Young shoppers seeking adventure, identity in purchase choices

A craze for "blind box" toys has fixated China's Generation Z population on the sublime joys of surprises associated with treasure hunting.

Essentially palm-sized figurines, the toys are individually packaged into opaque poly bags and sold separately. The charm lies in the unknown as toys within typically come in series, and buyers typically do not know which figurine they get until they unpack them.

Some may feel thrilled when they get sought-after characters, while others, frustrated with getting what they already have, end up spending more to complete a collection.

The latest darling of the toy segment has thus caught fire in the stock market.

Pop Mart International, widely regarded as the creator of the craze on the Chinese mainland, has enamored investors with its recent success. Its shares have surged around two-thirds just five months after debuting on the Hong Kong bourse.

The shopping binge has drawn more players, such as New York listed Chinese variety lifestyle goods retailer Miniso to join the action.

Its subsidiary Top Toy is doubling down on the country's vast, blue ocean market.

The company plans to open 100 stores nationwide this year, and is eyeing to launch its inaugural overseas shop, according to Sun Yuanwen, founder and CEO.

With 23 stores already in eight first and second-tier cities, Top Toy reported stellar revenue related to a series of new openings. For instance, an outlet in the high-end IFS mall in Chengdu, Sichuan province, raked in 270,000 yuan ($41,931) in sales on the very first day, with per customer transactions hitting 400 yuan.

"We are checking places in Singapore, Japan and South Korea to decide on the best location for our first overseas store this year," Sun said.

Chinese toymakers are betting on the country's 500 million millennials and members of Gen Z, who are flush with disposable income and willing to spend on such indulgences.

There will also be a limited series of characters for special occasions such as Christmas or Chinese New Year for the same price, with no premium price for limited edition holiday specials, and some buffs are even lining up in front of shops overnight.

The market for "blind boxes "could grow to 25 billion yuan in 2025 from just 3 billion yuan in 2019, according to consultancy Qianzhan Intelligence.

"Compared with 2014, disposable income saw 59.6 percent growth in 2020, which leaves a huge space for nonrigid demand. The changing consumption nature is propelling customers to pay for experience and their preferences," Sun said.

Apart from teaming up with established intellectual property entities like Japan's Bandai and Marvel of the United States, Top Toy is releasing three original IP figurines that can better express the cultural likings of Chinese youth.

"I think this goes well with the 'guochao' trend being embraced by younger buyers," he said. Guochao refers to the rise of hip, homegrown brands poised to vie for popularity with international labels.

"With the rise of China, it is only natural to see some leading local brands emerge that herald the latest consumption trends worldwide."

The rising designer toy market in China has displayed the country's young adult appreciation for arts and culture, according to Chen Shaofeng, vice-dean of the Institute for Cultural Industries at Peking University.

"At the same time, they are eager to find self-identification. Buying and collecting certain kinds of art toys is a way to express themselves, and a way to tell people who they are and what they like," Chen said.

