Special bonds raise pickup hopes

Experts: Despite sluggishness, H2 room for scaling up local issuances will be ample

China's issuances of local government special bonds, key instruments that partially fund investments in infrastructure projects, have decelerated in the first half of the year, creating room for scaling up in coming months, which should help anchor the economy, officials and experts said on Tuesday.

Local government special bonds worth 1.0144 trillion yuan ($156.5 billion) were issued from January through June, accounting for only 28 percent of the annual issuance quota of 3.65 trillion yuan, the Ministry of Finance said on Tuesday.

Explaining the perceived tardy progress, Xiang Zhongxin, deputy head of the ministry's budget department, attributed the slowdown from last year to the nation's normalizing of its management of the bonds this year.

"For the next phase, the ministry will guide local authorities to reasonably manage the pace of issuances and improve information disclosure, maximizing the efficiency of bond proceeds," Xiang said.

Local government special bonds refer to those financial instruments issued by local governments to partially fund public projects and are repaid from income generated from these ventures. The bonds are seen as a key driver of infrastructure investment and economic restructuring.

"Fiscal policy can become more proactive in the second half, especially in terms of local government special bonds, given that a large portion of the issuance quota has not been used," said Wang Jinbin, vice-president of the School of Economics at the Renmin University of China in Beijing.

Infrastructure investment has been a pain point in the first-half growth of fixed-asset investment in China, making it necessary to step up policy efforts to shore up investment and offset any possible weakening in exports, said Wang, who is also a member of the China Macroeconomy Forum.

The rapid growth of fiscal income compared with spending also provides room for greater fiscal support, he said.

China's fiscal revenue increased by 21.8 percent year-on-year to 11.7116 trillion yuan in the first half, thanks to a low comparison base, a rise in factory-gate prices and a rebounding economy.

Over the same period, fiscal spending increased by 4.5 percent to 12.1676 trillion yuan, the ministry said.

The country should make better use of local government special bonds and other funds to advance key projects, like critical engineering and those involving basic living conditions, Premier Li Keqiang said at a symposium on July 12 with experts and entrepreneurs.

Yet, some experts said the future expansion in special bond issuances may be limited amid stricter regulation to contain implicit government debts.

"The room for greater fiscal policy support should not be overestimated," said Tao Chuan, chief macroeconomic analyst with Shanghai-listed Soochow Securities.

The government is likely to be tolerant of slower economic growth and shun any aggressive fiscal expansion that will impair the fruits of stabilizing macro leverage and containing debt risks, Tao said in a research note.

Xiang, the MOF official, said the ministry has strengthened supervision over special bonds to ensure that bond proceeds are used more efficiently, including to improve the monitoring of project performance and clarify that no general-use property projects shall be funded by special bonds.

In the first half, about half of the newly issued special bonds were used in major projects in areas like transport infrastructure, municipal administration and industrial parks, Xiang said.

About 30 percent were used in areas that improve social welfare, like construction projects to safeguard the housing of low-income households, he said. The remaining 20 percent were used in areas like agriculture, energy and logistics.

The ministry also sought to improve the efficiency of spending by making it a normal practice to directly allocate budgetary funds to prefecture- and county-level governments and placing more funds under the mechanism this year, totaling 2.8 trillion yuan.

Local authorities have allocated 2.506 trillion yuan of the funds to the units that use the funds, providing timely support for safeguarding employment, official data said.

Chen Jia contributed to this story.

Today's Top News

- Huangyan Island National Nature Reserve gets official go-ahead

- Defense leaders from over 100 countries to attend Xiangshan Forum

- China honors model teachers in celebration of Teachers' Day

- Xi sends congratulatory letter to 2025 China Intl Fair for Trade in Services

- China set to revise Foreign Trade Law to address challenges

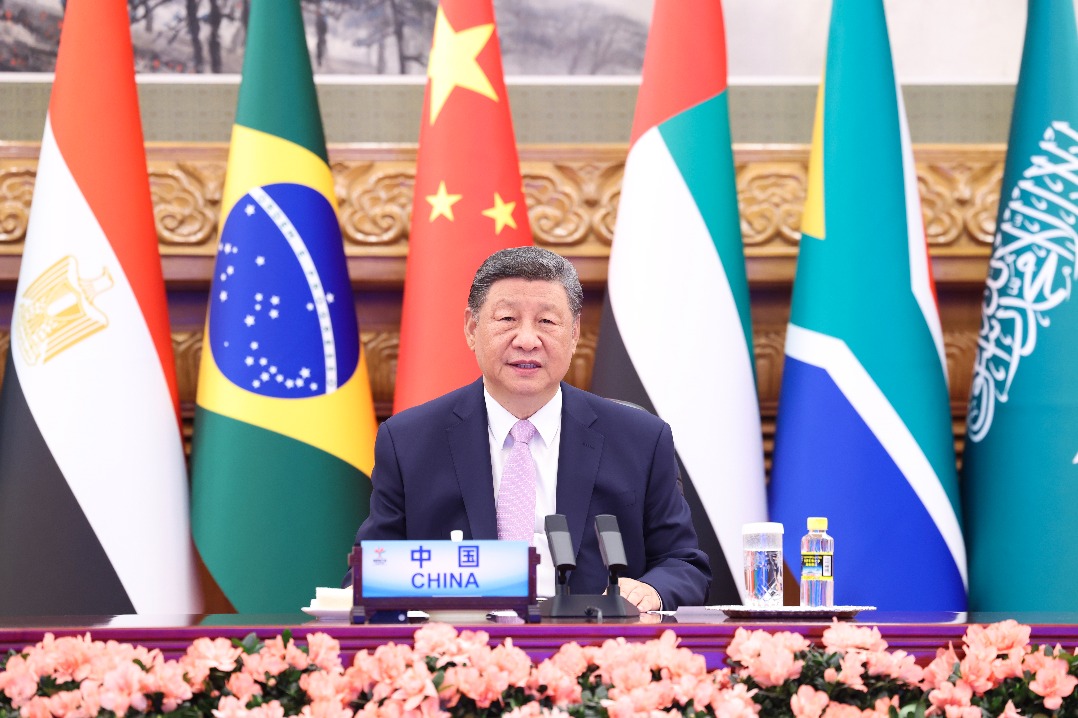

- Xi's BRICS speech charts path forward