Why yuan-dollar tango keeps trade firms on tenterhooks

In March, the RMB exchange rate fell back to the era of 6.50 yuan per US dollar, wiping out all the pick-up year to date. With rising market discussion on the reasons for recent RMB exchange rate correction, many institutions lowered their expectation of RMB appreciation within the year.

In fact, I have always been emphasizing that logic is more important than conclusion in foreign exchange analysis. What has happened by now does not deviate from the logic of exchange rate fluctuation I've argued for many times.

The year-to-date RMB exchange rate was not as strong as expected.

At the beginning of this year, in response to the concern over whether the RMB would break above 6 yuan per dollar, I said it is just an adaptive expectation based on simple linear extrapolation, but rapid RMB appreciation does not mean the currency is facing substantial pressure or strong expectation to appreciate.

Investors should pay attention to possible market correction and policy adjustments triggered by sharp RMB appreciation in the short term.

As a matter of fact, it rose above 6.5 yuan per dollar on the first two trading days of this year, but went range-bound within a narrow band of 6.43-6.50 from Jan 6 to end-February. The RMB's average mid-point exchange rate and the average exchange rate at the daily trading close (against the dollar) both rose 1 percent on a monthly basis in January, compared with 0.2 percent in February, indicating the diminishing market force to long RMB.

Implied by the one-year non-deliverable forward (NDF), the market expected the RMB to go slightly strong in the fourth quarter of 2020. In the first two months of this year, the expectation of appreciation and devaluation appeared alternately, and in March it turned to a depreciation direction. However, neither appreciation nor depreciation expectation is strong.

Policymakers recently disclosed a blueprint regarding the next stage of capital account opening-up with a focus on enhancing capital outflow. This move is expected to release effective forex demand and ease RMB appreciation pressure.

Some forecast that scenarios that affect RMB exchange rate will develop.

I summarized the uncertainties affecting the 2021 trend of RMB exchange in December last year, including the spread of COVID-19 pandemic, economic recovery, export prospects, the China-US interest rate spread, the US dollar index, financial risks, and major power relations.

Driven by market sentiments, the forex market maintains multiple equilibrium status points. Therefore, reaching a conclusion before finding the evidence must be prevented in forecasts of the foreign exchange rate trend. The recent strong RMB trend is supported by multiple positive factors. Nonetheless, the market may become less sensitive to positives and more vigilant about negatives once downside factors outweigh upside ones.

The strong RMB trend reached its peak on Feb 10, just before Spring Festival, and then pulled back amid volatility, mainly because the three scenarios mentioned above have occurred.

Against the backdrop of steady progress of vaccination, effective control of COVID-19 and global economic recovery, the US Federal Reserve may not raise its key interest rate given the domestic economic rebound, but the US Treasury yield is likely to be elevated with marginal monetary tightening and growing inflation expectation, narrowing China-US yield spread as a result.

The US dollar is expected to further weaken with rising market risk appetite, but the time span and magnitude of the depreciation depends on which of the major economies' recovery is faster after the pandemic.

If investors' risk appetite reverses, the global financial market will be under pressure again with asset prices likely to plummet. In that case, the RMB will be put to test, to see whether it is safe or risky in nature.

The market believes the recent RMB exchange rate correction is mainly attributable to the strong US dollar trend and the correction in the US stock market, thanks to steady recovery of the US economy, accelerated vaccination and strong fiscal stimulus plan, plus the rising US Treasury yields amid inflation expectation, but at the cost of RMB depreciation.

More than 160 million US residents have been vaccinated by now, accounting for over 40 percent of the population. The daily average new COVID-19 cases are around 60,000, down 75 percent from the peak of 250,000 in early 2021.

According to the latest forecast of the Organization for Economic Cooperation and Development, the US economy contracted by 3.5 percent last year and is expected to grow 6.5 percent this year. The eurozone was down by 6.8 percent and is tipped to rise by 3.9 percent this year, while the United Kingdom will likely rebound to 5.1 percent from a drop of 9.9 percent, and Japan may rise to 2.7 percent from (minus)-4.8 percent.

Since the beginning of this year, the 10-year US Treasury yield has seen a continuous rally, moving upward from less than 1 percent at end-2020 to above 1.7 percent as of April 2, representing an 85 percent rebound and leading to a shrinkage of 73 basis points in the 10-year China-US Treasury yield spread. Meanwhile, the US dollar index dropped first and then rebounded, with a cumulative increase of 3.4 percent and a maximum increase of 3.7 percent.

