Some COVID-19 levies going

Finance Ministry to sustain measures like reductions in value-added tax

China will withdraw some temporary tax and fee reduction measures that were issued after the COVID-19 outbreak, while ensuring more support for small businesses to sustain economic recovery, according to the Ministry of Finance.

Some of the temporary and emergency tax and fee cuts related to pandemic prevention and control will expire later and the ministry will not extend them.

But policies such as value-added tax reductions for small businesses will be sustained, in order to maintain the necessary support for economic recovery, the ministry told China Daily on Friday.

Given the fast economic recovery this year, China's fiscal revenue jumped 24.2 percent on a yearly basis during the first five months of the year. The country's fiscal revenue reached 9.65 trillion yuan ($1.5 trillion) during the period, according to official data.

The rapid year-on-year growth has been mainly due to the low base in the same period of last year and the growth in the producer price index, which also reflects the speed of China's economic recovery, said a spokesman from the Ministry of Finance.

Total tax income rose 25.5 percent from a year earlier to 8.38 trillion yuan in the first five months, with fee income rising by 16.2 percent to 1.26 trillion yuan.

The overall tax revenue indicates that the economy has recovered to a higher level, said Zhang Xu, an analyst with Everbright Securities. It has also exceeded the two-year fiscal revenue growth target set by the government.

In addition, the value-added tax and consumption tax growth reflects the rebound of the economy to a higher level, said Zhang.

Despite the withdrawal of temporary tax and fee reductions, China will continue the institutional tax reforms introduced in recent years, such as reducing the value-added tax rate, value-added tax rebate and special additional deduction of personal income tax, so as to release the policy effects, said a spokesman with the finance ministry.

Policies will continue to benefit small and micro enterprises, and support the nation's manufacturing industry and technological innovation, the spokesman said.

Government spending, however, has slowed down in the first five months, while infrastructure expenditure continued to decline. From January to May, the national general public budget expenditure was 9.355 trillion yuan, up 3.6 percent on a yearly basis. Out of that, the central government general public budget expenditure was 1.2 trillion yuan, down 8.9 percent from a year earlier.

To prevent economic downward risks in the second half, Beijing may need to strengthen fiscal support and accelerate government spending to stabilize investment, experts said.

Local government bond issuance, which has slowed in the previous months, is expected to speed up in the second half, according to Xie Yaxuan, an economist with China Merchants Securities.

By Tuesday, 1.285 trillion yuan of new local government bonds were issued, accounting for 30 percent of the annual quota. Out of this, 420.5 billion yuan was from general bonds, while special bonds accounted for 864.5 billion yuan, according to the finance ministry.

"Compared with the same period last year, the government bond issuances this year have slowed down, mainly because of the large scale of special bonds issued last year, and the policy effect will continue to be released this year," said the spokesman from the ministry.

Analysts from the Moody's Investors Service expect new local government bond issuances to pick up from May with the total amount set to exceed last year's levels.

China has introduced a new guidance for local State-owned enterprises' debt and risk management, which aims to address contingent liability risks. The guidance requires local governments to maintain closer oversight of local SOEs' debt and leverage, and to facilitate the debt restructuring of defaulting SOEs to restore market confidence and prevent contagion risks. The government is likely to support local SOEs where necessary, but it will become increasingly selective, said the Moody's analysts.

Today's Top News

- Xi addresses SCO summit meeting in China's Tianjin

- Xi chairs SCO summit meeting in China's Tianjin

- 'Shanghai Spirit' should be advanced with new vitality

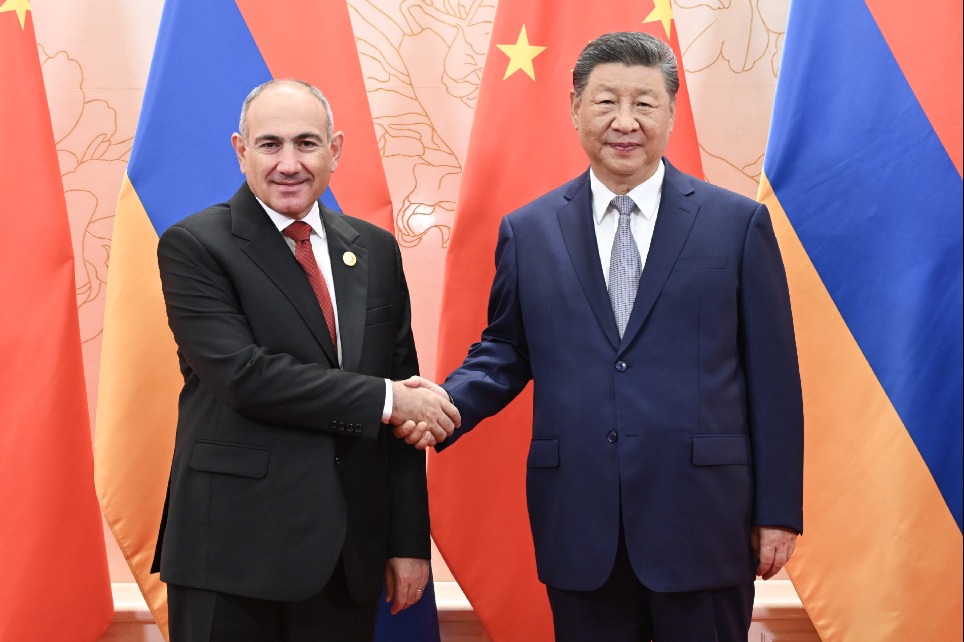

- Xi, leaders engage in high-level talks

- Xi cements neighborly bonds with SCO friends

- Kyrgyzstan, China deepening strategic partnership in a new era