Growth prospects better as year draws to a close

Sequential growth in China almost stalled in the third quarter of 2021 owing to sporadic COVID-19 outbreaks, regulatory tightening and power shortages, in addition to the lagged effect of macro policy normalization. The government, acknowledging the downside risks to the economy, recently fine-tuned real estate policy and boosted coal supply to prevent further slowdown in construction and production.

And the People's Bank of China cut the reserve requirement ratio by 50 basis points on Monday to better support the real economy, in a clear sign of easing policy headwinds.

However, we (at Standard Chartered Bank) do not expect an aggressive loosening of macro and structural policies, as China's focus on long-term high-quality growth curtails the appetite for stimulus. Innovation, decarbonization and "common prosperity" rank high on China's long-term agenda amid challenging demographic trends and a tougher external environment.

So the government will likely continue to reallocate resources from over-invested industries (such as real estate) to support the development of home-grown technologies, encourage investment in renewable energy in order to achieve peak emissions before 2030, and crack down on monopolies to promote social mobility and reduce income disparity. In this context, the Chinese authorities have emphasized the importance of a cross-cycle design for macro policies.

That said, we think counter-cyclical policies will still be implemented when sharp economic downturn increases the risk of large-scale unemployment and undermines financial stability. Recent policy adjustments suggest the government wants to curb the downside risks and pave the way for steady growth next year.

The recent meeting of the Political Bureau of the Communist Party of China Central Committee called for stabilizing the macro economy and keeping growth within a reasonable range. As such, the government may set a growth target of 5 percent or above for 2022, with macro and structural policies aligned to achieve the target.

On regulatory policies, we think they are likely to reach a "steady state" and become neutral at some point, when practices in the targeted industries (real estate, education and internet platforms) become aligned with government efforts to promote innovation, green development and common prosperity.

In particular, housing credit conditions will likely improve in the quarters ahead. As a result of property policy tightening, real-estate loans' share of total new loans dropped sharply to about 15 percent in the third quarter of 2021 from over 50 percent in the second half of 2016. This trend may have bottomed out, given the historical pattern and the recent policy-supported increase in mortgages.

Regulatory guidelines indicate a fair share of credit for the property sector at 25-30 percent. Under our conservative assumption that real estate loans will rise to 25 percent of total new loans by mid-2022, growth in these loans would accelerate to about 10 percent by the end of 2022 from about 5 percent at present.

Besides, better funding conditions should keep property investment from contracting further in the first quarter of 2022, mitigating the investment drag on growth, and macro policies are likely to become more supportive in 2022, with the tightening bias being removed.

The People's Bank of China has pledged to stabilize credit growth, keeping total social financing growth broadly in line with nominal GDP growth. With limited room to cut the reserve requirement ratio further, we expect the central bank to inject more liquidity into the market by ramping up re-lending to banks, including via the recently introduced decarbonization supporting tool.

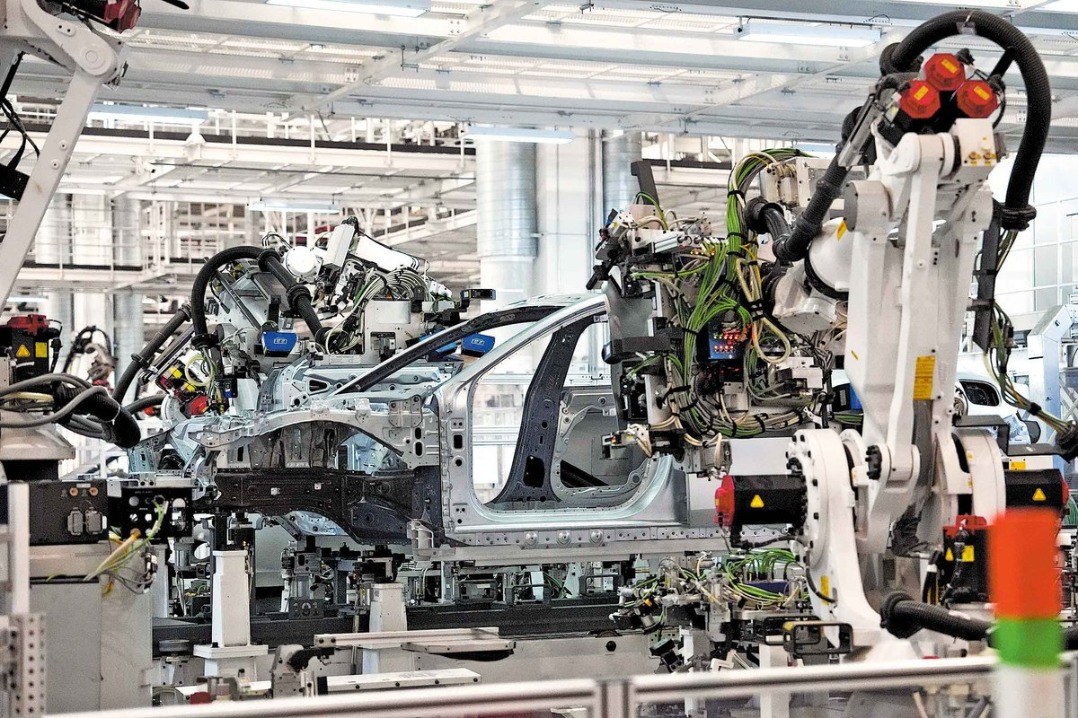

The abating policy headwinds should be conducive for growth to return to potential in 2022. We therefore forecast 2022 growth at 5.3 percent. Robust manufacturing investment and a pick-up in infrastructure investment are likely to partially offset the weakness in real estate investment.

As for consumption, it is likely to benefit from a stable job market and rising household income, as well as a possible easing of pandemic prevention and control measures in the second half of 2022 when a vast majority of the population is fully vaccinated. And we expect export growth to normalize following an extraordinary performance this year, and forecast a marginal positive contribution to GDP from net exports.

But we see balanced risks to our 2022 GDP forecast; upside risks may arise from an easing of auto chip shortages, which would accelerate car production and sales, and downside risks may come from a prolonged weakening of housing demand if sustained policy tightening and defaults by major developers fuel expectations of a price correction. And the impact of new novel coronavirus variants, including Omicron, may be mixed, as experience so far suggests a loss of activity (especially services) in China may be offset by an increase in China's exports due to disruption of the supply chains in the rest of the world.

The views don't necessarily reflect those of China Daily.

The author is chief economist for Greater China and North Asia at Standard Chartered Bank.