Healthcare, life sciences lure global investors

Sectors to remain leader in Chinese firms' mergers and acquisitions

Healthcare and life sciences are forecast to continue to be a leading area for Chinese companies' overseas mergers and acquisitions in 2022. That is particularly so as digitalization is expected to help medical services excel at finding cures for diseases, providing top-notch healthcare, and attracting diversified and multidisciplinary investment in the sector, experts said.

The announced value of Chinese companies' overseas mergers and acquisitions reached $57 billion in 2021, up 19 percent year-on-year but down 28 percent compared to 2019, according to a report from the international professional services firm EY.

Though challenges exist, EY identified investment trends that justify cautious optimism for 2022, with healthcare and life sciences expected to be a major investment target, said Loletta Chow, global leader of the company's China overseas investment network.

The value and volume of China's overseas M&A deals in healthcare and life sciences have been growing for two consecutive years, EY reported. In 2021, the sector's value increased by 240 percent year-on-year, and the volume grew by 64 percent, a historic high. Investments were made in countries including the United States, South Korea and India.

"The global medical supply chain is moving toward regionalization and localization. This can create opportunities for Chinese medical enterprises both in going out and bringing in," EY said. "Moreover, the COVID-19 pandemic has changed individual health awareness and behavior over the long term, and demand for healthcare services is mounting, paving the way for a comprehensive healthcare upgrade via digitalization."

One typical deal was an acquisition last year of a 47-percent stake in Hugel Inc, South Korea's top botox maker, from Bain Capital for about $1.5 billion. The stake was acquired by a consortium led by CBC Group, a Chinese firm dedicated to healthcare investments. Hugel's numerous medical aesthetic products have the lion's share of the market in South Korea as well as having worldwide reach.

