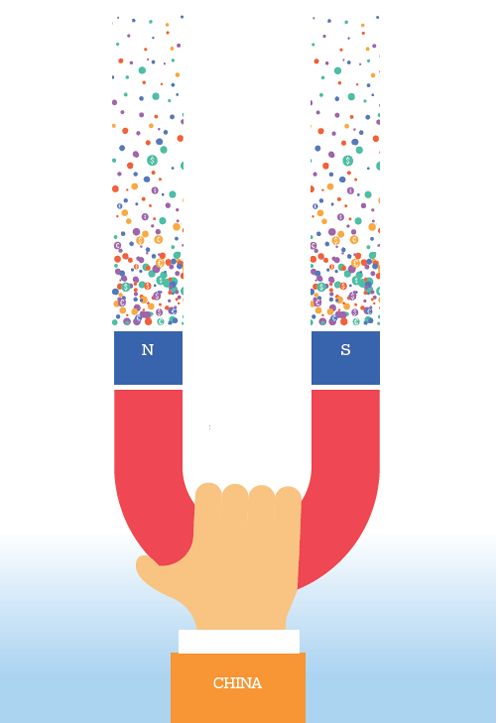

International investors pursue RMB-denominated assets

Experts encourage further opening of financial markets

With RMB-denominated financial assets more attractive than ever to global investors, experts are saying that China should continue to steadily open its financial markets.

Most economies worldwide are still paralyzed by the coronavirus pandemic, and commodity prices recently surged to record highs.

Financial assets such as RMB-denominated ones, which can provide stable returns, are being chased by investors worldwide, but inflation has become a major factor in diluting gains.

In April, holdings of RMB bonds by foreign institutions rose month-on-month by 64.86 billion yuan ($10.16 billion).

Such institutions favor the treasury bond issued by the central authorities in China. In April, their holdings of such bonds rose by 51.74 billion yuan month-on-month, according to China Central Depository and Clearing Co.

Financial conditions have continued to improve in the United States, the eurozone and the United Kingdom, according to research by Moody's Investors Service, while such conditions in emerging markets have recovered to their historical average. Policy support and the progress made with rolling out of COVID-19 vaccines have boosted these conditions.

In addition to the attraction of financial assets, foreign capital inflows to China's financial markets have been triggered by the widening gap between yields of Chinese treasury bonds and those issued in the US.

The Chinese currency has gained more than 10 percent against the US dollar over the past year, buoyed by the economic rebound from the pandemic and capital inflows from overseas. It recently reached highs last seen in May 2018, but this rapid appreciation is expected to be short-lived, because market forces will result in a two-way fluctuation of the exchange rate.

According to experts, the increased participation of foreign capital in China's financial markets will not change in the short and medium term.

Zhong Hong, vice-president of the Bank of China's research institute, said foreign investors will continue to buy RMB-denominated assets this year, while there may still be some uncertainties and fluctuations in the global market.

These investors are attracted by China's sound economy and its relatively stable interest and exchange rates, compared with those elsewhere in the world, Zhong said.

Quotas option

Fang Xinghai, vice-chairman of the China Securities Regulatory Commission, said Chinese regulators would take measures to keep the capital market stable during further opening-up, and prevent large-scale fluctuations, which can be caused by cross-border capital flows.

He added that one option is to apply quotas to control daily southbound and northbound trading through the Shanghai, Shenzhen and Hong Kong stock connect programs.

"In the event of foreign capital coming in and causing big fluctuations in the stock market, we can temporarily stop trading," Fang said during a panel discussion at the Boao Forum for Asia in April.

"We also have measures to prevent the market being affected by major fluctuations, which can result from large inflows and outflows of foreign capital," he added.

At the end of March, foreign capital accounted for about 5 percent of China's stock market, he said, adding that in comparison, the proportion of Chinese stocks in major global indexes remains very low.

As foreign capital floods increasingly into the domestic stock market, it is playing a more important role in pricing shares. The fact that such capital is mainly held by institutional investors means it can contribute to market stability, Fang said.

He added that financial regulators are considering further increasing the proportion of Chinese stocks in major global markets and expanding the scale of inclusion to attract more foreign capital.

Xuan Changneng, deputy head of the State Administration of Foreign Exchange, or SAFE, said moderate net inflows of cross-border investments in securities-mainly in stocks and bonds-have been maintained so far this year, in line with the generally stable situation on foreign exchanges.

