Consumption recovery fuels rise of Global South

Launched in 2018, the China International Import Expo, which opened in Shanghai on Sunday, is an important barometer of consumption in China. Latest data show the recovery of consumption is accelerating.

In the third quarter of this year, China's economy grew at a faster-than-expected pace — faster than the same period last year. Consumption recovery, in fact, is helping the central government achieve its full-year GDP growth target of "about 5 percent". In the third quarter, China's GDP grew by 4.9 percent year-on-year, beating all projections.

The acceleration of consumption recovery is evident on a quarter-by-quarter basis. From July to September, the country's GDP grew by 1.3 percent quarter-on-quarter — much more than the second quarter of 0.8 percent and higher than the 1.0 percent forecast.

Retail sales reflect broad-based advancement, as headline growth hastened from 4.6 percent year-on-year in August to 5.5 percent in September. Relative to the 2019 pre-COVID-19 pandemic levels, domestic tourist traffic and tourism revenue increased by 4 percent and 1.5 percent, respectively. This trend is likely to continue in October due mainly to the eight-day Mid-Autumn Festival and National Day holiday.

Despite being weary of external and internal headwinds, however, Chinese consumers are back in full force, but are more discriminate and cost-conscious. Still, China's industrial profits, that is, the profits of major industrial enterprises, rebounded by 7.7 percent year-on-year in the third quarter.

Besides, along with consumption, fiscal stimulus will also play a key role in strengthening the economy. In September, infrastructure investment and other State investments grew by 6.2 percent and 7.2 percent, respectively, with railways and electricity recording double-digit growth.

Also, China approved the issuance of sovereign bonds worth one trillion yuan ($137 billion) late last month, with the aim of rebuilding flood-hit areas and improving the urban infrastructure to cope with national disasters in the future. Investment in infrastructure supports imports of items such as iron ore, crude oil and copper, which bodes well for commodity exporters to China.

What can consolidate consumption recovery? Watch the labor market. As the headline jobless rate fell to 5 percent in September, wage income increased by almost 7 percent year-to-year in the first three quarters. The question is: Can such employment growth be sustained in the months to come?

However, the real challenge remains the under-performing property market. One promising sign, though, is that the recent stimulus for the property sector may have had a positive effect in first-tier mega-cities such as Shanghai and Guangzhou, and some second-tier cities.

As long as policymakers can minimize the downside risks in the property market, and revive consumers' confidence, growth will increase and stability consolidate. In this challenging balancing act, positive outcomes are premised on reforms. The need is to "cross the river by feeling the stones", as late leader Deng Xiaoping used to say.

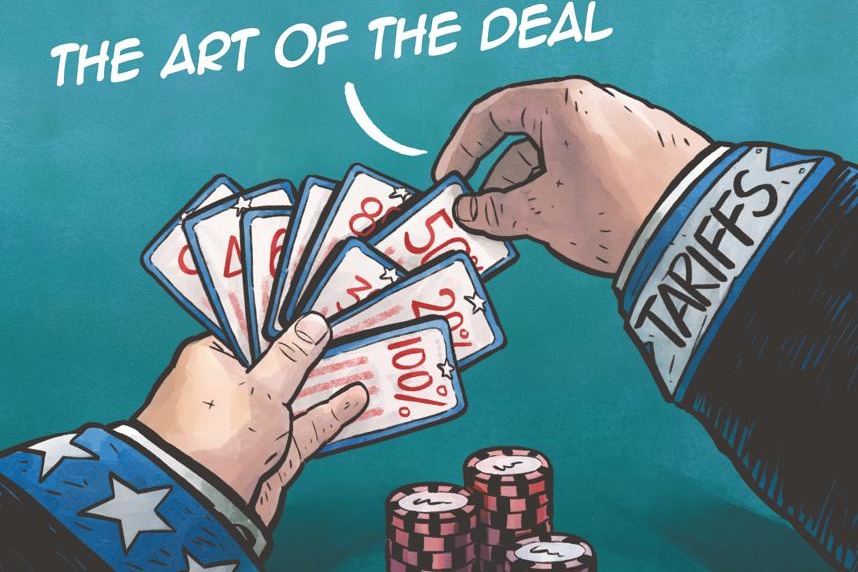

In September, China reported a smaller-than-expected decline in exports from a year ago, perhaps because the misguided protectionism policies and geopolitical games of the West have hit global trade and investment hard since 2017. In contrast, China has pushed for global economic cooperation and development. Two years ago, China granted zero-tariff treatment to 98 percent of taxable items originating in 10 least-developed countries. The move will raise China's imports from the least-developed countries, which in turn will expedite economic development in those countries.

China is also strengthening trade and investment ties with the member states of the Regional Comprehensive Economic Partnership, which are the source of nearly a third of China's total trade value.

Similarly, the Belt and Road Initiative has facilitated Southeast Asia's economic recovery. China's trade with ASEAN member states has been growing two-to-three times faster than the European Union and the United States. And Belt and Road projects are moving ahead, from South Asia and Eurasia to Latin America, the Middle East and Africa.

No wonder China is projected to contribute more than 30 percent to global economic growth in 2023, Kristalina Georgieva, head of the International Monetary Fund, affirmed recently. The pursuit of global development has not been easy, though. From China's trade with the least-developed countries, the RCEP member states to the country's growing trade with Belt and Road countries and the Association of Southeast Asian Nations, in each case, the West has tried to divide these blocs to check China's rise.

Worse, the ongoing Palestine-Israel conflict — which is the result of decades of misguided policies — has already caused energy prices to climb. And a prolonged conflict would cause an energy shock, which would translate into higher food prices, that is, another Ukraine-style proxy war. Still worse, further escalation of the conflict would mean an atrocious dual shock that will lead to more severe global repercussions.

Over a decade ago, I met in Shanghai Helmut Reisen, then research head of the Development Center of the Organization for Economic Cooperation and Development. His team was among the first to show that the impact of China's growth on the low- and middle-income countries increased significantly in the 2000s: every 1 percentage point of growth in China boosts 0.3 percentage point of growth in other countries connected to China.

In other words, if external headwinds caused by foreign interests reduce China's growth by 1 percent, the consequent negative effect would be especially damaging for emerging market and developing economies. Notice that the projection was made before China further strengthened trade ties with countries through the RCEP, the Belt and Road Initiative and ASEAN. Today, these impacts — positive and negative — would be far more severe. Those who launch unwarranted trade wars and indulge in geopolitical games to contain China undermine development in and the overall rise of the Global South.

The views don't necessarily reflect those of China Daily.