Time to ride the tide of blue ocean business

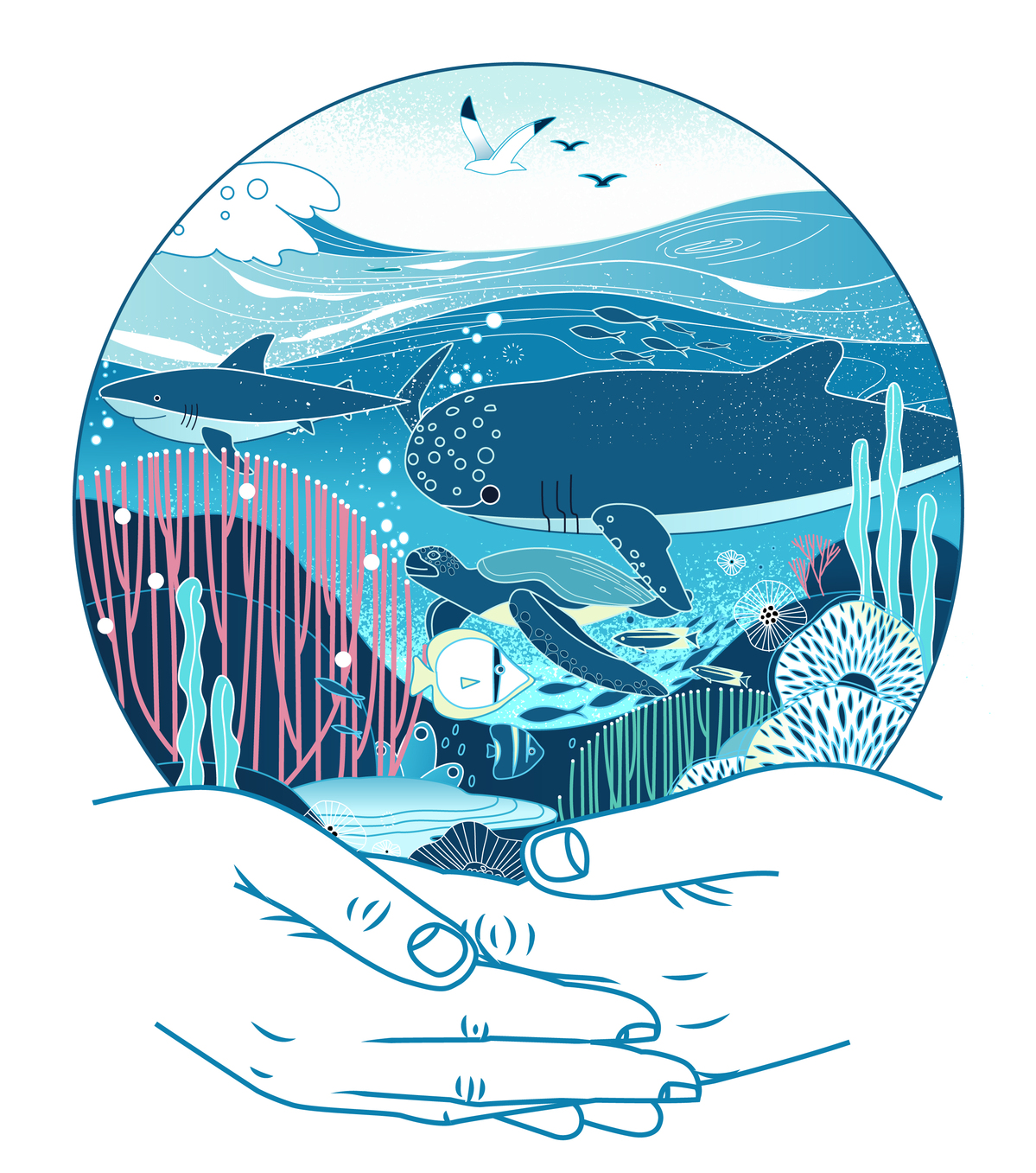

The global economy would not exist without the ocean. Ocean-based industries contribute $1.5 trillion annually and hundreds of millions of jobs in fishing, shipping, marine tourism, and renewable energy. These economic services, however, are at risk due to unsustainable marine practices and overexploitation of ocean resources.

This year the World Economic Forum Global Risk Report identified biodiversity loss and human environmental damage as two of the biggest risks to the global economy.

Continued business-as-usual approaches will result in reduced natural capital-such as fish from the sea-and disruptions in supply chains. These pose a risk to most businesses, even those that indirectly rely on the ocean, as more than half of global GDP is moderately or highly dependent on nature.

Demand for sustainable investment increasing

Pressure is building on unsustainable businesses to disclose climate-and nature-related risks. With credit rating agencies mainstreaming sustainability assessments and transition planning, and global accounting standards being updated to ensure inclusion of sustainability risks, there is simply no place to hide.

Also, the financial sector is seeing unprecedented demand for sustainable investment opportunities. Partly due to the ongoing pandemic, the growth of funds focused on sustainability is shattering records-and global agreements are being forged to remove harmful subsidies that support unsustainable businesses.