Today's Top News

- Xi says China, Kazakhstan reliable partners for each other

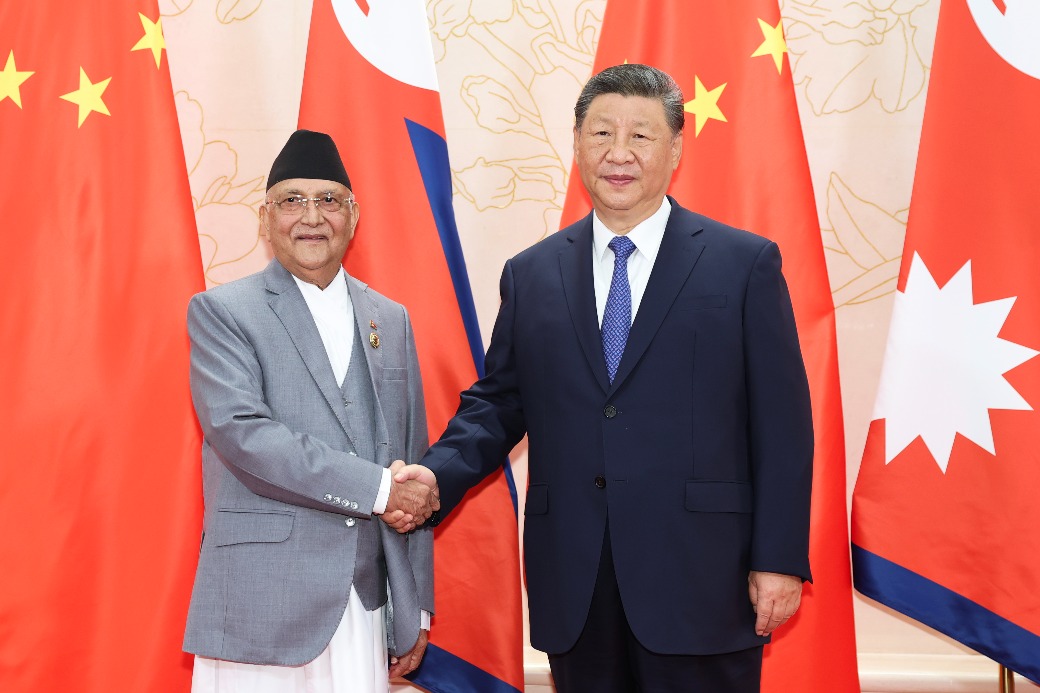

- Xi meets Nepali prime minister

- Xi meets Cambodian prime minister

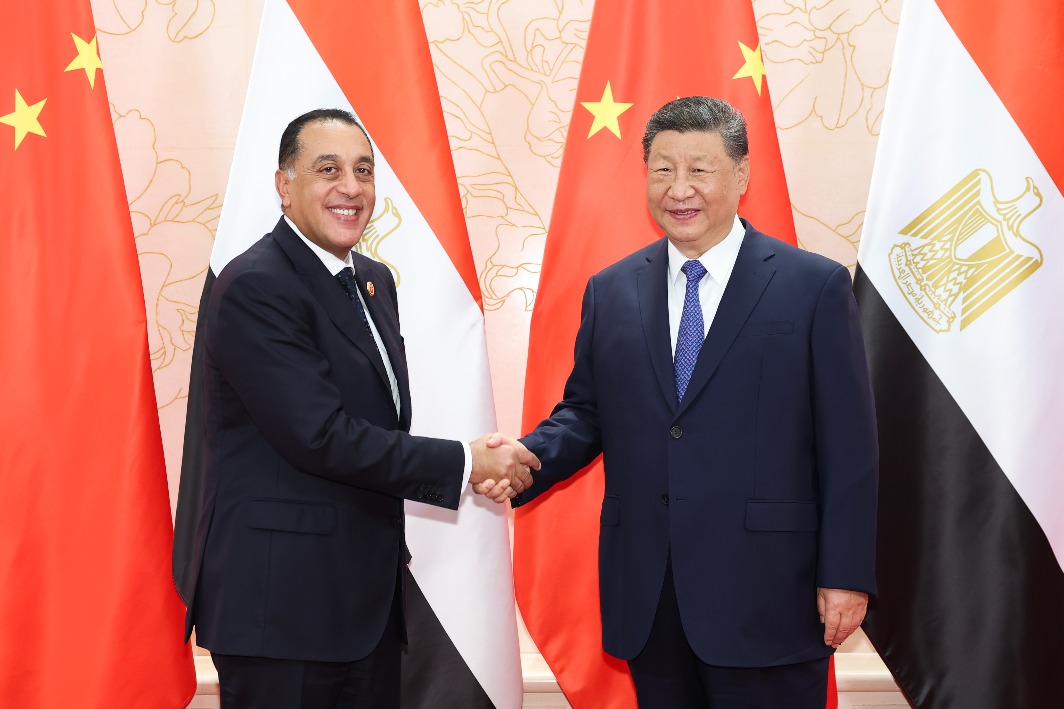

- Xi meets Egyptian prime minister

- Xi says China always a trustworthy partner of UN

- China calls for closer US dialogue to strengthen economic ties