As of April 1, the Dow Jones Industrial Average retreated 3.2 percent at most from the previous peak on Feb 24, the S&P 500 and Nasdaq indexes fell 4.4 percent and 10.5 percent at most from their previous peaks on Feb 12, respectively. From Feb 25 to April 1, the Shanghai Composite Index, the Shenzhen Component Index, and the ChiNext Index recorded largest declines of 5.8 percent, 9.8 percent, and 12.4 percent, respectively.

According to data from the International Finance Association, net foreign capital inflows in emerging market stock and bond portfolios slowed to the lowest level in nearly a year in March.

Adapting to "the new normal" is better than expecting "the new cycle".

Theoretically, with the fundamental-based equilibrium exchange rate remaining stable, the foreign exchange rate should experience two-way volatility, as it will fall back after surging too high and rebound after dropping too low, amid changing dynamics of mixed factors.

For example, from early 2017 to end-March 2018, the RMB appreciated 10 percent within 15 months. However, it then slumped 8 percent within four months from April to July 2018, and fell to nearly 7 yuan per dollar by end-2018, representing a total 10 percent decline since end-March.

The decline was mainly due to the US dollar index rebound, escalation in economic and trade conflicts, and suspension of the use of countercyclical measures.

Fluctuations in the RMB exchange rate against the dollar were around the level of 6.5 during last month, which once again confirmed my view that a constantly appreciating or depreciating currency does not exist.

With the RMB exchange rate falling back to 6.5, many foreign trade companies that previously stayed in wait-and-watch mode are buying more yuan as the exchange rate rapidly dropped 500 basis points, according to some media sources.

A similar situation occurred during the two-way volatility of the RMB in 2018. While the US dollar index moved down, the RMB continued appreciating in early 2018 and hit "post-8.11" (that is, the Aug 11 reform in 2015) new high in March, with cumulative appreciation of 3.9 percent. The monthly spot and forward (including options) forex settlements by banks recorded mild deficits in the absence of short-selling driven by panic over the RMB appreciation.

In April and May, the RMB turned weak with a 2 percent drop amid the US dollar index rebound, with monthly forex settlement of $29.1 billion in the same period. However, the RMB maintained weakening trend after June and recorded cumulative decline of 8 percent by end-October.

From June to December 2018, only October and December saw surplus of no more than $1 billion for each, compared to the monthly average deficit of $11.7 billion for the other five months.

Apparently, with the advantage of hindsight, after experiencing the long-lasting RMB appreciation, companies which made quick moves to sell their foreign currencies in April and May 2018 would regret having acted too early. It is hard to say whether the same situation will recur.

However, the market trend last week has demonstrated that volatility in the RMB exchange rate is inevitable if our anticipations come true. While there is no right or wrong decision for companies mentioned above, their gains and losses seem explicit, assuming they are risk-neutral rather than betting on the direction of currency movement.

The writer is global chief economist of BOC International (China) Co Ltd.

The views don't necessarily reflect those of China Daily.

