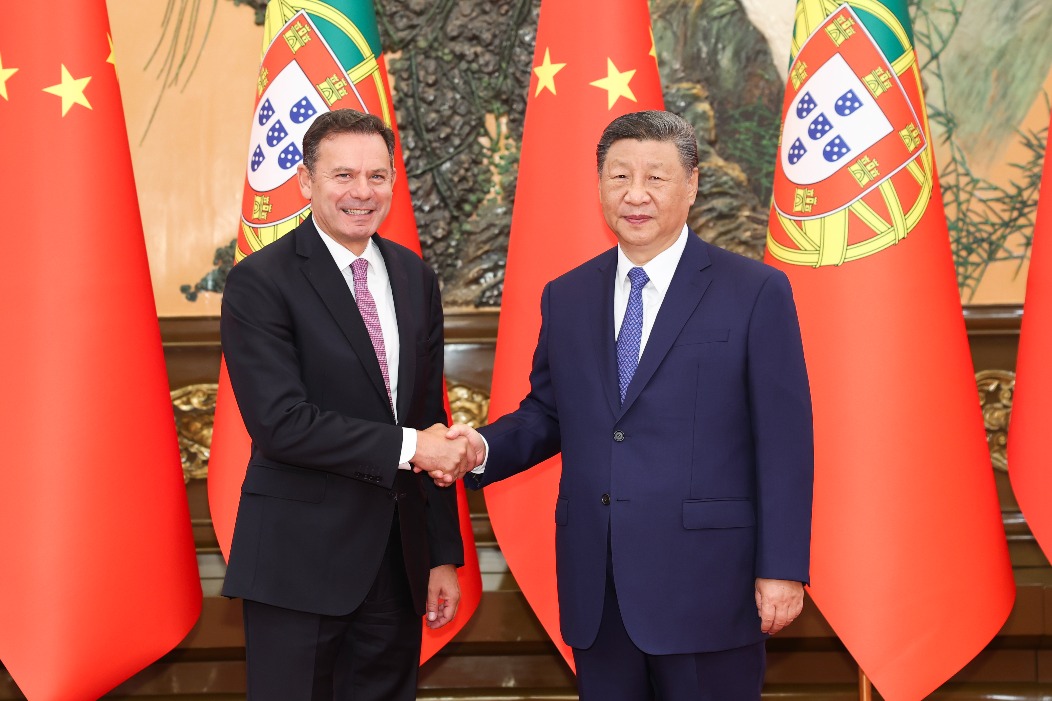

- Xi meets Portuguese prime minister

- Autonomous regions making good progress on multiple fronts

- Trade fair highlights broadened opening-up

- New markets to spur foreign trade

- Global Governance Initiative a timely call