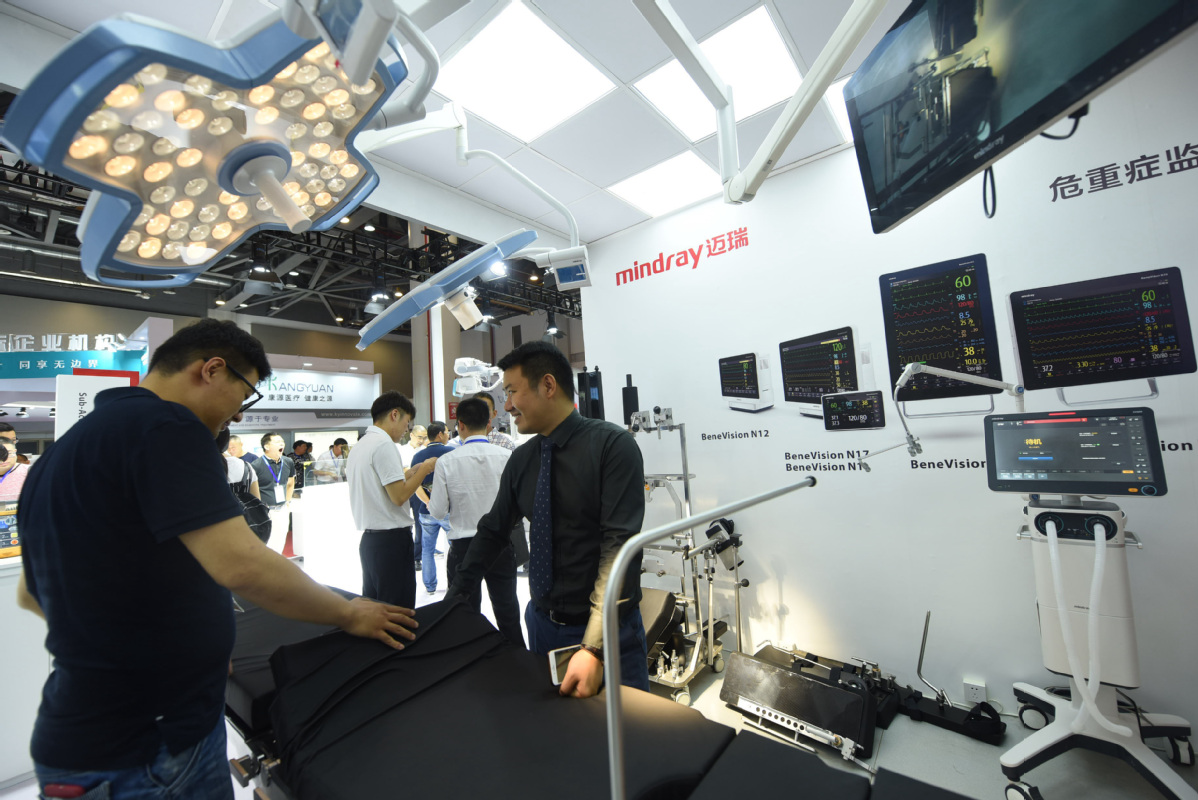

Also last year, Chinese medical device company Shenzhen Mindray Bio-Medical Electronics Co Ltd acquired HyTest, a Finland-based supplier of raw materials used in tests for diseases such as COVID-19.The 545-million-euro ($601 million) deal was key in becoming more independent in making and developing core materials for testing reagents. When the deal closed in September, Wu Hao, president of Mindray, said in a statement that the acquisition of HyTest would enable the Chinese company to have top-notch raw material research and development as well as innovation capabilities.

"We expect HyTest to invest additional resources into continuous development of technologies and products as well as to advance technological innovation and academic exploration. We will support HyTest in continuing to invest in R&D as well as strengthen and improve its key competitive edge," Wu said.

In addition to healthcare, EY also forecasted that Chinese companies would make further use of their manufacturing advantages this year to explore and deeply participate in reshaping global industrial and supply chains. Investment in green and sustainable development also is expected to pick up and become a key contributor for expanding the international involvement of Chinese enterprises.

Last year, by deal value, the top three sectors of Chinese companies' overseas M&As were TMT-which refers to technology, media and entertainment and telecommunications, real estate, hospitality, construction sector and advanced manufacturing and mobility. The three sectors accounted for 55 percent of the total, according to EY.

By deal volume, the top three sectors were TMT, health care and life sciences, and financial services, accounting for 60 percent of the total.

Though Chinese companies' overseas M&A volume in TMT has been decreasing in recent years, it is still a very popular sector, EY said. In 2021, these investments were made in the United States, South Korea, Singapore, the United Kingdom and Japan. Major subsectors included software systems, semiconductor design and manufacturing, and e-commerce.

Last year, China's newly signed overseas engineering, procurement and construction projects increased 1.2 percent year-on-year to $258.5 billion. There also were more major projects in transportation. Among them, the value of newly signed engineering, procurement and construction contracts in the countries and regions involved in the Belt &Road Initiative reached $134.0 billion, accounting for 51.9 percent of the total.

According to EY, Asia was the top geographical destination for Chinese companies' overseas M&As, with announced deal value up 85 percent year-on-year at $26.4 billion, representing 46 percent of the total in 2021. Asia also recorded more large deals, with seven deals exceeding $1 billion. Half of the top 10 destinations in 2021 were in Asia, including Singapore, South Korea, Indonesia, India and Japan.

Europe was the second most popular destination, with Chinese companies' announced overseas M&A deals in the continent reaching $16 billion, up 13 percent year-on-year, according to EY. There were 161 transactions, mainly in consumer products, TMT, and healthcare and life sciences. The volume of Chinese enterprises' healthcare and life sciences M&As in Europe doubled in 2021 from the previous year, and the value of those deals increased 354 percent, which EY reported was more than those of other continents.

Research reports from French bank Natixis show a different picture, however. Alicia Garcia Herrero, chief economist for Asia-Pacific at Natixis, said in a post on professional networking site LinkedIn that Europe still attracted the largest number of deals from Chinese companies last year, followed by Asia-Pacific. Thanks to Chinese internet company Tencent Holdings' purchase of an additional 10 percent of Universal Music-giving it a total stake of 20 percent-the US rose as the biggest destination in terms of deal value, though Universal Music is still partly linked to Europe because part of the company is held by French interests such as the conglomerate Vivendi.

Industrial sectors, especially in Europe, attracted the largest number of deals from China. Other key sectors included healthcare, energy, information communications technology and chemicals and materials, she said.

According to the Hurun China Cross-Border M&A Report 2021, the top 50 overseas M&A deals done by Chinese mainland companies reached 168.2 billion yuan ($26.42 billion) last year, a drop of 45 percent compared with 2020.

The drop came as the global economy continued to be hit hard by the COVID-19 pandemic and a slowdown in economic development, as well as other factors such as anti-globalization sentiment, the report said.

But there also are positive trends and prospects for growth in Chinese companies' overseas M&A deals. Feng Lin, CEO of DealGlobe, a Shanghai-based consulting firm, said the Regional Comprehensive Economic Partnership agreement, for instance, is a positive factor that will boost cross-border M&A deals by Chinese enterprises.

The RCEP agreement is a multilateral trade agreement among China, Japan, South Korea, Australia, New Zealand, and the 10 member states of the Association of Southeast Asian Nations. It is the world's largest regional trade agreement.