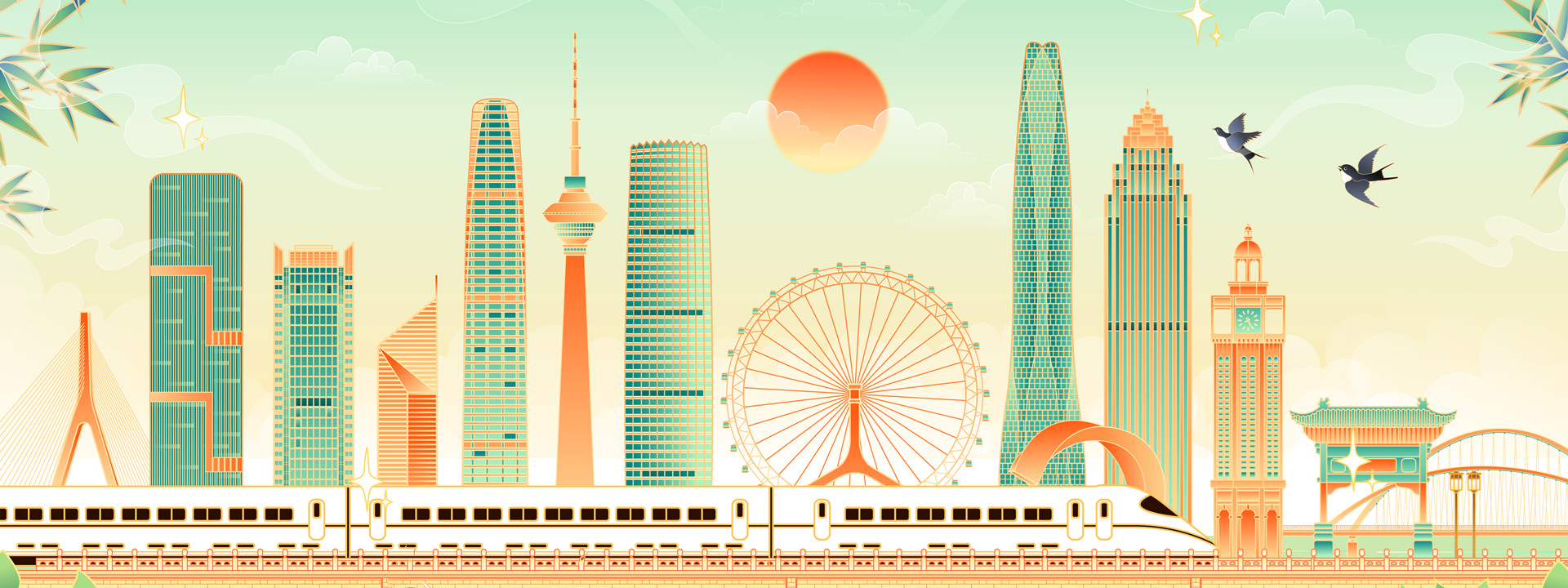

Tianjin Updates

2025-06-26

China willing to share more opportunities

Premier Li Qiang said on Wednesday that in the face of global challenges, countries around the world should make the economic "pie" bigger through open and win-win cooperation rather than playing zero-sum games or following the law of the jungle.

read more- Smart cities key to driving SCO's intl influence

- Inspired by tour, Tianjin visitors show confidence in enhanced regional ties

- China and Russia: Cities building stronger ties

Copyright ©? Tianjin Municipal Government.

All rights reserved. Presented by China Daily.

京ICP備13028878號(hào)-35

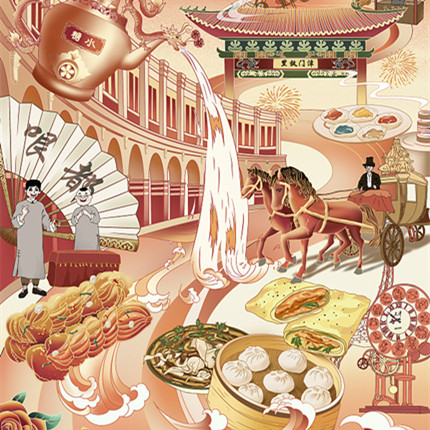

Why Tianjin

Why Tianjin Investment Guide

Investment Guide Industry

Industry Industrial Parks

Industrial Parks

Health

Health Visas

Visas Education

Education Sports and recreation

Sports and recreation Adoption

Adoption Marriage

Marriage