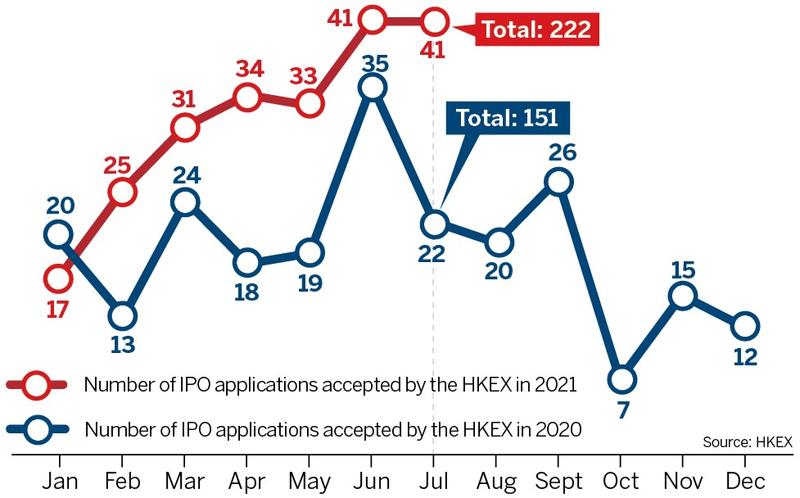

Global race to lure unicorns

An HKEX spokesperson stressed that the bourse's strategy is firmly focused on the mainland. "It is mainland anchored, but the new panel has nothing to do with data review policies," the person told China Daily. All prospective IPO issuers, regardless of which jurisdiction they are from, must comply with their domestic laws and regulations before going public, the person added.

The HKEX has been ramping up efforts to become more technology-savvy to add muscle to the city's financial and data development, strengthening its competitiveness in the arena.

Hong Kong introduced a new listing regime in 2018 that supports the listings of innovative companies, including tech firms and those with weighted voting right structures. Edward Au Chun-hing, southern region managing partner at Deloitte China, said this also covers firms that run a lot of data.

HKEX's most recent initiative was to set in motion an upcoming platform aimed at streamlining and shortening the IPO subscription and settlement cycle. The entire process of the Fast Interface for New Issuance will be seamless and digital, reducing risks for issuers going public during stock market volatility, and enabling investors to make more timely decisions on new offerings.

Au said he believes the platform, which is expected to roll out in the fourth quarter of next year, will help facilitate companies' flotations in Hong Kong.

Other initiatives taken in support of Hong Kong's technology goals include the launch of Client Connect, the establishment of the Innovation and Data Lab, and a planned Data Marketplace for sharing data and analytics via a commercial pricing mechanism to mobilize and monetize the vast amount of data being produced.

Au said the regulatory authorities could start preliminary studies and research to explore cross-border data transfers to help "new economy" businesses in Hong Kong and on the mainland expand their services and enhance customers' experience beyond their borders. This could, in turn, attract more data-rich firms to list in the city. Such measures, he said, will boost Hong Kong's position as an international financial center.

However, he pointed out that many technology companies remain in a "holding pattern" and have yet to make a final decision on their listing plans as the mainland's revised regulations have yet to become law and still could be amended.

In Au's opinion, some tech companies may not be able to meet HKEX's listing requirements for weighted voting rights arrangements, financial performance or the vetting-focused regime, which is different from a disclosure-based regime in the US.

Furthermore, tech companies with innovative business models that fail to identify comparable peers in Hong Kong's stock market might still like to seek public offerings elsewhere, he said.

The US market attracts a greater variety of innovative IPO issuers from various countries and has more investment funds and institutions.

Alvin Ngan, an analyst at Hong Kong-based Zhongtai Financial International, said he thinks that some companies will wait and see before making a final decision.

But he is optimistic that the reviews and approval process could be "relatively relaxed" if internet-based firms choose to list in Hong Kong. This would benefit HKEX in the long run if companies find fewer channels elsewhere for listings.

The number of mainland companies inquiring about going public in Hong Kong, or shifting from the US to Hong Kong, has gone up recently, according to a report by online financial news platform 21jingji, citing a lawyer involved in IPO consultations.

Pan Helin, executive dean of the Institute of Digital Economy at Zhongnan University of Economics and Law, said, however, the mainland's data review regulations would not completely hinder Chinese companies from raising funds in the US.

He reckoned there could be a short-term effect on the operations of data-rich, internet-based software enterprises as the rules have yet to be finalized, but the impact on hardware producers in the manufacturing, medical and electronics sectors would be negligible.

- China's anti-fascist war to be retold through words of Western correspondents

- Fuxing Island to host 2025 Shanghai Urban Space Art Season

- Flight ban call after drones collide above iconic Shanghai skyscraper

- Officer shines as a leader who treats his soldiers like an elder brother

- Businesswoman accused of corruption extradited back to China

- One day in Taicang: Play apprentice, be a local