These trends should come as no surprise. "Blue ocean" was flagged as a metaphor for a space for limitless business opportunities as early as 2005, when W. Chan Kim and Rénee Mauborgne published the ground-breaking book, Blue Ocean Strategy. They contended that many companies were competing in so-called "red ocean" established markets with an existing number of competitors and often razor-thin margins, such as low-cost family cars.

Conversely, they argued, "blue ocean" markets provide an underdeveloped business space ripe for innovation with vast opportunities for sustainable and profitable growth-for instance the fully electric cars developed by Tesla Motors.

This potential is rapidly being realized. Businesses now have a choice: compete in crowded markets of the "red ocean" with increasing financial, climate and nature-related risks, or explore the largely uncontested potential of blue ocean.

Large enterprises are pivoting to ride the blue wave. A study commissioned by High Level Panel for a Sustainable Ocean Economy on Ocean Solutions that Benefit People, Nature and the Economy published last year found that sustainable ocean investments could produce $15.5 trillion in net benefits by 2050 and build future-focused industries that generate six times more food and 40 times more renewable energy.

In the fisheries sector, reducing the 35 percent of seafood wasted in the value chain could have measurable environmental and economic benefits. M&C Asia, a major seafood importer in Hong Kong, China, holds two sustainability certifications for its work tracing each fish from dock to plate, allowing it to charge premium prices.

The Sustainable Seafood Fund, which aims to deliver fishery improvement projects to reduce fisheries investment risks, including pipeline development, repayment risks, market risks and execution risks, partners with corporate buyers using long-term purchase agreements to secure fish and repay investors through fees based on volume or value.

In solid waste management, 60 percent of global land-based marine plastic pollution comes from five countries in Asia. To enhance its margins, Indorama Ventures, a global manufacturer in polyethylene terephthalate, is expanding its plastic bottle recycling capacity and decreasing ocean waste. The environmental benefits earn the company blue ocean credentials, important for environmentally conscious investors.

The global green economy is worth nearly $8 trillion. But the new frontier is the blue economy, and it too is booming. Take clean energy for example. The terrestrial green energy market is vibrant but limited by land available for capacity expansion. Oceans can provide limitless supplies of renewable energy. Offshore wind alone could generate 23 times more power than current total global electricity consumption.

With global offshore wind costs plummeting by 32 percent in 2019 and expected to decrease further, the huge markets of Europe and China could attract $400 billion of investments over the next two decades. Even the shipping industry, once powered by fossil fuels, is catching on.

New market entrant NEOLINE is developing a sail-based maritime transportation business in the North Atlantic, offering decarbonized shipping that is price-stabilized due to significantly lower exposure to fuel prices.

We should look to the seas, especially to sustainable aquaculture, also to feed the world. First-movers like Norwegian company Cermaq are developing facial recognition technology for salmon farming to conduct biological tests on each animal, enabling targeted applications of food and chemicals and reducing environmental and economic waste.

Oceans 2050, a foundation established by the granddaughter of legendary ocean explorer and conservationist Jacques Cousteau, focuses on advocacy for ocean abundance restoration and is pioneering regenerative seaweed aquaculture that will sell both carbon credits and a premium food product while creating jobs for vulnerable coastal and island communities in 12 countries in Asia, Europe, and North and South America. This trend is not limited to fish and other seafood. Traditional crops are being grown in underwater pods to conserve energy, water, and chemicals.

Purpose-built companies are being developed with the primary aim of investing in nature to make our oceans healthy and more resilient. CLS is a global company operating in 90 countries to provide high-tech fisheries management products and services, such as electronic monitoring systems.

Aquaai Corporation builds robotic fish that combine real-time data, artificial intelligence, and machine learning to deliver marine monitoring and compliance services. Other innovators include WIPSEA, which stands for Wildlife Process Solutions for Environmental Assessment and uses drones and big data to improve marine megafauna monitoring, and the CHARM foundation that invented coral-farming robots.

The time to seize blue opportunities is now

The pandemic has offered governments around the world a chance to "build back bluer" by using the economic pause to re-imagine sustainable development and reinvigorate stimulus spending on the environment. For companies considering new blue opportunities, the time is now to get preferential access to new funds. Many are already taking advantage.

Investors such as Mirova are capitalizing funds for private ocean investments such as the Althelia Sustainable Oceans Fund at $132 million. Funding is also available to design blended public-private blue investments through the global network for blended finance, Convergence.

Accelerators such as Katapult Ocean are investing in blue start-ups, while platforms like Investible Oceans are connecting businesses to investors. The"1000 Ocean Startups" coalition is bringing together the global ecosystem of incubators, accelerators, competitions, matching platforms and venture capital firms supporting start-ups for ocean impact.

The global blue economy is fast becoming a profitable, sustainable reality. The question facing traditional businesses now is: Will you be part of the pollution, or part of the solution?

Ingrid Van Wees is the vice-president for Finance and Risk Management of the Asian Development Bank; and Melissa Walsh is the program manager of the Ocean Finance Initiative at the ADB.

The views don't necessarily reflect those of China Daily.

If you have a specific expertise and would like to contribute to China Daily, please contact us at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.