John Waldron, president and chief operating officer of The Goldman Sachs Group, said pilot projects providing increased free convertibility of foreign exchange have been launched recently in Beijing and Shenzhen, Guangdong province.

He said these projects indicate the right direction for financial opening-up, and the opening of capital services is good news for many foreign-funded enterprises entering China.

On May 6, in the latest move to assist the opening-up of China's financial sector, the People's Bank of China-the central bank-released new detailed rules for the proposed Greater Bay Area Cross-Boundary Wealth Management Connect. The rules include quotas for residents of the GBA to make certain financial investments.

Wealth Management Connect is a pilot program aimed at helping residents of the GBA, which comprises nine cities in Guangdong, along with Hong Kong and Macao, to make cross-boundary investments in wealth management products, or WMPs, offered by banks in the GBA.

The proposed aggregate quota of 150 billion yuan and a limit of 1 million yuan per person for cross-boundary WMP investments in the GBA is particularly noteworthy.

Sonny Hsu, vice-president and senior credit officer at Moody's Investors Service, said the proposed rules are positive news for the asset management units of banks on the Chinese mainland, Hong Kong and Macao.

"However, the banks' potential revenue from the program will be limited, as northbound and southbound investments are initially capped at 150 billion yuan," Hsu added.

Analysts said the connect program, if implemented, will mark a further step toward convertibility of the renminbi under the capital account.

A pilot area has also been established in the southern province of Hainan. On April 9, SAFE and other financial regulatory departments jointly issued a set of new policies to further boost opening-up of the financial sector at Hainan Free Trade Port.

These rules allow certain institutional investors to freely send funds, both incoming and outgoing, by adopting required methods, and to make investments under designated quotas. Meanwhile, foreign exchange registration procedures have been simplified.

Joe Yizhou He, managing director of Australian Capital Equity, has witnessed China's accelerated financial opening-up since regulators announced a series of policies in 2018.

These measures included lifting the foreign ownership cap for banks and asset management companies, treating domestic and foreign capital equally and allowing some financial institutions to set up branches and subsidiaries at the same time.

"To date, policy implementation has been efficient," said He, who is working on establishing a renminbi investment entity at Hainan Free Trade Port through the Qualified Foreign Limited Partnership program.

"The special policies in Hainan can facilitate foreign investment into China, as the application procedure and market access requirements have been simplified, and a greater level of flexibility is offered compared with other regions in China," He said.

China's capital markets, in particular, have experienced deeper reform and further opening-up.

"With China's stock markets becoming more welcoming to the light-asset new economy sector, I have seen more entrepreneurs in this sector choose the A-share market as their IPO (initial public offering) destination," He said.

Policy support

Although foreign capital was introduced into the A-share market almost two decades ago, there has been an acceleration in recent years following the launch of the Shanghai-Shenzhen-Hong Kong Stock Connect Program. The acceleration was boosted when MSCI Indexes, which measure stock market performance in a particular area, incorporated China stocks in 2018.

In the private equity market, many foreign investors, who have a wait-and-see attitude, are expected to make more RMB-denominated direct investment due to the arrival of policies to further open up the financial market.

"From my experience, the foreign exchange policies so far support the free conversion of a certain amount of profits that we earned in China, and there are basically no obstacles in doing so," He said.

As China has swiftly controlled the pandemic, foreign investors have shown increased confidence and optimism toward the country's markets.

In addition to the secondary stock and bond markets, they are paying more attention to equity investment, especially in innovative and high-tech companies, according to experts.

Australian Capital Equity is seeking investment opportunities in advanced fields such as the digital economy, new lifestyles and technology innovation.

On April 20, President Xi Jinping said in a keynote speech delivered via video link to the opening ceremony of the Boao Forum for Asia Annual Conference that China would continue to develop Hainan Free Trade Port and new systems for a higher-standard open economy.

"China will take an active part in multilateral cooperation on trade and investment, fully implement the Foreign Investment Law and its supporting rules and regulations, cut further the negative list on foreign investment, continue to develop the Hainan Free Trade Port, and develop new systems for a higher-standard open economy," he said.

"All are welcome to share in the vast opportunities of the Chinese market," the president said.

Waldron, from Goldman Sachs, said that if China continues to improve laws and regulations in the financial sector in compliance with international standards, and ensures unrestricted access for foreign investment, the country can expect to attract more international investors and institutions.

The measures taken will further strengthen global investors' confidence in the Chinese market, he said.