How to find investment opportunities in China ESG

China's appetite for responsible investments is on the rise as Environmental, Social and Governance, or ESG, investing becomes a mainstream global phenomenon. We take a closer look at how to find ESG investment opportunities in China.

Government regulations in recent years have been requiring companies to adhere to social and environmental standards. China has pledged to reach net carbon neutrality by 2060 and media reports said regulators are requiring mandatory ESG disclosures for listed companies by the end of this year.

Society in general is also much more conscious about ESG issues. Investors realize that analyzing the ESG performance of a company can help them make better investment decisions, avoid risky companies, and identify potential opportunities.

We observe that ESG issues could affect company revenues and earnings. Consumers are being more proactive on social causes and may even abstain from buying products of unethical companies. Companies are bearing the costs of unethical corporate practices.

For example, the sales of tobacco companies may be affected by a municipal ban on indoor smoking. The rise in future spending by companies to ensure their products meet ESG guidelines is a factor in our analysis.

In China, one main challenge is the lack of adequate ESG information on its companies that lag disclosure requirements of Western peers. Some companies may not have dedicated personnel for ESG responsibilities.

We often examine the corporate governance of the company, looking at the entity structure (whether private or State-owned), the independence of the board and shareholder composition-these are potential risk areas that could affect the ESG evaluation of a company.

When dealing with qualitative data, we do greater research into the management's future direction, sourcing quantifiable evidence as support and leverage on the expertise of our analysts, including our team based in Shanghai.

Asian companies in general are still developing their ESG policies. We take a forward-looking approach when evaluating a company's current state. For instance, a Chinese investee company may be lagging its Western peers in terms of ESG policies, but it could also be making progress toward its future ESG plans.

A company could be practicing fair employment-free of discrimination against gender, race and ethnicity-however, it may not have documented an official written policy on equal employment opportunity.

Through our engagement with company management, we often identify areas of improvement and guide management to developing clear and concise ESG policies.

Why ESG matters to investors

Early results from our analysis show that ESG characteristics may have a possible linkage to a company's financial performance, fueling the speed that we are integrating ESG into our investment process.

Whether one is an investor, corporate or individual, ESG has implications for the future. From a social and environmental point of view, we are continuously seeking accountability, asking if those companies are making efforts toward their ESG commitments, because if they are not, that will hurt their businesses and eventually the long-term performance of investment portfolios.

We require an ESG report for each of our portfolio holdings written by the analyst or fund manager who covers that company. We believe our analysts with their extensive research experience may be able to evaluate qualitative factors more accurately or identify specific company issues that may have been missed by external resources.

However, the value of investments and any income will fluctuate, which may partly be the result of exchange rate fluctuations, and investors may not get back the full amount invested.

Mike Shiao is chief investment officer for Asia (excluding Japan) at Invesco, a global investment management company. Yoshihiko Kawashima is Invesco's head of ESG (Environmental, Social and Governance) for Asia ex Japan.

The views don't necessarily reflect those of China Daily.