Today's Top News

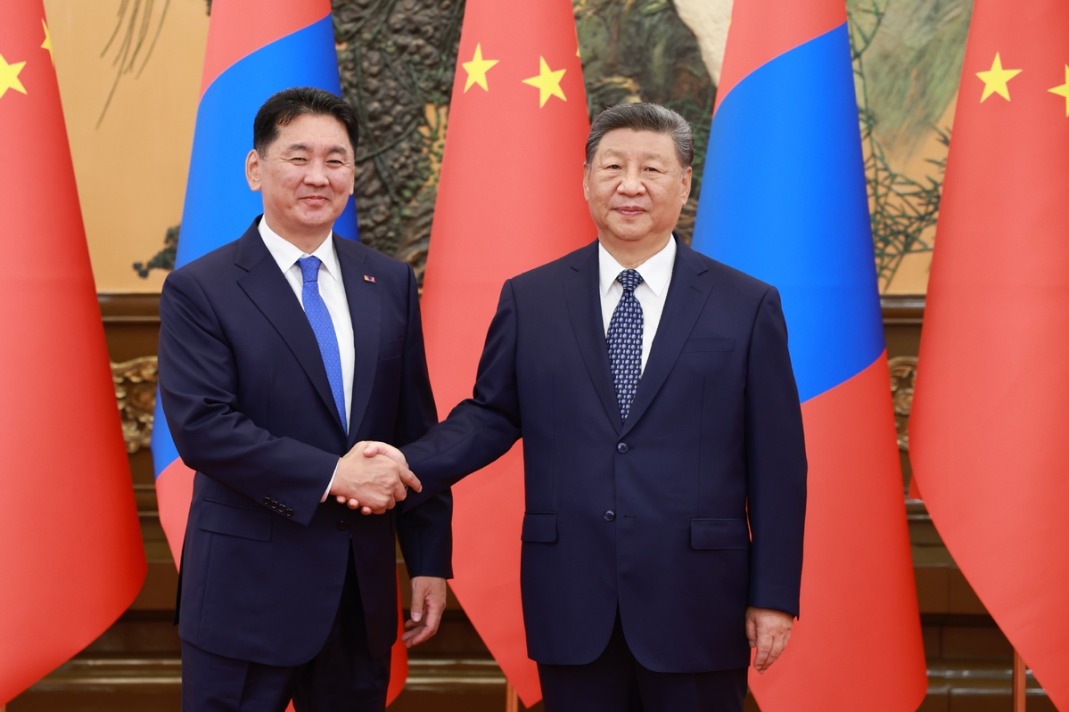

- Xi, Putin, Khurelsukh meet in Beijing

- Xi meets Mongolian President Ukhnaa Khurelsukh

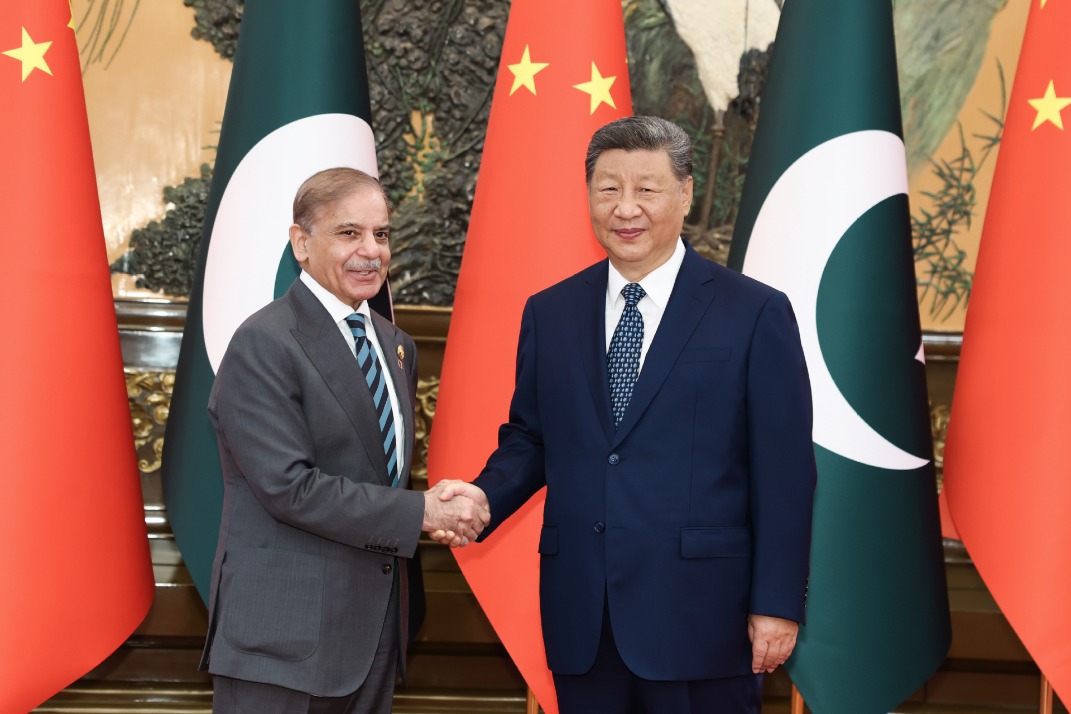

- Xi meets Pakistani Prime Minister Shahbaz Sharif

- Xi meets Uzbek President Shavkat Mirziyoyev

- Summit bears fruit in global governance

- Leading lenders have standout Jan-June run