Tax services eye firms with offshore biz

Regulators facilitate system with better solutions for players from home, abroad

Chinese tax officials are providing professional services to help local companies enter the global market, and are also introducing more China-based solutions as successful examples for international tax coordination mechanisms.

Tax authorities are introducing more global solutions related to complicated tax issues. At the first Conference of the Belt and Road Initiative Tax Administration Cooperation Forum held in Wuzhen, Zhejiang province, in 2009, the tax bureau in Suzhou, Jiangsu province, introduced a specific classification of cross-border enterprises and provided tax services based on the classifications.

Zhu Hai, chief accountant at the tax bureau of Suzhou, presented the case at a news conference on Thursday.

Another case involved the bureau exploring two international tax theories on costs and markets, which have been accepted by many global peers, Zhu said.

Some of the bureau's cases solving cross-border tax issues have been accepted by the Organization for Economic Cooperation and Development, the tax official added.

In Suzhou, an increasing number of enterprises have devised "going global" strategies involving 61 countries and regions. Because tax laws and regulations often vary by region, the State Taxation Administration in Beijing has issued tax guidelines addressing 104 countries and regions.

Based on national guidelines, the Suzhou tax bureau focuses on major policies and issues related to enterprises' overseas development plans. The policy briefing was welcomed by domestic companies as they become increasingly interested in doing business abroad, according to Zhu.

"Supported by the specific guidelines carried out by the local tax authorities, business executives will no longer be afraid of going global," Zhu added.

The tax bureau in Suzhou also set up a special working team to solve tax-related problems and provide follow-up services for companies when they conduct business overseas.

Domestic companies will have no worries about tax disputes when going abroad if they can be supported with professional tax services as they are unfamiliar with foreign tax and law details, experts said.

In order to better protect the legitimate rights and interests of "going global" enterprises, the State Taxation Administration leverages negotiation mechanisms to deal with and resolve cross-border tax disputes encountered by enterprises in a timely manner.

Since 2016, Suzhou's tax bureau has participated in bilateral consultations between the State Taxation Administration and relevant countries or regions, and helped 16 enterprises in Suzhou to resolve overseas tax disputes, said the tax official.

Li Jian, head of the tax bureau in Yiwu, Zhejiang province, said that the bureau has set up the country's first international tax service station to provide "one-stop" tax services for foreign investors.

The station includes a service to introduce China's tax policies in Chinese, English and Russian. Thus entrepreneurs from different countries can understand policies in a timely fashion. The service also supports exports from Yiwu, a renowned commercial hub.

"We provide tax exemption services for exported goods in line with domestic business models to attract more foreign traders," Li said. "There are many exporters in Yiwu, so the amount of tax rebate is large every year, about 6 billion yuan ($930 million). How to efficiently return the money to taxpayers is a challenge."

In accordance with the requirements of the State Taxation Administration, to speed up tax refunds for export companies, the Yiwu tax bureau has leveraged a new online system for export tax rebates, and export enterprises can receive funds by simply filing and scanning related documents, which can save time for exporters, Li added.

The measure has been adopted by 15 provinces in China, he added, which supports rapid growth of Chinese exports.

Today's Top News

- Huangyan Island National Nature Reserve gets official go-ahead

- Defense leaders from over 100 countries to attend Xiangshan Forum

- China honors model teachers in celebration of Teachers' Day

- Xi sends congratulatory letter to 2025 China Intl Fair for Trade in Services

- China set to revise Foreign Trade Law to address challenges

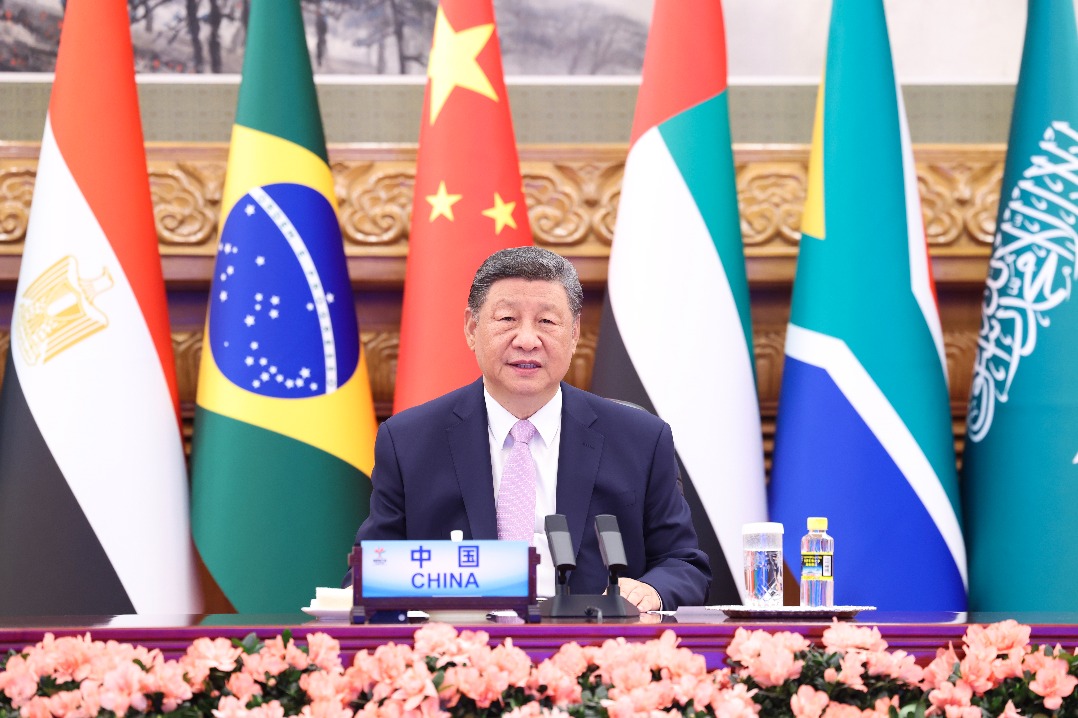

- Xi's BRICS speech charts path forward