Coal firms post higher profit in first quarter

Thanks to the economic recovery and production capacity resurgence, the country's listed coal companies saw their profits soar during the first three months, and an analyst believes the momentum is set to continue.

The joint net profit of China Shenhua Energy Co Ltd and China National Coal Group Corp reached 15.1 billion yuan ($2.35 billion) in the first quarter with an average daily profit of 170 million yuan, up 44.5 percent year-on-year, according to the financial results of the country's two major coal companies.

China Shenhua Energy Co Ltd-once the country's top coal producer by volume before its merger with State-owned power generator China Guodian Corp to create the world's largest energy conglomerate China Energy Investment Corp-said its revenue during the first three months stood at 67.6 billion yuan, up 32.4 percent year-on-year. Net profit jumped 18.4 percent to more than 11.6 billion yuan.

China National Coal Group Corp witnessed an even more drastic increase in profit. Its revenue soared 61.5 percent year-on-year during the January-March period to more than 44.4 billion yuan. Net profit surged 444.1 percent compared with the same period last year to more than 3.5 billion yuan, a record high since the company was listed in 2006.

The surge was mainly due to the steady macroeconomic recovery, which fueled coal price surges and increased production and sales of coal, coal chemical products and coal mine equipment products, the company said.

China National Coal Group Corp expects its profit to continue surging drastically during the first half.

With the recovery in industrial demand, upcoming summer peaks and the overhaul of railway lines, net profit of coal companies in China are expected to continue increasing during the second quarter and demand for coal will also see strong growth in the first half due to robust demand from the power, steel and construction materials sectors.

Wei Hanyang, a power market analyst at Bloomberg New Energy Finance, said revenues of coal companies this year have benefited from both fuel demand growth and strong coal prices.

"This year, coal prices at Qinhuangdao port remained higher than anytime compared to the first nine months of 2020, due to robust demand driven by economic stimulus and recovery," Wei said.

"It has also edged higher than 2019 levels, except for some summer months."

Wei said the high coal prices also reflect the fact that "coal still plays an important role in the Chinese economy and decarbonization could take some time".

China is planning to reduce the share of coal in its overall energy mix to less than 56 percent this year, according to a guideline recently released by the National Energy Administration. The figure was 56.8 percent in 2020 and 57.7 percent in 2019, said the administration.

This year, China plans to further replace coal in final energy consumption with electricity equivalent to 200 billion kilowatt-hours, while increasing the proportion of electricity in final energy consumption to 28 percent, according to the administration.

More than 80 percent of China's coal supply is under medium and long-term contracts with prices between 540 yuan ($85) and 550 yuan per metric ton, according to Xinhua News Agency.

Due to the impact of COVID-19 and changes in supply and demand last year, the country's coal prices experienced a V-shaped trajectory last year. A two-and-half month decline cycle started in mid-February, followed by a low point in early May and then a subsequent rise about a month later. Prices have been rising since September 2020.

Today's Top News

- 'Shanghai Spirit' should be advanced with new vitality

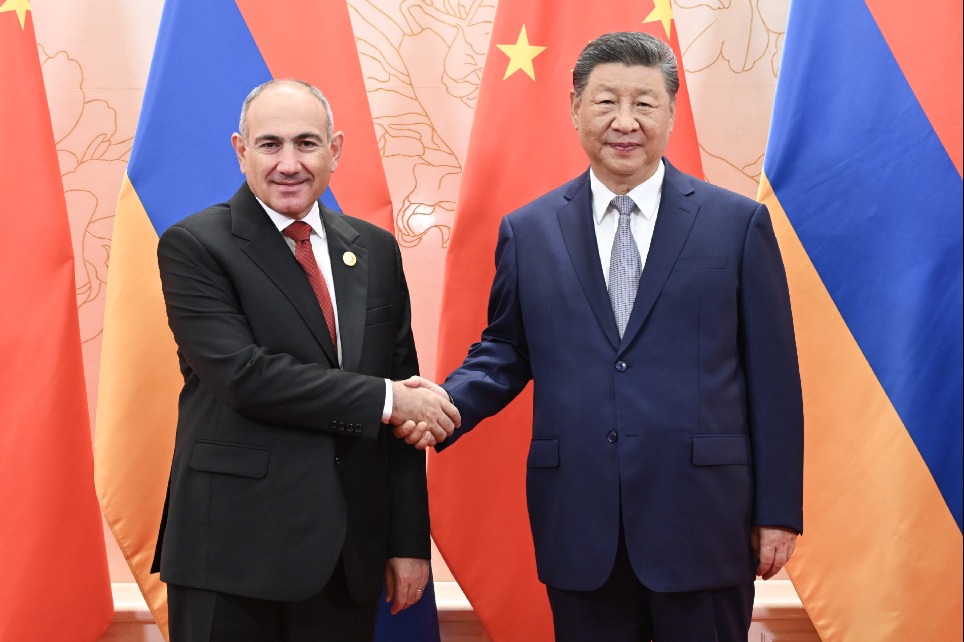

- Xi, leaders engage in high-level talks

- Xi cements neighborly bonds with SCO friends

- Kyrgyzstan, China deepening strategic partnership in a new era

- Partnership seen as key to Sino-Indian relations

- Xi: SCO plays growing role in safeguarding peace