Today's Top News

- Xi says China, Kazakhstan reliable partners for each other

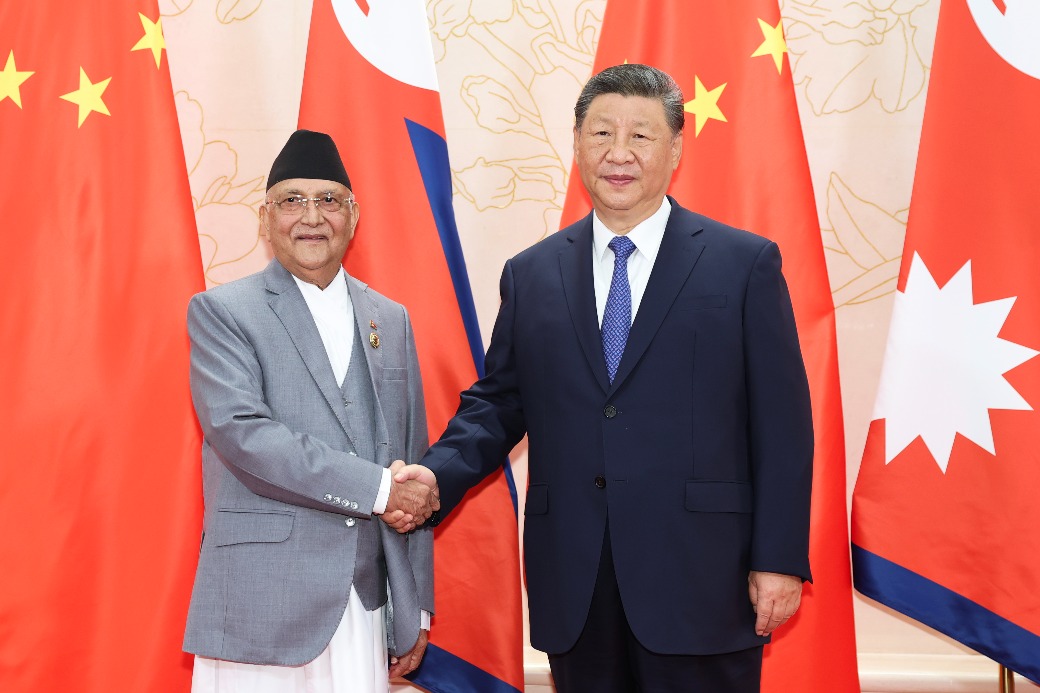

- Xi meets Nepali prime minister

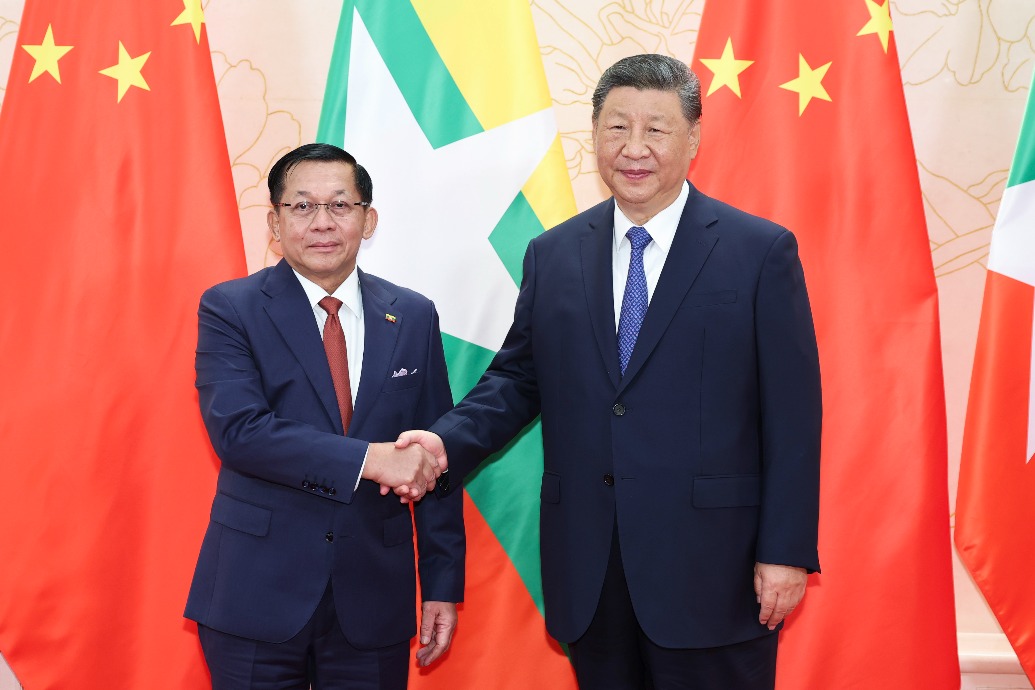

- Xi meets Cambodian prime minister

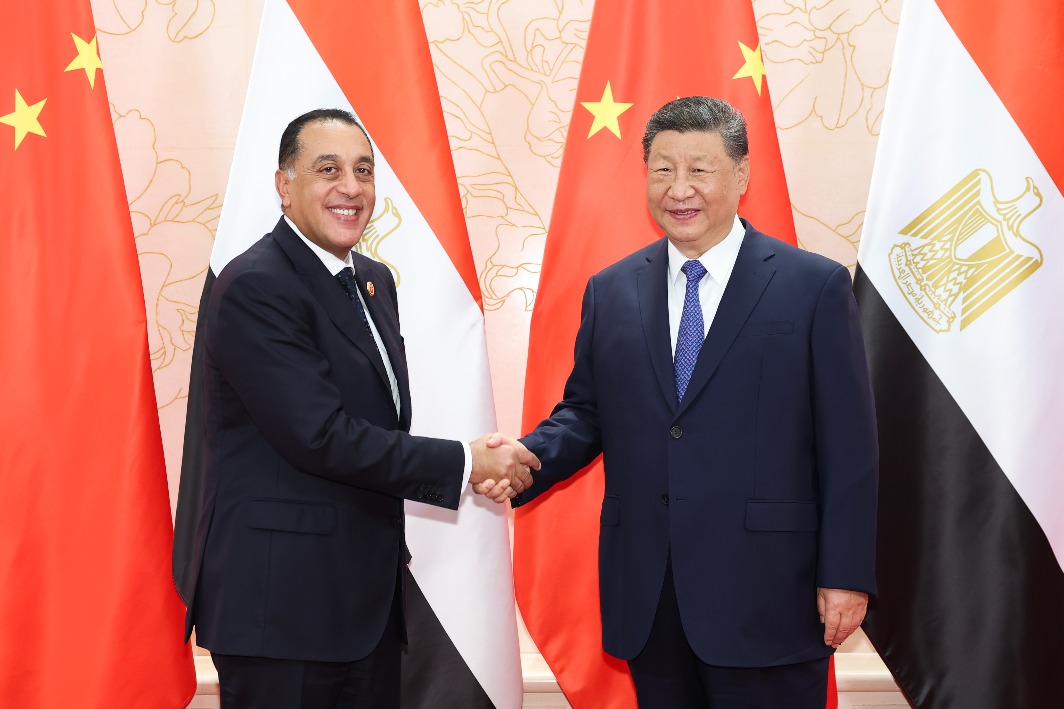

- Xi meets Egyptian prime minister

- Xi says China always a trustworthy partner of UN

- China calls for closer US dialogue to strengthen economic ties